5 Things We Learned This Week - 4/06/2025

Submitted by Silverlight Asset Management, LLC on April 7th, 2025

April 5, 2025

The S&P 500 fell 9% this week as a “tariff tantrum” erupted on Wall Street. The Bloomberg Aggregate Bond Index gained 1.1%, Gold fell 1.5%, and Bitcoin decoupled from risk assets by gaining 0.3%.

The ISM Manufacturing PMI dropped to 49 last month, signaling contraction, with New Orders at a 22-month low and Prices Paid surging 7 points, hinting at rising costs. The ISM Services report later showed slowing growth and fewer industries expanding, a concern since services dominate GDP. Challenger Job Cuts spiked 60% in March, hitting Government, Technology, and Retail hardest—the highest outside the COVID downturn. The BLS Employment Situation Report revealed unemployment rising to 4.2%, though payrolls beat expectations due to returning strikers.

Why Trump's Tariffs Were Worse Than Expected

This week, Trump unveiled tariffs averaging 29%—a shock to Wall Street, which had braced for a modest 10%. This weighted-average rate isn’t just aggressive; it’s the highest in a century, surpassing even the 20% of the infamous Smoot-Hawley Act of 1930. Economists revile Smoot-Hawley as a colossal blunder—it sparked a trade war, slashed global commerce by two-thirds, and deepened the Great Depression. Retaliation from trading partners crushed US exports, proving protectionism can backfire spectacularly.

Yet here we are, with tariffs outpacing that disaster, and little explanation beyond bravado. Policymakers owe us more—where’s the empirical evidence for this move? History offers slim pickings for tariff triumphs. Smoot-Hawley flopped in the Depression. When did tariffs ever fuel prosperity? The lack of an answer is telling. Without a solid “why,” this policy feels like a house of cards—bold, but unlikely to stand long.

The Trump tariff calculation wasn’t “reciprocal” as claimed—matching foreign tariffs—but a blunt stab at shrinking trade deficits. They took a country’s deficit with the US, divided it by imports, and slapped on a rate. Fairness? Out the window. An example of a country being unfairly and irrationally penalized under the Trump tariff plan is Lesotho, a tiny and impoverished African nation. Despite its limited economic power and reliance on exports to the US, Lesotho faced a 50% tariff on its goods under Trump's "reciprocal tariffs" policy. This punitive rate was calculated based on Lesotho's trade surplus with the US, which exists because the U.S. imports significantly more from Lesotho—mainly jeans and diamonds—than Lesotho can afford to import. Applying steep tariffs to a poor nation like Lesotho, which lacks diversified economic opportunities, disproportionately harms its economy without advancing any clear US policy objective.

The American Economy Isn't Perfect, But It's Winning

“It was the best of times, it was the worst of times,” Charles Dickens wrote in A Tale of Two Cities, capturing a world of stark contrasts—revolution and hope, despair and progress colliding. He meant that life’s highs and lows coexist, often defined by where you stand. Much of how we interpret reality is relative, shaped by comparison. Take the US economy today: Is it the best of times or the worst? For some, soaring costs signal decline; for others, the recently recorded stock highs scream prosperity. Perspective decides.

Donald Trump claims America has been “ripped off” for decades, promising his tariffs will make us “wealthy again.” But the data says we’re already there. The US has the world's largest economy with a nominal GDP of $30 trillion. Since 2000, US real GDP growth has averaged 1.8% annually, outpacing the global 1.5%. Per capita GDP? It’s soared from $36,000 in 2000 to $65,000 now, dwarfing the world’s $12,000. Real wages have grown steadily, outperforming many G7 countries. Real estate values have climbed more than the rest of the world. Finally, US equities have vastly outperformed international markets, with the S&P 500 delivering annualized returns of 12%, compared to 4% globally since 2010. Bottom-line: America’s economy isn’t just winning—it’s the envy of the world.

The issue that's feeding populism is the relative wealth gap. That issue is real, but it's likely caused by a slew of forces outside of just the trade deficit. Why does the President think it makes sense to shrink the overall size of the economic pie through anti-free market trade legislation? Free market capitalism is what propelled the American economy to become the mightiest on Earth, and it's still the best of all the imperfect systems out there. For a succinct explanation of why this is the case, you can watch the brilliant economist Milton Friedman school Phil Donahue in this two-minute clip.

The Liquidity Picture Is Improving

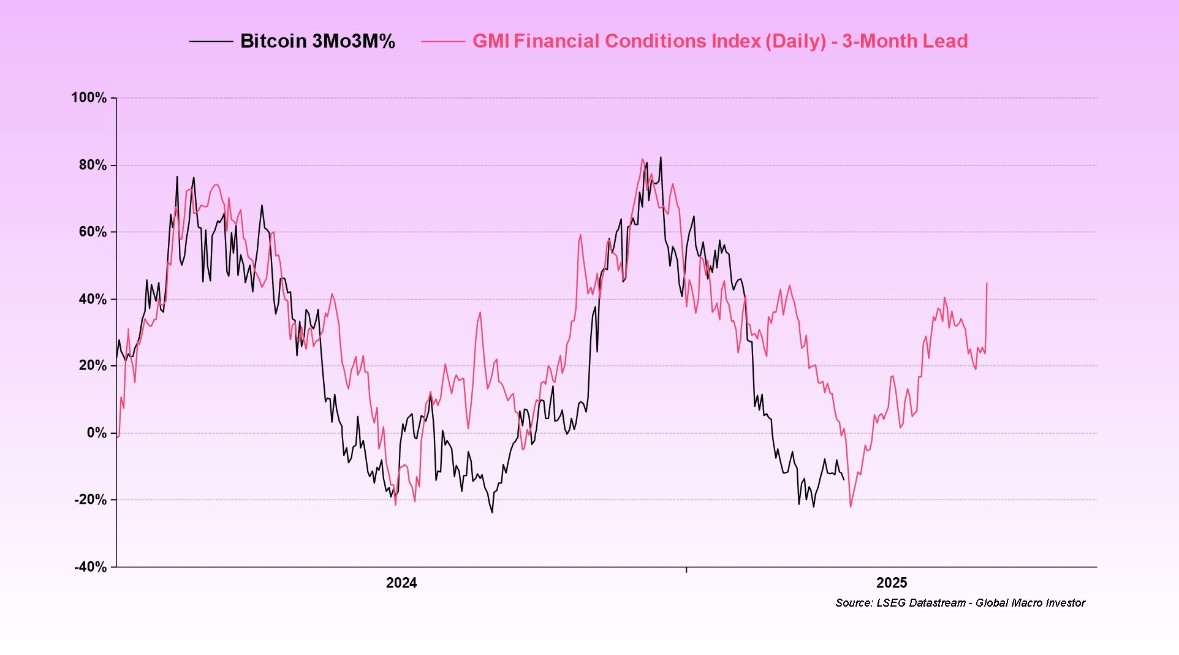

The market liquidity picture is poised to improve in the coming weeks. At the helm of the US Treasury is a macro hedge fund manager, not a clueless central banker. Scott Bessent, who is not one of the tariff hawks, brings a nuanced understanding of liquidity's impact on financial conditions and markets. His strategy focuses on easing the three pillars of financial conditions—dollar strength, interest rates, and oil prices—to stimulate the business cycle. This approach has already driven a sharp loosening in financial conditions, evidenced by Raoul Paul’s GMI Financial Conditions Index and Global Total Liquidity metrics, which are now trending higher. Bitcoin and other risk assets typically follow liquidity trends.

The GMI Financial Conditions Index (FCI) reflects changes in financial conditions by aggregating key financial variables that influence the availability and cost of credit, as well as overall market stress. Like other FCIs, it incorporates metrics such as interest rates, credit spreads, equity valuations, exchange rates, and market volatility to provide a comprehensive snapshot of financial health. When these variables indicate easier access to credit and lower borrowing costs—conditions described as easing—the index signals improved liquidity and a more favorable environment for economic activity

The effects of this liquidity surge are expected to manifest soon, potentially triggering a robust recovery in asset prices. Adding to this tailwind is the rebalancing activity of target-date funds. According to Vincent Deluard of StoneX, approximately $120 billion will shift from bonds to equities as these funds restore their 60/40 allocations—a dynamic historically associated with trading bottoms. Together, these factors set the stage for a sharp rebound in risk assets. Even if this turns out to be a long-term bear market, it won't be a straight line. Better to be a buyer than seller here.

Netflix Thesis to Own: The King of Streaming Isn't Afraid of Tariffs

Netflix (NFLX) is a new investment that was recently added to Silverlight client portfolios. The high quality company’s strategic edge lies in its vast content library, bolstered by award-winning originals and a global subscriber base exceeding 260 million. This scale drives a virtuous cycle: more users fund richer content, widening the competitive gap. Recent earnings underscore this strength—2024 saw 60% EPS growth. Analysts project earnings growth to top 20% each of the next two years. Profit margins continue to impress, with free cash flow margins hitting all time high levels, and gross margins recently rising to all-time high around 46%. Looking ahead, catalysts like live sports expansion and ad-tier growth could propel shares higher in 2025.

Netflix is relatively insulated from tariff risks compared to many companies because its core business—streaming digital content—is not directly tied to physical goods or supply chains that are typically targeted by tariffs. While the company does face challenges from international taxes, such as Europe's Digital Services Tax (DST) and local content investment requirements, these measures are unlikely to derail its profit growth trajectory. Analysts argue that Netflix’s significant contributions to local economies, including job creation and investments in regional content, make punitive tariffs less likely.

Restaurant Customer Helps Waitress Retire

Betty, 81, trudged through her waitressing shifts at Eat’n Park, her $910 Social Security check chaining her to work. Retirement was a mirage—until Tamie Konzier, a TikTok influencer, stepped in. Overhearing Betty’s plight during a meal, Tamie spent a few minutes crafting a video, blending her social media savvy with a dash of compassion. That spark of human capital ignited a GoFundMe, raising over $300,000 from strangers in days. Betty’s now got a trust fund and a recliner calling her name.

Wealth isn’t just cash—it’s how we spend our time. Tamie traded minutes for Betty’s years. And those thousands who donated? They prove goodness still thrives—people eager to help, not for gain, but because they can. One woman’s creativity, mixed with collective kindness, turned Betty’s endless shifts into a well-earned retirement.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX