Starbucks' Big Stock Buyback Limits Future Upside

Submitted by Silverlight Asset Management, LLC on August 31st, 2019

After Howard Schultz resigned as Starbucks' CEO last June, I profiled the company's investment merits in a post. "It's coffee almost never goes on sale, but the stock is now," I wrote.

Starbucks shares have since returned 79%, while the S&P 500 is up 8% over the same period.

Starbucks bottomed near $50 around the same time an expanded share repurchase plan was announced. Management had already committed to return $15 billion to shareholders via buybacks and dividends through fiscal year 2020. Newly appointed CEO Kevin Johnson pledged to increase the target by an extra $10 billion.

$25 billion was an extraordinary sum to return to shareholders, considering Starbucks' overall market cap was under $80 billion. There's no such thing as a "Can't Lose Investment," but this setup was darn close. Here you had one of the premier business franchises in the world, offering a double-digit shareholder yield (dividends + buybacks), in an environment where bonds yield next to nothing.

When the buyback program accelerated in late-2018, shares outstanding fell sharply. The stock price broke above a multi-year trading range, and it's been off to the races ever since.

SBUX shares outstanding (blue) and share price (green).

Investor sentiment has also been further aided by improving corporate performance.

Beverage innovations like the Nitro Cold Brew, as well as better digital engagement with customers, have spurred a rebound in same-store-sales. In the U.S., same-store-sales growth was +7% last quarter compared to +1% a year ago.

Starbucks also maintains ample runway to grow its store count, particularly abroad. In 2019, management expects to open 2,000 net units, including 600 in China.

While I maintain a positive long-term view on the company, I recently decided to exit my position. Here's why.

Starbucks' Share Repurchase Program Comes With IOUs

There are a couple "IOUs" linked to Starbucks' buyback program that investors should be mindful of going forward.

First, the company incurred a lot of debt to fuel all these buybacks.

- Three years ago, Starbucks had about $3 billion in debt and a debt/equity ratio of 59%.

- The company now carries $9.2 billion in debt and the debt/equity ratio exceeds 800%.

Second, Starbucks' valuation profile has changed.

Enterprise value (EV) considers the value of an entire company—debt and equity. That's an important metric now since Starbucks just incurred a bunch of debt.

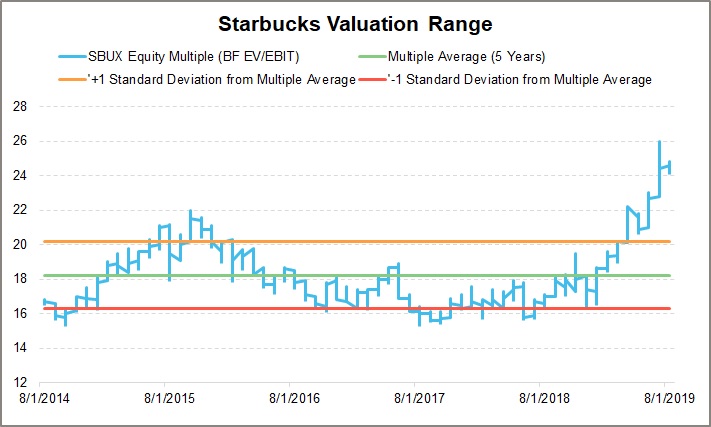

Below is Starbuck's valuation range over the last five years, measuring the ratio of EV to estimated earnings before interest and taxes. Starbucks presently trades at 24.8x, which is a 36% premium to the historical average of 18.3.

Valuations in the broad equity market have drifted down over the last year, which makes Starbucks recent valuation surge an even more interesting anomaly.

Does Starbucks really have enough growth potential to justify this high of a multiple?

Starbucks' growth rate has been okay in recent years, but not lights out. Top-line sales are growing annually at around 10%. Earnings-per-share rose almost 30% over the last year, but much of that came from an artificial lift due to a lower share count. Overall operating income will likely be down year-over-year ($4.43 billion est. in '19 vs. $4.46 billion in '18).

Markets are ruled by supply and demand.

The supply of Starbucks shares has shrunk considerably due to buybacks.

Meanwhile, demand has surged. From my perch, it appears a lot of future returns have been pulled forward by Starbucks' buyback program. I say this because much of the recent run-up was fueled by a higher valuation, which isn't sustainable in perpetuity. There will be a payback period down the road.

Two things likely sparked a higher valuation:

- Demand increased because the company started aggressively buying its own shares. Buybacks really accelerated in Q4 of last year, when the broad market was languishing.

- Starbucks started to outperform, which creates a new layer of demand. The stock has been receiving progressively bigger weights in passive index funds and momentum-based strategies.

For context, Starbucks is now the 9th largest holding in the iShares Momentum Factor ETF (MTUM).

That investment product does not buy stocks based on fundamentals. It doesn't care if earnings are seeing a temporary lift. It doesn't care if the valuation is three standard deviations higher than normal. It only cares about one thing: the stock is going up.

This typifies the modern market we find ourselves in. Positive momentum—independent of whatever the initial catalyst is—feeds on itself. A snowball effect takes shape, and the prices certain securities trade at have a blurry connection to fundamental reality.

It's unlikely Starbucks will have any issues servicing the extra debt.

But the aggressive buybacks likely created a positive feedback loop that pushed valuations up considerably. That makes for a riskier investment without as much upside going forward, because valuation always mean reverts. In the long run, stocks track the intrinsic value creation of the underlying company.

Over the next couple years, the company will slowdown the pace of buybacks. Growth metrics will lose some of their shine, as the artificial boost from a declining share count vanishes. Momentum investors will fall by the wayside. And the value crowd in the market will thumb their nose at Starbucks until that multiple comes down... a lot.

Originally published by Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX