5 Things We Learned This Week - 2/1/2025

Submitted by Silverlight Asset Management, LLC on February 1st, 2025

Feb 1, 2025

After a volatile week, the S&P 500 closed down 1.0%. The Bloomberg Aggregate Bond Index gained 0.4%, Gold rallied 1.1%, and Bitcoin fell 3.3%.

The headline Personal Consumption Expenditure (PCE) Index rose to 2.6% in December, an increase from 2.4% in the previous month. The Core PCE, which the Federal Reserve favors as an inflation measure, stayed the same at 2.8%. Despite inflation easing from its peak levels post-pandemic, it remains stubbornly high. This is why the Fed paused on further rate reductions at this week's FOMC meeting. Fed Chair Powell said, "With our policy stance significantly less restrictive than it had been, and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance".

DeepSeek's Impact on the AI Cycle

Tech and AI infrastructure stocks fell sharply on Monday after the outlook for future capex suddenly became cloudier. Forbes columnist, Mike O'Sullivan, believes DeepSeek's emergence marks the end of the first phase of the AI investment boom. He writes:

"The important development is that the cost of production threshold for large AI models has been set much lower. Other cheaper models are on the way, Bytedance's Doubao-1.5 or Moonshot's Kimi k1.5 are two emerging examples. To that end, the first phase in the AI boom now comes to an end. Much like other key technology infrastructure breakthroughs – railway (railway companies made up 50% of the stock market in 1900), automobiles (France dominated the auto market from 1903 to 1929, at times manufacturing half of the world’s cars) to the internet (anyone remember AOL or Netscape”) – the initial innovation garners huge amounts of capital, is expected to change the world, which it does but often not in the ways investors expect. The legacy is usually a new web of infrastructure.

In the next phase of AI, investors will now not likely pay up for model developers but will focus on unique datasets, applications of AI (health) and the AI industrial supply chain - energy for AI, for example."

Trump's Tariffs Will Drive Up the Cost of Avocados

If you like avocado on your Chipotle, get ready to pay more.

President Trump announced 25% tariffs on Mexico and Canada, and 10% tariffs on China. In total, the new tariffs will impact almost half of US imports.

President Trump's 25% tariffs on Mexican imports are expected to significantly increase avocado prices in the US. Since Mexico supplies over 90% of avocados consumed in the US, these tariffs will bite American consumers. According to David Ortega, a food economist and professor at Michigan State University, there could be “pretty significant increases in the price of avocados. Maybe not the full 25%, but pretty close, given that there’s very little substitute ability with regards to where we would source avocados.”

When tariffs are imposed, firms pass the higher costs onto consumers, leading to higher prices for products. This means inflation will probably go up for a range of items, including vegetables, fruits, tequila, clothing and cars. As expected, Mexico, Canada, and China have already announced retaliatory measures. Let the trade wars begin.

The Economic Impact of Tariffs: Lessons from History

Tariffs are intended to protect domestic industries. As a tactic, they have shown mixed results in terms of generating economic prosperity. On the positive side, one could argue America's tariff policy in the 19th century helped build its industrial base. Also, China's more recent use of tariffs clearly benefited the country's rapid industrialization. On the negative side, President Trump's tariffs on steel and aluminum in 2018 led to job losses and higher prices for consumers, according to a study by the Federal Reserve. In the 1990s, the US enacted tariffs on Japanese cars, which resulted in higher prices for American consumers without boosting domestic auto production. The most severe example of tariffs backfiring was the Smoot-Hawley Tariff Act of 1930, which prolonged the Great Depression by stifling international trade.

Whether you're a Trump fan or not, it's important to stay level headed about his trade policy. Trade wars create more uncertainty, which typically leads to volatility. For this reason, we recently increased cash levels in client portfolios as a defensive maneuver.

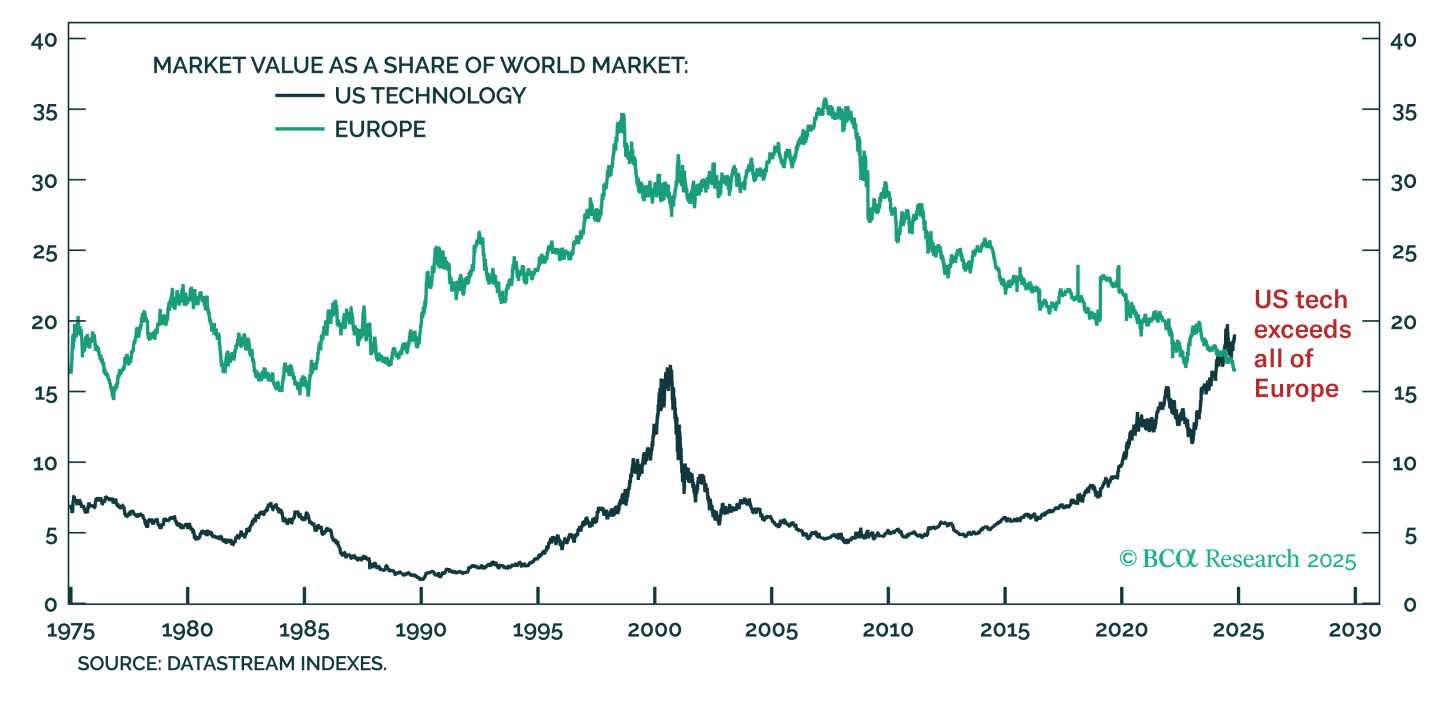

The US Tech Sector Is Worth More Than All of Europe

US tech stocks now comprise over 20% of the global stock market, an all-time high that exceeds the peak of dot com mania in 2000.

For the first time in over 50 years, US tech stocks now comprise more of the global stock market capitalization than all European stocks combined. This shift is due to Web 2.0’s productivity gains, which funneled profits into a few dominant US tech companies. Today, the market expects generative AI’s productivity gains to similarly benefit these same companies, but this seems unlikely. Web 2.0 was unique due to its network effect, and historically, the big winners of one technology cycle rarely dominate the next.

One of the lessons from this week's market action is to be weary of overly concentrated risk. Monday's selloff was based on the realization that mega cap tech stocks don't have impenetrable economic moats. Competition is coming.

NFL Fans Rally to Support Tight Ends Who Dropped Key Passes

The Buffalo Bills Mafia is one of the most dedicated fan bases in the NFL. They're also a classy bunch.

In a heartwarming display of sportsmanship, Buffalo Bills Mafia fans rallied together to support Baltimore Ravens' tight end Mark Andrews after he dropped a crucial pass in an NFL playoff game. Bills fans raised over $90,000 for Andrew's favorite charity, a diabetes research and advocacy organization.

The kindness didn't go unnoticed. The following week, when a Buffalo Bills tight end experienced a similar fate by dropping a key pass, Ravens fans returned the favor. They donated to the Bills player's favorite charity, creating a beautiful cycle of goodwill between the two fan bases. This exchange of generosity highlights the positive impact sports can have beyond the game.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX