When the Music Stops

Submitted by Silverlight Asset Management, LLC on October 19th, 2017

No one rings a bell to signify a market top. It sneaks up on us.

The music just stops.

***

At the stroke of midnight, February 3, 1959 started out an ordinary day.

An hour later, what happened in an Iowa cornfield made it an extraordinary day in the eyes of American pop culture.

A group of musicians was touring the Midwest. Conditions were far from luxurious. The tour bus was unheated, and it had been several days since a pit stop at a laundry mat. Tired of wearing the same clothes night after night, one of the band leaders made a fateful decision that would alter the course of rock and roll history.

Anxious to get some clean clothes, Buddy Holly chartered a plane to take him from Clear Lake, Iowa, to Fargo, N.D. Joining the 22-year-old on the plane that stormy night was another up-and-coming music star, Ritchie Valens, just 17-years old. Valens earned his seat on the plane via a coin flip win over Holly’s guitarist, Tommy Allsup.

The plane crashed, killing everyone aboard.

The country was shocked by the news. Who could see a thing like that coming?

Twelve years later, an artist named Don McLean wrote a song called American Pie. Inspired by the Buddy Holly tragedy, it talks about “the day the music died.”

***

On July 10, 2007, Citigroup’s CEO, Chuck Prince, was speaking to the Financial Times.

Prince made an offhand quip about dancing. He would later come to regret it, for the quote became an infamous stain on his career. Try Googling him and you’ll see what I mean.

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

It wasn’t long before the financial crisis erupted, and Citi danced right off a cliff.

Prince’s comment touched a nerve and became a hallmark of the crisis. It personifies the psychology of a bubble.

Defending his quote to a U.S. Congressional panel several years later, Prince disclosed that he thought the globe was awash in liquidity in 2007, and only a significant disruptive event could change the momentum in the leveraged buyout market.

***

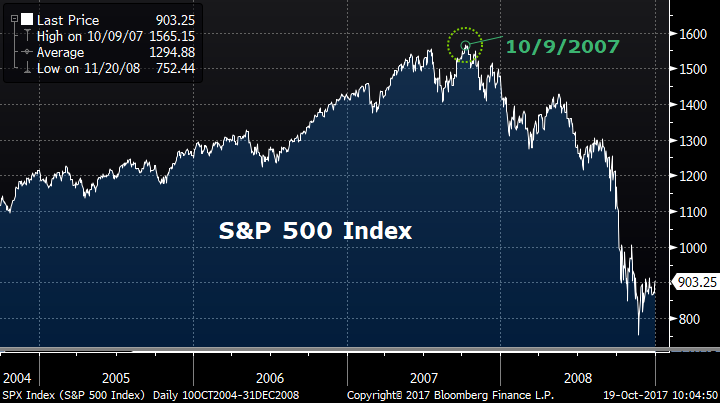

October 9th, 2007, seemed like an ordinary day on Wall Street.

CNN recapped the trading session as follows:

Dow, S&P break records

Blue-chip averages hit intraday and closing highs after minutes from last central bank meeting add to bets that the Fed can lower rates again this year.

“I think the market had a knee-jerk reaction to the idea that the Fed can cut rates more, if they need to,” said one analyst.

Later that week, President George W. Bush said recent job figures signaled “a vibrant economy.”

Decent jobs data, dovish Fed—bullish cocktail, right?

Wrong.

This month marks the 10th anniversary of the last major market peak.

Reflecting on what happened ten years ago, there are many takeaways. Here’s one that stands out: if you want to anticipate when the music for this cycle stops, the only thing you should anticipate is you are unlikely to know the day it arrives.

A chorus of media pundits are not going to alert you.

Rather, it’s more likely to be a sublime, ordinary day.

- Like the early minutes of February 3, 1959

- Like the early hours of July 10, 2007, before Chuck gave that interview

- Like when the closing bell rung at the NYSE on October 9, 2007

The reason you don’t hear a bell signifying a major top is because markets usually top amid good news. Investor sentiment is positive. Investors are all in.

Searing these two statements into your memory will allow you to see cycle turns in a whole new light:

- Markets top when they run out of buyers

- Markets bottom when they run out of sellers

It’s as pure and simple as that. Yet almost everyone tends to forget this is how it works.

People look for news catalysts to justify market shifts. They think smart sellers create tops, and smart, informed buyers shift the tide at major bottoms.

Really—it’s supply and demand—and tops form when demand dries up.

So, what do you do with that information?

If you’re a buy and hold investor—perhaps nothing, other than embracing uncertainty for what it is: a fact of life.

If you’re inclined to tactically update your asset allocation, it is wise to do so proactively, as the market rises. A rules-based approach may work best, to avoid being seduced into complacency or fear at the wrong time.

Another piece of pragmatic advice: try to enjoy the good times.

Cycles come and go, as do we.

You may not be able to call a top, but you can try your best to own today—make it count.

***

Don McLean at his finest:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.