Twilight in the Desert?

Submitted by Silverlight Asset Management, LLC on July 26th, 2017

There is a deal people on Wall Street refer to as “The IPO.”

Saudi Aramco is scheduled to go public late next year. Some estimate the company’s value could be as high as $2 trillion. In case you’re wondering—that’s almost 5x Apple’s value.

Aramco’s prized asset is the upstream unit, which boasts crude reserves 10x the size of ExxonMobil’s.

As the leader of OPEC and one of the largest oil producers in the world, the Saudi Kingdom lies at the epicenter of the global hydrocarbon market. To say their officials are well-attuned to the supply and demand setup for oil is an understatement. So, it seems wise to ponder this question: If Saudi Arabia wants to reduce oil exposure, do you want to increase yours anytime soon?

***

Twilight in the Desert was a book published in 2005 by Matthew Simmons. The main theory put forth was that Saudi Arabia was running out of oil, which could lead to an oil super-spike.

After the book’s release, Simmons made a wager with New York Times columnist John Tierney. The two men bet $10,000 that the year-end average of the daily price-per-barrel of crude oil in 2010, adjusted for inflation, would be at least $200. Simmons took the over, Tierney the under.

Tierney won. The average price for a barrel of oil in 2010 turned out to be $80 ($71 in 2005 dollars), obviously much less than the $200 Simmons had predicted. Simmons passed away in August of 2010, but his colleagues made good on his bet and paid Tierney.

If Simmons were still alive, he’d be amazed at today’s oil market. His analysis was detailed and thorough, yet his prognostication proved completely wrong.

It may indeed be ‘twilight in the desert,’ but not for the reasons Simmons postulated. In fact, the problem facing Saudi Arabia in 2017 isn’t too little supply, it’s too much.

The fracking boom between 2010 – 2014 led to a surge in worldwide oil production which overwhelmed demand and drove oil prices down to as low as $26 per barrel early last year. Oil prices have since recovered to $48.

Oil will struggle to sustainably rally until the industry rebalances global supply and demand. Three hurdles stand in the way.

OPEC losing control of supply. Compliance with OPEC's oil production-cut target has slid to just 19%. June output fell by just 246 thousand barrels per day (kbd) from agreed-upon levels against a promised 1,164 kbd cut.

Saudi Arabia has delivered on its promised cuts, but Iraq and UAE have not. Meanwhile, sharp production increases in exempt nations like Libya and Nigeria have hindered the cause.

Also compounding the problem is the fact that any price gains which materialize from OPEC production cuts help fuel the fortunes of North American drillers, who are happy to increase output at any glimmer of higher prices.

Overall oil production continues to rise, despite Saudi Arabia’s best efforts to curb it. In fact, many producers have announced increases to their drilling and completion budgets for 2017.

Electric cars change the demand picture. The move toward electric vehicles is real and just getting started. Tesla took a step toward becoming more of a mass-producer when the $35,000 Model 3 sedan started rolling off the assembly line. Volvo just announced it will begin phasing out fossil fuel-only cars in the next two years.

Electric cars are expected to make up more than half of vehicles sold globally by 2040, according to Bloomberg New Energy Finance (BNEF) forecasts.

One of the major markets expected to create a tipping point is China. The nation’s leaders are grappling with heavy pollution. They also want to move away from gasoline to reduce heavy dependence on oil imports–something they view as a strategic vulnerability. By 2025, China may install quotas mandating that a fifth of new vehicles be battery-only.

Gasoline demand will not vanish entirely, but it will recede on a per capita basis. A key variable that will dictate the pace is battery costs. BNEF estimates lithium-ion batteries will drop from a current cost of $273 per kilowatt hour to $73 by 2030, making electric vehicles much more cost competitive.

The “Easy Money Era”

“When capital is in oversupply, it is inevitable that risk aversion dries up, gullibility expands, and investment standards are relaxed.”

- Howard Marks, There They Go Again… Again

The energy sector is the “poster child” for lackadaisical investment standards. Or more specifically, the exploration and production (E&P) firms, which are heavily dependent on outside capital to maintain drilling programs.

As an Oklahoma oil and gas expert recently said about one such E&P firm, “There is still unlimited capital, and as long as that is true, you can grow anything. If the company had been forced to live within their cash flow, then their production would go down. Then they would have run into a death spiral where nobody would want to invest in them.”

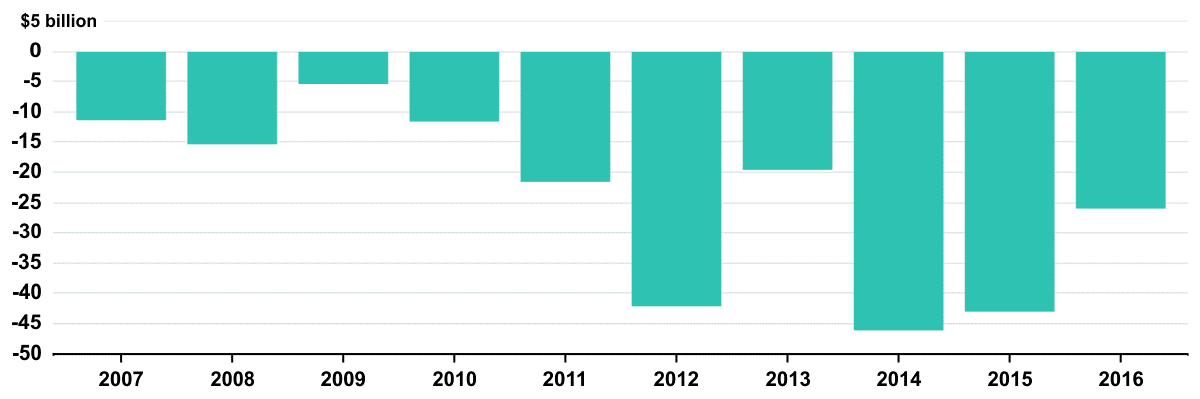

As an example of what ‘not living within their cash flow’ looks like, the Bloomberg chart below shows free cash flow for a group of 85 domestic E&P firms. The group has generated negative cash flow for almost a decade!

U.S. E&P combined free cash flow

Source: Bloomberg Gadfly analysis. Free cash flow (operating cash flow less capex) for a sample of 85 U.S. E&P companies with a market cap. of $100 million or more.

Many of these firms are equivalent to the walking-dead. Currently they have unlimited debt and equity capital raising opportunities. So, they keep pumping, even at unprofitable levels. This makes it perilously difficult for Saudi Arabia to rebalance the oil market.

As oil prices dropped below $45 a barrel earlier this summer, bonds issued by companies such as California Resources, Denbury Resources, EP Energy, MEG Energy and Northern Oil and Gas started to trade at distressed levels.

Now that the Fed is pondering reductions to its balance sheet, the “easy money” era, which has long financed unprofitable E&Ps, may come to an end soon.

After a record number of oil and gas bankruptcies in 2016, the energy sector could be hit with a second wave of restructurings in 2019, if oil prices remain below $50 a barrel. While new fracking techniques have improved drilling economics, many producers still need oil prices well above $50 a barrel to generate long-term profitability. Sub-$50 oil, coupled with a wall of credit lines scheduled to expire in 2019, could be the catalyst to force another wave of debt restructurings.

We’re looking for oil prices to top out soon around $50. Our risk model shows a support range between $32.32 and $36.97. Our best guess is oil will trade to those levels in the next 6-12 months. If we’re right, a lot of distress will be inflected on the high yield energy credits, similar to early last year.

To summarize our investment view, we are of a mindset to remain patiently on the slidelines. The secular outlook for energy remains fundamentally challenged.

Sources: Bloomberg, BI Industries, Demark Analytics, The Financial Times

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX