Rule-breakers

Submitted by Silverlight Asset Management, LLC on June 29th, 2017

A few years ago, a man gave a speech. He told the audience he never imagined that he’d someday be employed by “the argumentative young boy who grew up in my house, eating my food and using my name.”

To say the boy was a handful is an understatement. He refused to clean his room and frequently showed up late for dinner. When he was 12, he got in such a heated argument with his mother that his father was compelled to throw a glass of water in his son’s face. Speaking to a counselor about the incident, the boy proclaimed, “I’m at war with my parents over who is in control.”

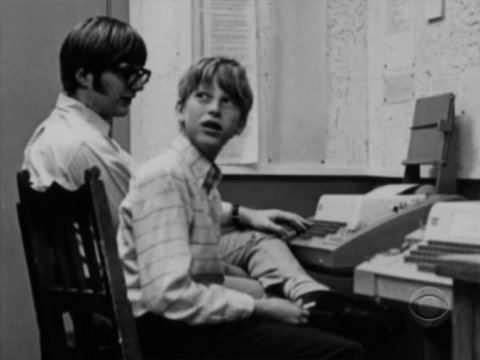

The man who gave the speech is Bill Gates, Sr.

His son, of course, is Bill Gates, Jr., the richest person in the world.

Bill Gates Jr. continued his rule-breaking ways later in life. He famously dropped out of Harvard to start Microsoft, and a couple years ago, during a TED talk, he let mosquitos loose on the audience.

Gates is a rebel. And that is a key part of why he’s so successful.

***

A recent study found that defiant children who exhibit a penchant for rule-breaking are more likely to succeed in their careers than their responsible, rule-abiding peers.

In 1968, researchers collected data to ascertain the personality characteristics of over 700 children. When the children reached the age of 52, researchers checked back to see how they progressed as adults. They found the rule-breaking trait among children was “the best non-cognitive predictor of higher income.”

So, if you have a defiant child or grandchild, maybe you’re doing something right after all!

The point here is not to imply that parents should strive to raise Machiavellian children or encourage misbehavior. What it does speak to, however, is that originality is a virtue we may want to embrace more than we do.

Human beings are attracted to novelty. We gladly pay extra for it. Whether it’s a good, service, or person we want to join our team. Creative expression which adds value to others’ lives will always be valuable and justly rewarded by society.

On the other end of the spectrum—commoditized, conventional, conformist workers will increasingly fall victim to the ruthless side of Joseph Schumpeter’s ‘creative destruction principle.’ It's the nature of the economy. Progress for all invariably means misery for some; i.e. the displaced.

The workplace which rewarded rule-breakers over the last forty years will likely continue to do so in the next forty years. In the current so-called Information Age, rules-based, repetitive jobs are increasingly being automated.

Who will program the rules the robots follow? Those who can think outside the box to imagine better systems and processes. Those who aren't afraid to reinvent the rules.

***

Actions drive results. Thus, no one should play the same game as everyone else, and expect a uniquely superior outcome. This is a simple, intuitive idea, but it’s largely missing from conventional school and parenting playbooks.

Application to investing? Consider this: in 2003, around 50,000 candidates sat for CFA exams. However, by 2014 that number swelled to 160,000 candidates. The increase in very well-educated investors makes it a smarter overall market.

The CFA does not explicitly teach anyone how to beat the market, though. Rather, it arms students with financial tools. Learning how to operate tools, especially complicated ones, is a useful part of mastering any craft, but it’s what you build that counts.

“Learn the rules like a pro so that you can break them like an artist.”

- Pablo Picasso

Any CFA can read a financial statement. Not all CFAs can smartly forecast how those financial statements will evolve in the future, because that requires multidimensional, creative thinking—something many quants and computers have a difficult time mastering. Dare I say, there is an artistic side to investing, often overlooked by a mass of conventional ‘rule-followers.’

Jeff Gundlach is a serious rebel of the investment world. He is the founder of Doubleline Capital and considered by many to be the top bond investor of the modern era. One reason Gundlach routinely shreds his investing competition is a unique ability to think in abstract terms. Put simply, he connects dots in ways others don’t.

He also breaks the rules by having the courage to make bold predictions, many of which turn out right. Like forecasting Trump’s election victory a year in advance, and sticking with the call right up to the election, when virtually everyone thought he was wrong. Until he wasn’t.

Gundlach does not just read the papers and regurgitate the consensus view in his investor presentations and interviews. That’s what everyone else does.

This man does something harder. He interprets the news.

He figures out how the rest of us see events, then he creatively connects the dots on how things may turn out down the road, where surprise power lurks, and where mispricing may be hiding. Creative thinking gets his investors to the right places, at the right times.

Whether any of us like it or not, people like Gundlach and Gates will continue to win the future, because they have two magical ingredients working in their favor: creativity and the courage to express it.

Source: Student Characteristics and Behaviors at Age 12 Predict Occupational Success 40 Years Later Over and Above Childhood IQ and Parental Socioeconomic Status, American Psychological Association, 2015.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX