Policy Factors Will Drive The Market In 2020

Submitted by Silverlight Asset Management, LLC on January 27th, 2020

If you got dizzy reading too many 2020 investment outlooks, and are still unsure how to position your portfolio this year, focus on fiscal and monetary policy. These are the most important market catalysts you can bank on, for now at least.

Several top hedge fund managers recently attended the World Economic Forum in Davos, Switzerland. Interesting soundbites emerged from the event.

“I love riding a horse that’s running,” David Tepper told CNBC. Mr. Tepper reportedly became convinced in December that the market would go higher as the Federal Reserve pumped more money into the system and as U.S.-China trade tensions eased.

Stan Druckenmiller, another legend, echoed Mr. Tepper. “I revealed a very bullish posture intermediate term since October when [Fed Chairman Jerome] Powell guaranteed he would not rescind the insurance cuts,” he told CNBC.

“In addition, Trump’s election prospects have increased with two trade agreements and big win in Iran which the Democrats have responded poorly to,” he added. “So I am still ‘riding the horse’ and bullish immediate term.”

Ray Dalio departed from the horse analogy, replacing it with a simple rhyme. He said investors shouldn’t be on the sidelines in the 2020 market, because “cash is trash.”

The collective net worth of these three gentlemen? About $35.4 billion, per the latest Forbes 400 rankings.

Tepper, Druckenmiller and Dalio know how to analyze charts and interpret valuations. They can see both are stretched. Yet they are where they are, because they understand how to properly compartmentalize such insights.

Sure, technicals and valuations matter. But the main story in their mind right now is the policy setup. Using that lens, here’s what you need to know to stay on the right side of the market.

Monetary Policy Outlook

The Federal Reserve’s pivot from hawkish to dovish was a major reason why stocks rallied in 2019. The Fed cut rates three times, which eased financial conditions and helped spur a powerful rally. The clip below shows how Chairman Powell’s pivot coincided with the market’s U-turn early in the year.

While the S&P 500 finished 2019 with a total return of 31.5%, the tenor of the tape in recent months has been particularly noteworthy. According to David Kostin of Goldman Sachs, the S&P 500 returned 11% over the past three months on realized volatility of 7% (annualized). The 1.7 return/volatility ratio ranks in the 99th percentile since 1950.

In other words, it’s been all upside and no downside.

This is true even with traditionally conservative stocks. The SPDR Utility Sector ETF (XLU) is the most overbought ever, with a current RSI reading near 87.

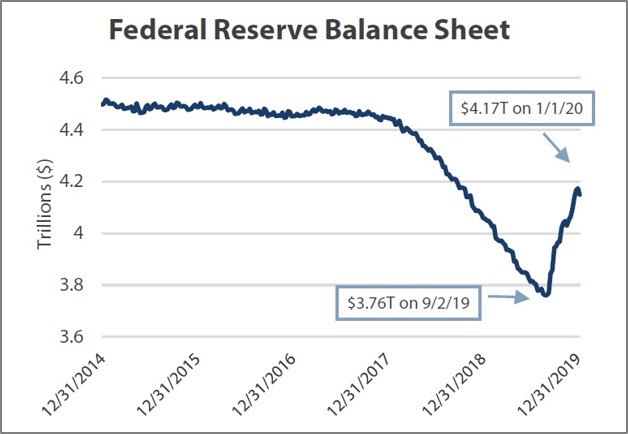

It’s hard to prove, but these performance anomalies are likely related to Fed policy. Specifically, the decision to expand the Fed’s balance sheet in September.

After short-term funding stress hit the repo market, the Fed began to supply additional repo funds and liquidity to banks. They’ve been expanding the balance sheet ever since, reminiscent of past Quantitative Easing (QE) campaigns.

Source: Bloomberg

Many believe there’s a knock-on effect from QE, whereby extra liquidity the Fed creates finds its way into capital markets. This may explain the nearly vertical ascent in equities over recent months.

The monetary tailwind is global. For example, the ECB reignited its own QE program in September, while China has been cutting the reserve requirements for banks.

Monetary policy will likely stay easy throughout this year. Chairman Powell recently said, “I think we would need to see a really significant move up in inflation that’s persistent before we would even consider raising rates to address inflation concerns.”

Fiscal Policy Outlook

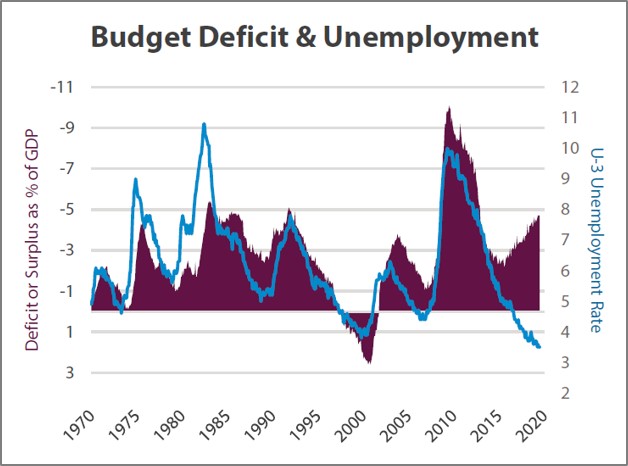

Since the Tax Cuts and Jobs Act of 2017 took effect, the U.S. fiscal deficit has grown from $681 billion to over $1 trillion — the highest level since the financial crisis.

In economic expansions, tax revenue normally rises faster than spending. Then, in recessions, revenue falls and spending ramps.

This cycle is different. Since 2017, revenue has grown 0.1% while spending grew 3.8%. Thus, the federal deficit is rising, which appears out-of-step since unemployment (blue line) is tracking near a 50-year low.

Source: Bloomberg

The U.S. economy has outperformed in recent years and interest rates remain near an all-time low. This provides ammo for European policymakers who argue the age of austerity should end.

In the U.S. and Europe, QE has effectively morphed into a direct financing of government deficits. And now that we’ve crossed that Rubicon, there’s probably no going back. Once politicians perceive a free pass to spend, they will spend.

- Germany has a 54 billion euro clean energy package and an 86 billion euro rail infrastructure initiative.

- France has abandoned its previous pledge to reduce public debt and will use extra tax collections to appease social protests.

- In the U.K., Boris Johnson’s Tories favor bigger deficits to fund infrastructure projects.

***

With markets on a tear lately, it’s natural some investors have a fear of heights. Stories about asset bubbles are common. They’re interesting, but also a distraction.

Yes, valuations play a key role in a risk/return calculus. But valuation should never be mistaken as a timing device. Expensive assets can become much more expensive, and vice versa.

That’s why policy matters.

Originally published by Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX