5 Things We Learned This Week - 11/16/2024

Submitted by Silverlight Asset Management, LLC on November 16th, 2024

November 16, 2024

The S&P 500 fell 2.1% this week as post-election euphoria faded. Bonds also sold off and gold fell 4.6%. Bitcoin outperformed after rallying 19.3%.

After a spate of sticky inflation data, traders trimmed rate cut expectations to a 56% chance the Fed will deliver a quarter-point cut at the December meeting. The Consumer Price Index (CPI) came in higher than expected at 2.6% and Core CPI was unchanged at 3.3%. The Producer Price Index (PPI) also rose more than expected. We expect inflation to remain above the Fed's 2% target in the first half of 2025.

Trump Stacks His Cabinet With Controversial Choices - What Are The Investing Implications?

The incoming President is assembling a cabinet of mavericks to shake up Washington. Matt Gaetz is a controversial choice for Attorney General, but will he focus on Republican policy objectives or settling the President's personal scores with political rivals? Tulsi Gabbard is a rebel choice for Director of National Intelligence considering she has no experience in the field of intelligence. Will she be an effective change agent or will she be squashed by the bureaucracy beneath her? Robert F. Kennedy is a controversial pick to be the next Secretary of Health & Human Services given his anti-vaccine positions. This could be bad news for big pharma companies, but we won't know for sure until we see what develops. A lot is up in the air.

Whatever our personal political preferences are, the investing implications of any incoming administration are always clear from one angle. The first year of Presidential cycles have below-average returns, and that's because presidents always have the most political capital to spend in the beginning of their terms. Independent of whether their policies are good or bad ideas over the long run, any changes in Washington create an uncertainty overhang that tends to suppress investor sentiment in the short run. Wall Street always worries about the possibility of unintended consequences, which means 2025 will probably be a bumpier year for volatility.

The Gig Economy Is Growing Fast

The gig economy is a different type of labor market market characterized by temporary, contract, and freelance jobs rather than permanent positions. The gig economy has grown fast since COVID as revenues at key platforms like DoorDash (+63%), Uber (+26%) and Airbnb (+20%) have skyrocketed. Innovation in this part of the economy is one of the key factors that has helped drive the US growth miracle that has surprised many economists in recent years. As one example of the scale of this trend, YouTube paid over $107 billion to creators in the last three years. Meanwhile, YouTube's revenue over the past four quarters crossed $50 billion for the first time, exceeding Netflix's annual revenue. Network effect is the key strategic attribute necessary to succeed in this arena, and once that is established the compounding potential for the platforms is very attractive. Gig economy exposure is a new portfolio theme we are actively researching and integrating into Silverlight managed portfolios.

Year-End Financial Planning Checklist

As year-end approaches, consider these crucial financial planning steps to set you up for a prosperous new year.

Review Your Budget: Assess your spending and saving habits to ensure you are on track. If you're a client and want help with this, let us know.

Maximize Retirement Contributions: Contribute to your 401(k), IRA, or other retirement accounts to take advantage of tax benefits.

Tax-Loss Harvesting: Sell investments at a loss to offset capital gains and reduce taxable income. We proactively do this for clients.

Evaluate Insurance Coverage: Ensure you have adequate health, life, and property insurance. Ping us if you want a sanity check on proper levels relative to your situation. We don't sell any insurance products and will give you our honest third-party opinion.

Update Beneficiaries: Review and update beneficiary designations on your accounts and insurance policies.

Charitable Donations: Make donations before December 31 to qualify for tax deductions.

Plan for Education Expenses: Contribute to 529 plans or other education savings accounts.

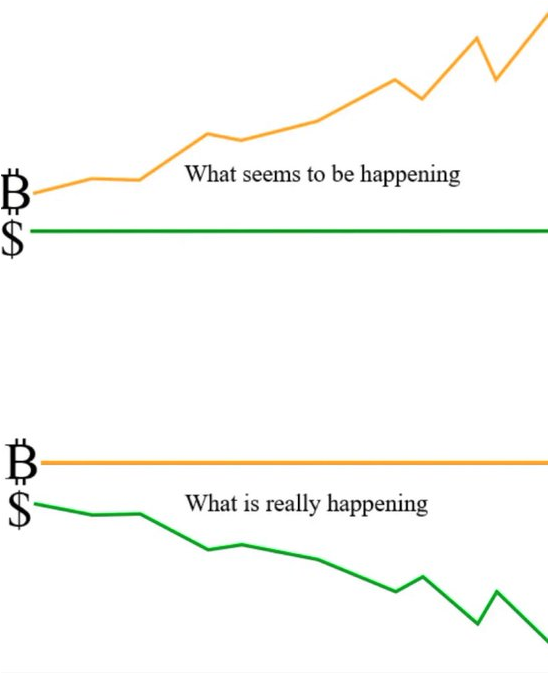

Bitcoin Is A Hedge Against Dollar Debasement

Since the Presidential election, Bitcoin has rallied 32%. Many people perceive the #1 crypto currency to be speculative. But it can also be thought of as a form of diversification and hedge against fiat money debasement. After all, owning only fiat money also carries risk.

Over the past 30 years, the dollar has lost significant purchasing power due to inflation. For example, in 1994, a gallon of milk cost about $2.50, whereas today it's around $4.00. Similarly, a new car that cost $20,000 in 1994 now costs over $40,000. Housing prices have also skyrocketed, with the median home price increasing from around $150,000 in 1994 to over $400,000 today. These examples highlight how much more expensive everyday items and major purchases have become, reflecting the dollar's diminished value. Debasement of fiat money, or the reduction in its value due to increased money supply, is a compelling reason to diversify into Bitcoin. Bitcoin's finite supply and decentralized nature make it resistant to inflation and government manipulation, offering a potential hedge against the declining value of traditional currencies.

It's Never Too Late To Cash In On A Dream

Ed Dwight was selected by President John F. Kennedy in 1961 to become the first Black astronaut. Despite completing the Air Force training program, he wasn't chosen for NASA's astronaut corps due to discrimination. Now, at 90 years old, Dwight will finally experience space travel aboard Blue Origin's upcoming mission. This mission, funded by the nonprofit Space for Humanity, will take Dwight and five other civilians to the edge of space for a few minutes of weightlessness. Dwight's journey symbolizes a long-awaited fulfillment of his dream and a significant moment in space exploration history.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.