The Wall Digital Currencies Are Destined To Hit

Submitted by Silverlight Asset Management, LLC on December 23rd, 2017

The rise of cryptocurrencies is one of 2017’s most captivating market stories.

A lot of market watchers have been left scratching their heads, not sure what to make of it. There’s strange new jargon to absorb—words like “blockchain.” Mystical, faceless founders, known only by Internet alias.

One thing that isn’t confusing is the price action. It seems overnight millionaires are regularly being minted. Bitcoin has soared over 1,500%, while some of its peers have done even better.

Yet for all the excitement surrounding bitcoin mania, there is also a dimension with a familiar arc.

What dooms most investment booms is a wall of new supply. That wall is quietly forming in the realm of digital currencies. Brick by brick, it grows bigger by the day, with each new coin being issued.

Yes—I’m pretty sure I’ve seen this story before, in different forms.

Here are a few examples, starting with my first “investment”.

Case Study #1: Baseball Cards

When I was 8 years old, I diligently saved up $100 from my allowance and birthday money, then parked it all in baseball cards. Specifically, I purchased a 1983 Topps complete set.

It seemed like a wise decision at the time. I studied monthly Beckett price guides religiously back then, and felt well-attuned to “the market.” Baseball cards were popular and steadily increasing in value.

Alas, it turned out to be a very bad investment.

For starters, my dog ate a third of the cards right after I bought them!

Even if I still had all the cards in mint condition though, I’d be lucky to get $40 for them today.

The baseball card market boomed throughout most of the 1980s, attracting an influx of hobbyists and speculators. I was one of those speculators, although I had no idea what the word meant at the time.

Baseball cards stopped increasing in value in the late ‘80s when the leading card issuer, Topps, saw an influx of competition. New companies like Score and Upper Deck jumped in the ring, joining fringe competitors like Fleer and Donruss.

For me, it became annoying tracking all the brands. How many 1989 Jose Canseco cards does a collector really need?

I stopped buying as many cards, and so did others. Price momentum stalled, which further dampened enthusiasm. The market became engulfed in a negative feedback loop it’s never recovered from.

Case Study #2: Tech

If you were a stock investor in and around 2000, you likely remember the tech frenzy. Any equity ticker representing a company with a .com at the end of its name was in very high demand.

In a free society, capital flows to where it's treated best. When a category is under-served and booming, new capital formation scrambles at a ferocious pace to catch up and cash in. Venture capitalists and investment bankers help make this happen by bringing new securities to market.

However, supply always overshoots at some point. That’s when booms go bust.

For instance, in 1999 over $50 billion of equity capital was raised via initial public offerings—a record. Over half of the total IPOs that year were technology related.

Around this time, the market became oversaturated with tech shares. The long bull run in tech stocks began grinding to a halt. Over the next two years, the tech-heavy Nasdaq Index lost 78% of its value.

Case Study #3: Real Estate

There was a time in the last decade when many people believed real estate prices only went up. Starting around 2006, many of those same people began to experience a rude awakening.

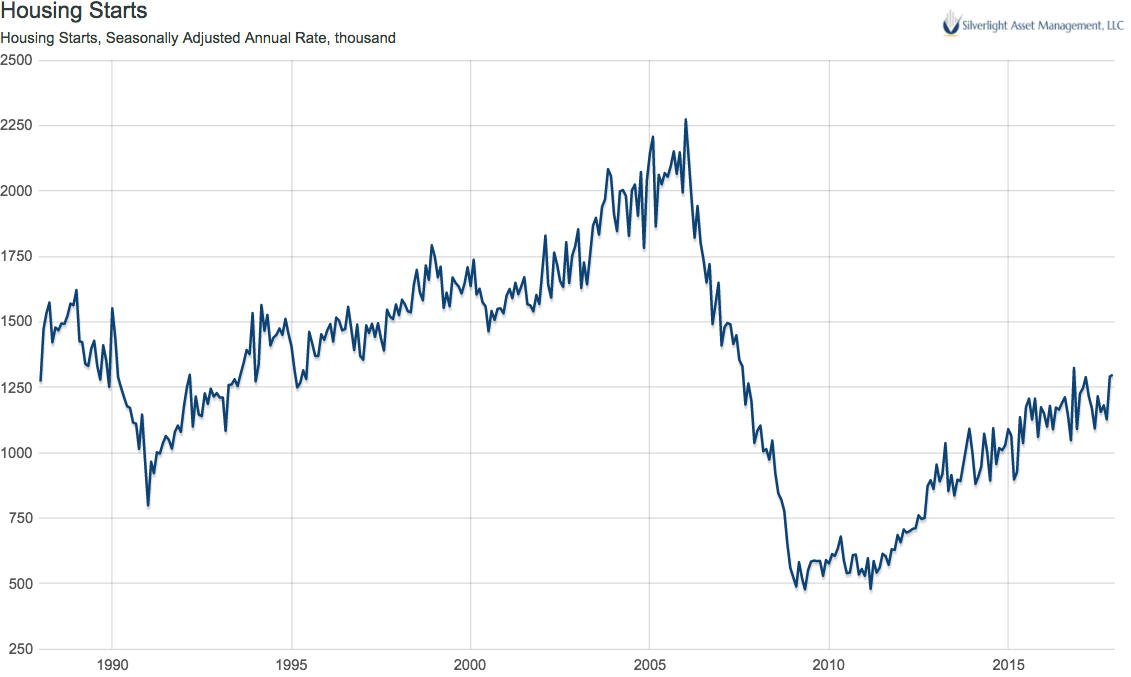

The housing collapse was precipitated by a period of ultra-easy lending standards, which increased the buyer pool. Higher demand nudged housing prices higher. Eager homebuilders then sought to capitalize by expanding the rate of housing starts beyond cyclical norms.

(Data source: HiddenLevers)

Eventually, housing supply became extended beyond a rational level. When demand conditions normalized, a price correction was imminent.

Each of the preceding examples illustrates the same investing lesson. That is: too much of a good thing—in any market—can be hazardous.

Will Cryptos Be the Next Case Study?

Financial blogger, Josh Brown, has been a bitcoin bull most of this year. He’s profited nicely from that stance. However, he recently wrote an insightful post articulating a budding concern.

“So I asked… the following rhetorical question: There are only three coins on the (Coinbase) platform. If there were five or ten, isn’t it more likely that they would all individually be worth less per coin, because Coinbase retail people would have more places to spread their bets?”

In my view, Josh is wise to worry about this. All cryptocurrency enthusiasts should be monitoring the threat imposed by rising competition for investment dollars via new tokens.

Bitcoin bulls point to limited supply as an attractive trait of the new ‘currency.’ Unlike the U.S. monetary base—which the Federal Reserve has perennially expanded since the U.S. ditched the gold standard—bitcoin supply caps at 21 million coins in 2040.

If the rules don’t change, supply limits appear to make bitcoin a better store of value than fiat currency.

However, there’s one big caveat: bitcoin isn’t the only digital currency game in town. And that could potentially become a very big deal.

Coinbase is presently the main exchange for trading digital assets, serving 13 million customers in 33 countries. Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC) are listed on the platform, and all have skyrocketed in 2017.

Litecoin (LTC), founded by a former Google engineer Charlie Lee, is said to be faster to mine than bitcoin. Perhaps that explains why it’s up 75-fold in the last 12 months?

By the way, Mr. Lee sold every one of his tokens this month.

Next month, a fourth option will become available on Coinbase in the form of Bitcoin Cash (not to be confused with the other bitcoin—BTC).

Ripple (XRP)—released in 2012, already has a market capitalization over $18 billion. How long until that one appears on Coinbase, and gains wider adoption? Will it be at the expense of rivals?

There are many other competitors to consider as well, like Dash, Monero, and NEM.

This army of second-generation cryptos will keep growing and nipping at bitcoin’s heels, just like all those sports card companies came after Topps.

To be clear, there are many things I do not profess to know about how digital currencies will perform from here.

- I don’t know where bitcoin will be trading ten years from now

- I don’t know if government regulation will upend the market

- I don’t know which digital coin is the best bet for 2018

Here’s what I do know: the fact we’re seeing all these new tokens emerge means we’re at the beginning of the end. Not necessarily the end of the cryptocurrency story in its entirety, but of this chapter—a parabolic ascent phase that caught most people by surprise.

Originally published by Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX