Silverlight Strategies Outperformed In 2022

Submitted by Silverlight Asset Management, LLC on January 11th, 2023

Any way you slice it, 2022 was a challenging year for investors.

The S&P 500 lost 18.1%, which ranks as the seventh worst year since 1929. Meanwhile, the Bloomberg US Aggregate Bond Index lost 13.0%, which ranks as the worst year ever for bonds.

Amid this difficult backdrop, I am pleased to report that Silverlight's Core Equity and International Equity strategies achieved record outperformance.

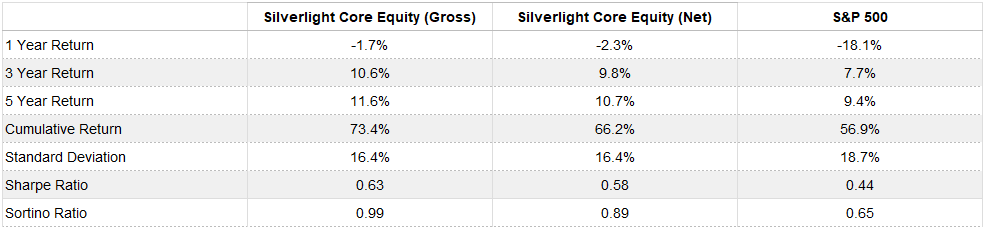

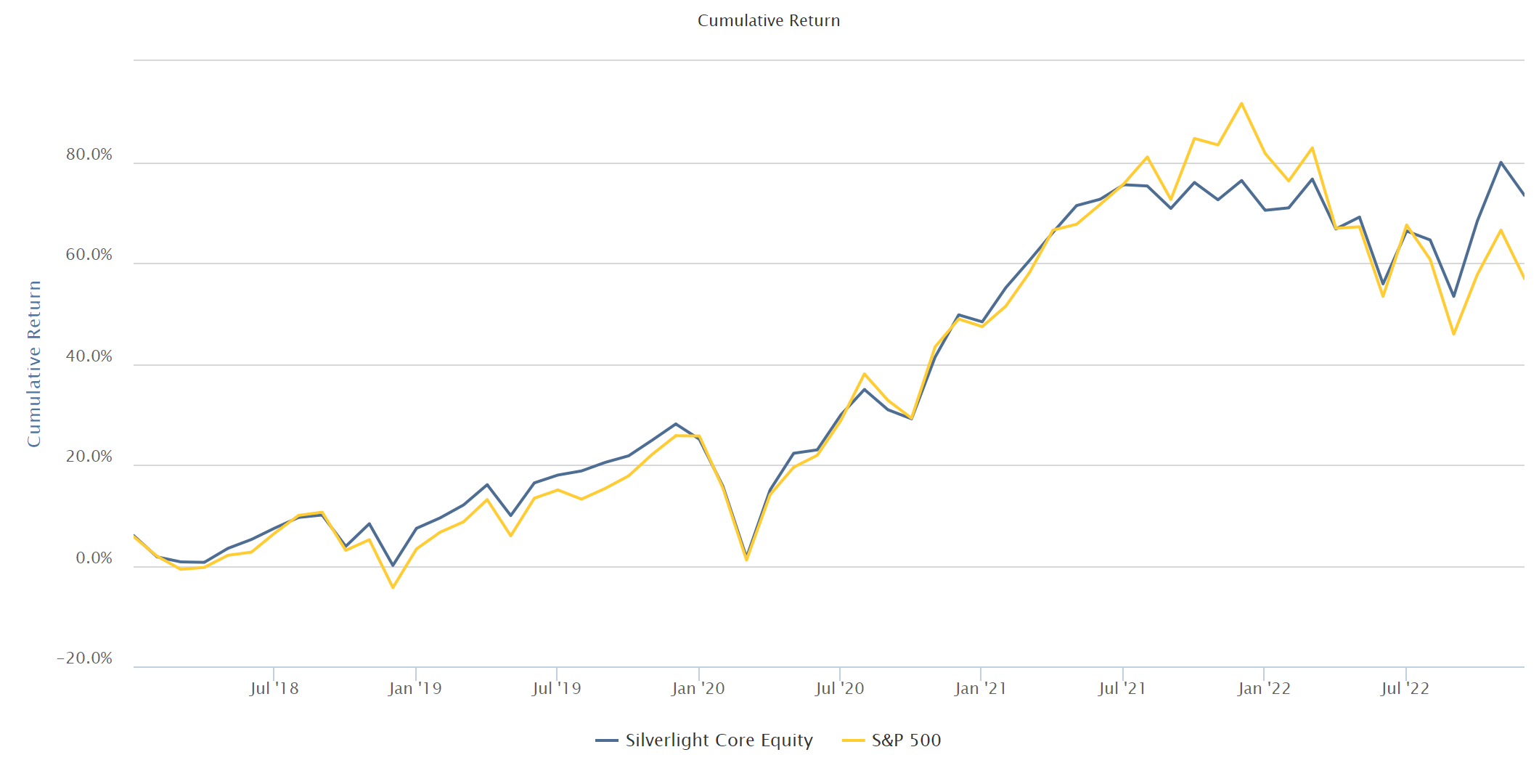

Silverlight's Core Equity strategy finished 2022 with a gross return of -1.7% (-2.3% net), outperforming the benchmark S&P 500 Index by 16.4% (15.8% net) and beating 98% of US Large Cap Core Equity peers in eVestment's institutional database.

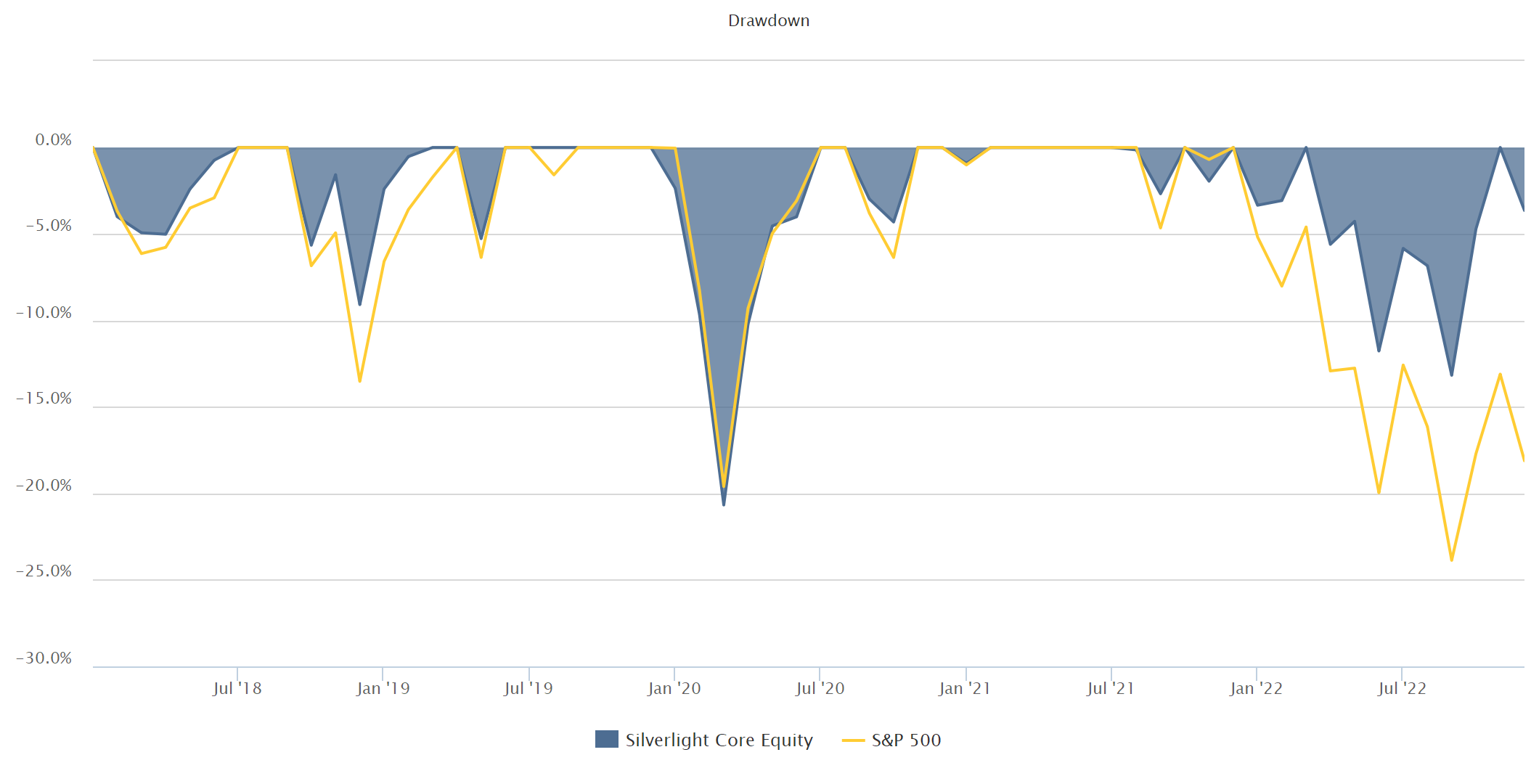

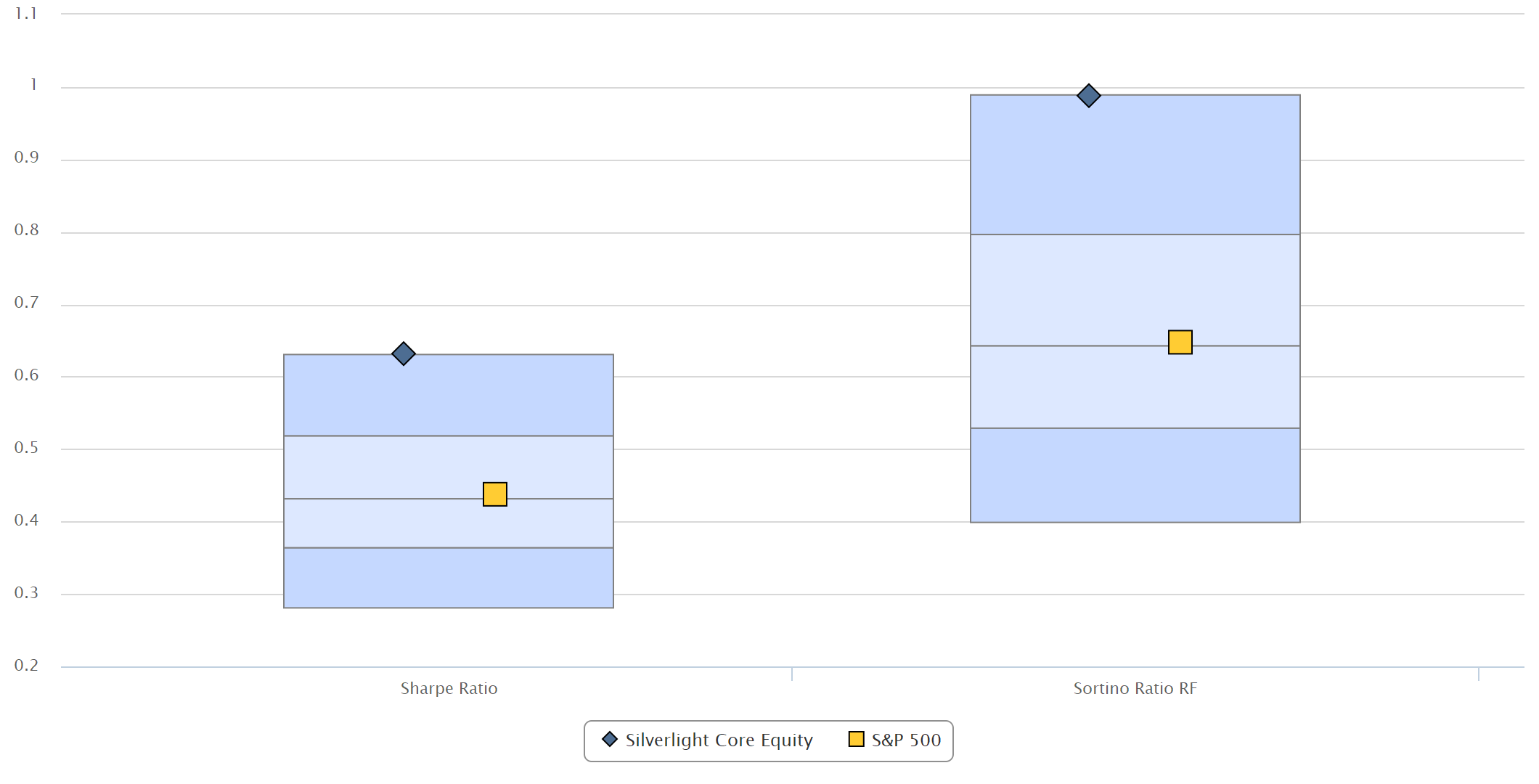

Over the last five years, Silverlight's Core Equity strategy has also beat the S&P 500 Index's return on a gross and net basis with below-average volatility, while outperforming 96% of peers on a risk-adjusted basis.

(Monthly returns from January 2018 through December 2022. The above quartile analysis is based on the US Large Cap Core Equity universe of separately managed accounts. Source: eVestment)

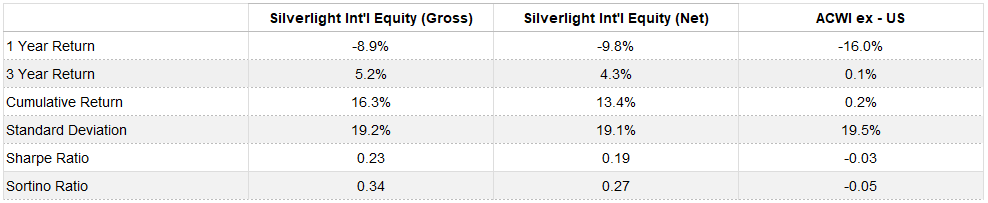

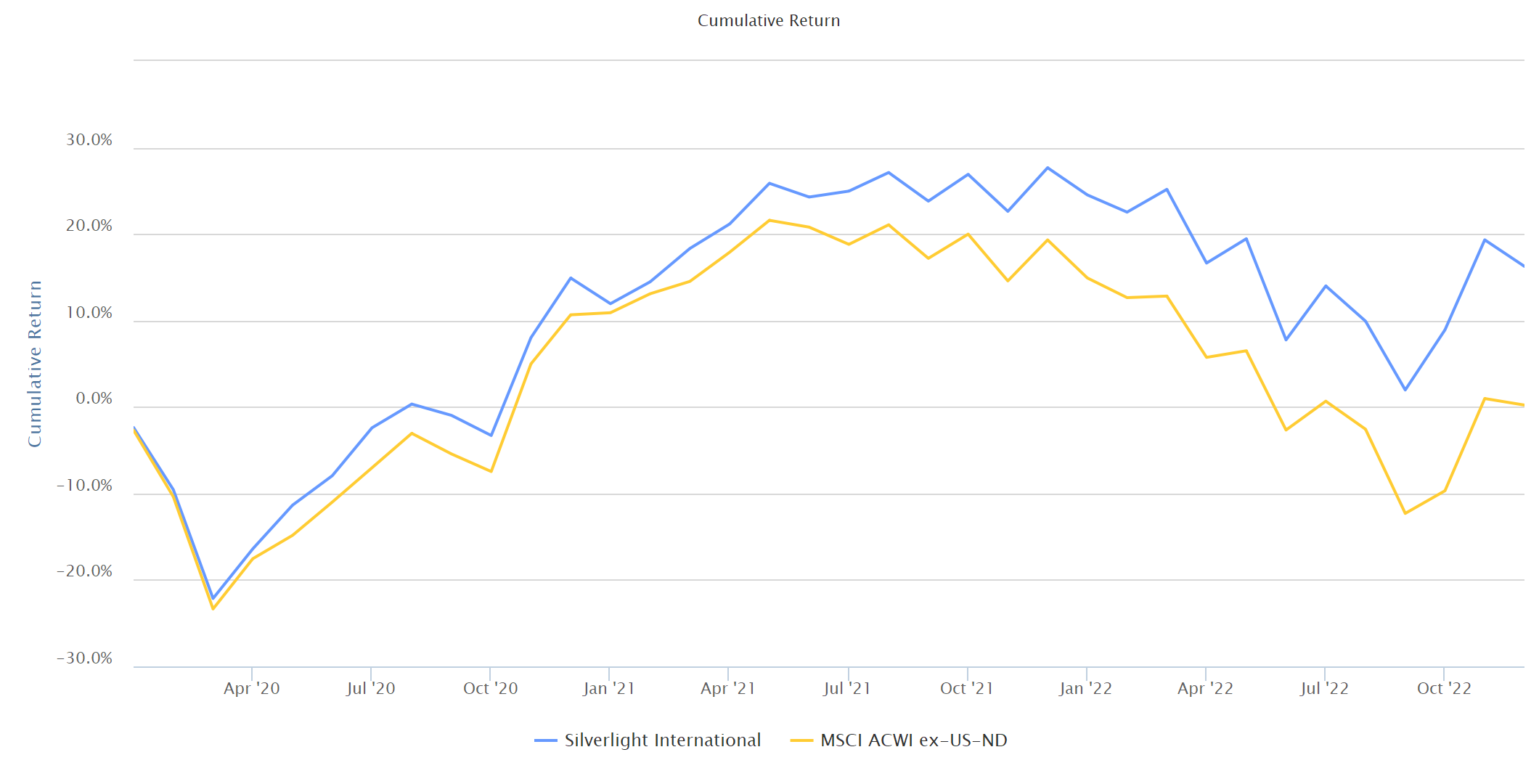

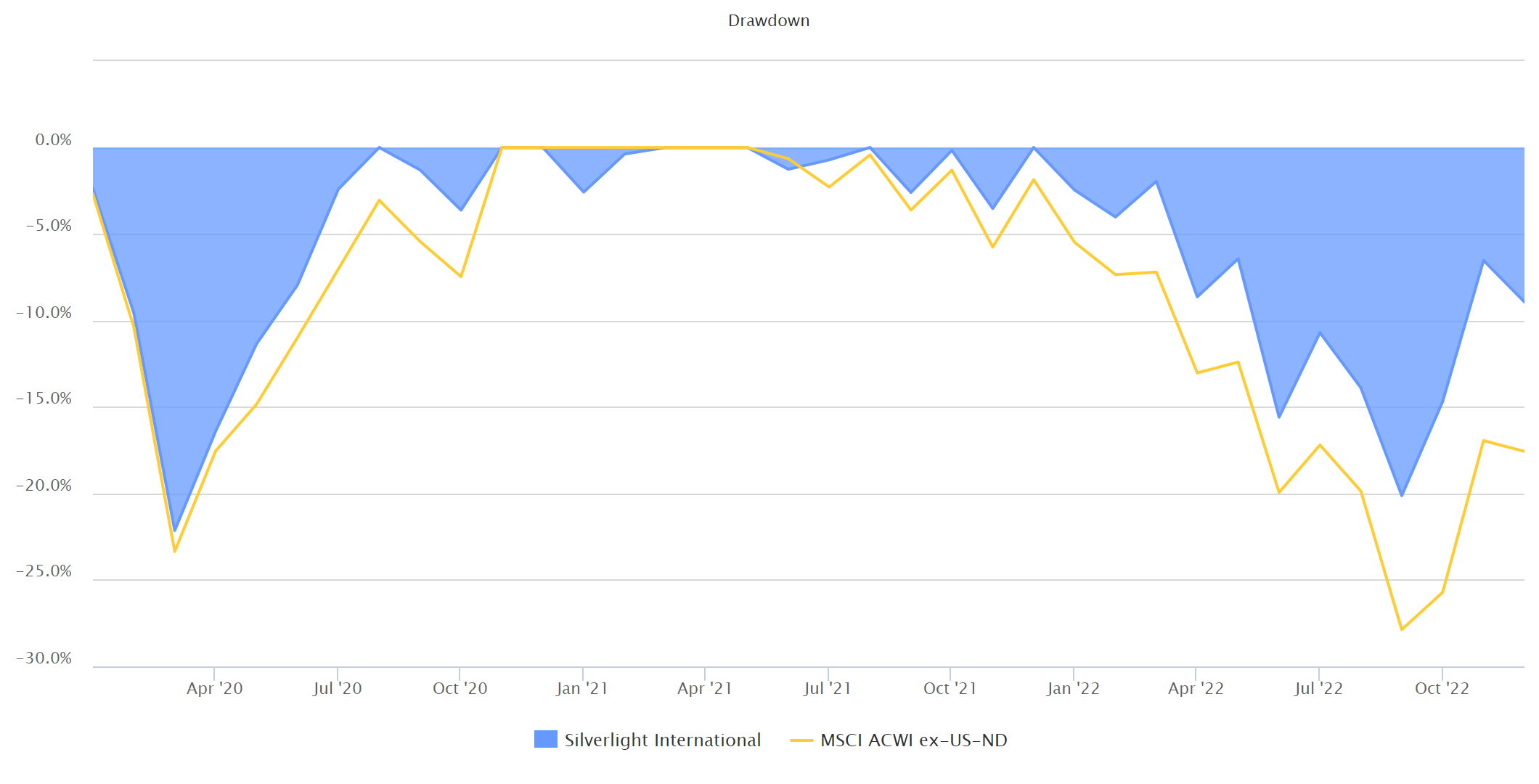

Silverlight's International Equity strategy finished 2022 with a gross return of -8.9% (-9.8% net), outperforming the benchmark ACWI ex-US Index by 7.1% (6.2% net) and beating 98% of ACWI ex-US Large Cap Core Equity peers in eVestment's institutional database.

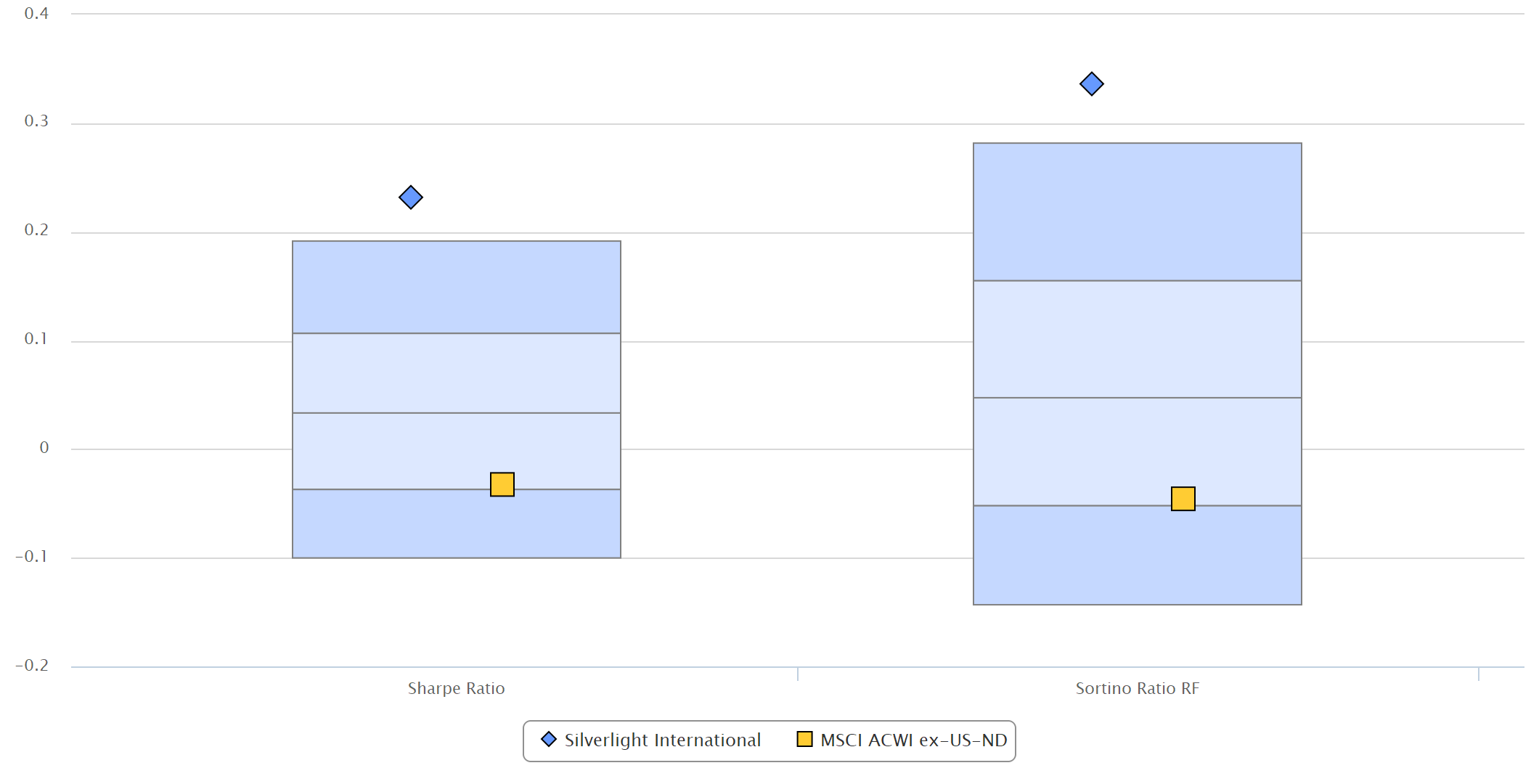

Over the last three years, Silverlight's International Equity strategy has beat the ACWI-ex US Index's return on a gross and net basis with below-average volatility, while outperforming 99% of peers on a risk-adjusted basis.

(Monthly returns from January 2020 through December 2022. The above quartile analysis is based on the ACWI ex-US Large Cap Core Equity universe of separately managed accounts. Source: eVestment)

***

One major reason why Silverlight strategies outperformed in 2022 was because we proactively implemented a defensive strategy. Since we perceived a bear market as the most probable market outcome, we raised approximately 25% cash at two different junctures during the year. After the market sold off sharply, we then became more constructive on risk assets and increased our investment exposure in time to catch significant rallies.

Going forward, we are much more constructive on the outlook for 2023 compared to last year. However, there is still a distinct possibility this bear market is not yet over.

If you or anyone you know has accounts that delivered unsatisfactory performance in 2022, please consider giving us a call. Active management can help smooth out the volatility of investment cycles, and our investment process has produced excess returns over multiple years across multiple strategies.

We will be reaching out to Silverlight clients to schedule individual portfolio reviews in the coming weeks. In the meantime, please contact us if you have any questions about your portfolio or the market outlook.

Good luck to all in 2023!

Silverlight Asset Management, LLC is an independently owned California Limited Liability Company and a state registered investment adviser. The information expressed herein has been prepared for informational purposes only and does not constitute a recommendation. Past performance is not indicative of future performance. Principal value and investment return will fluctuate. There are no implied guarantees or assurances that the target returns will be achieved or that objectives will be met. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX