Why Exchanges Outperform Discount Stock Brokers

Submitted by Silverlight Asset Management, LLC on October 11th, 2019

In the asset management space, discount brokers play a middleman role. They link consumers to exchanges where transactions are completed.

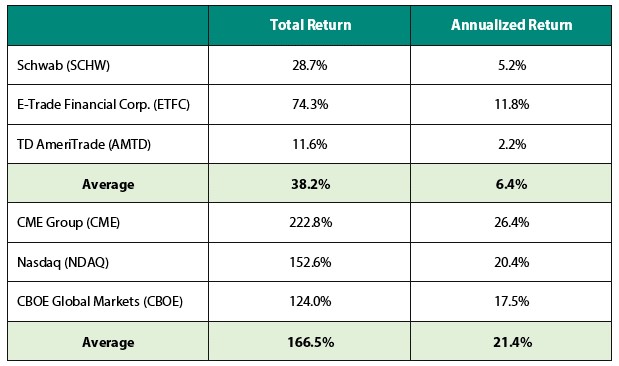

Here’s a look at how three major brokerage stocks have performed over the last five years compared to three major exchanges.

Source: Bloomberg

Why have the exchanges outperformed so dramatically?

Exchanges are special businesses with unique competitive advantages and powerful network effects.

- CME Group is the exclusive home of S&P 500 e-mini futures and is where 97% of all interest-rate futures in North America trade.

- Nasdaq is known for its equity exchange, but also has proprietary data products and technologies it licenses at high margins, because there are no easy substitutes.

- CBOE has pricing power tied to exclusive offerings like S&P 500 options and VIX futures.

CME, Nasdaq and CBOE boast operating margins of 55%, 41% and 44% respectively. Those numbers blow away the S&P 500’s operating margin of 13%.

Discount brokers like Charles Schwab and Ameritrade saw share prices plummet recently, after Schwab announced it was dropping its commission rate for U.S. equity and ETF trades from $4.95 to zero. It seems fitting the firm that pioneered the discount brokerage model back in the early 1970s is the first major brokerage to go all the way to zero.

Almost immediately, rivals E-Trade and TD Ameritrade followed suit. On Thursday, Fidelity announced it will offer not only zero commissions for online trades, but also provide higher yields for cash balances than peers.

A lot of folks are now left wondering what this new era of “free trading” means for investors going forward. And yet, it may turn out to be much ado about nothing.

“Declining per trade commissions have been an industry trend for decades,” says Stephen Biggar of Argus Research. “While the timing and extent of the drop is surprising, we see Schwab’s move as accelerating the inevitable.”

Schwab’s move was “inevitable,” because ruthless price wars are common in commoditized businesses. And that’s essentially what the modern trading landscape has become.

Trading commissions represent less than 10% of Schwab’s revenue, and it’s not where they make their margin. So, free commissions are essentially a loss leader to help funnel assets to other business lines, such as fixed income and asset management.

When you scale the numbers, zero commissions aren’t much of a game-changer for customers, either.

Think about it: does a $4.95 charge to trade really put a dent in most people’s bottom-line?

Sure, cheaper trades help the average investor’s cause, but the most important thing is making smart investments.

Keeping with that spirit, I want to highlight a simple principle that can make you a better investor.

Try to avoid firms that play a “middleman” role

You don’t need to be an expert in Porter’s 5 Forces to understand why middlemen have a hard time surviving. Just recall why there aren’t milkmen anymore, and you will start to connect the dots.

It’s hard to differentiate in the middle of a supply chain. Without differentiation, there’s no pricing power. And without pricing power, it’s hard to achieve high profit margins.

This has always been an important business principle, yet it’s particularly relevant today. Around the world, the middle layers of supply chains are being gutted at lightning speed. Firms are feverishly cutting costs to stay competitive, because modern technology has created unprecedented price discovery. That also makes differentiation more important than ever.

Firms trying to compete on price alone are destined to face a grueling race to the bottom, which only the biggest players have any real chance of winning.

That’s what is transpiring in the field of asset management, evidenced by the price war between discount brokers like Schwab and E-Trade.

It’s also happening in retail, evidenced by the price war between Amazon and Wal-Mart.

And it’s also happening in the cable industry, evidenced by the price war between streaming providers like Netflix and Disney.

If you stop to think about how many industries are experiencing price wars, it makes sense why there’s low inflation.

Low inflation can benefit consumers. However, it also creates a tougher environment for certain types of businesses (i.e. middlemen without pricing power).

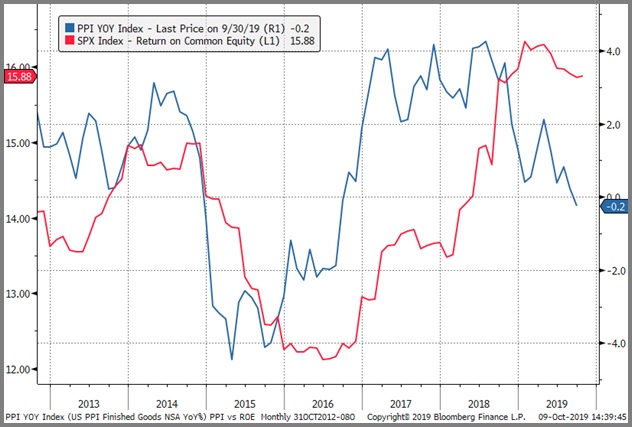

The Producer Price Index (PPI) unexpectedly fell this week, suggesting weaker demand is likely forcing firms to cut prices. As shown below, changes in PPI have been a pretty good leading indicator for the Return on Equity (ROE) profile of the S&P 500. This may have implications for earnings season, which kicks off next week.

Source: Bloomberg

Originally published by RealClearMarkets. Reprinted with permission.

Disclosure: I own shares of CBOE in accounts I professionally manage. This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX