Lesson From Boeing: Follow The Free Cash Flow

Submitted by Silverlight Asset Management, LLC on March 4th, 2019

Boeing is the best-performing Dow stock over the last ten years. Since March 1, 2009, shares have soared 1,307%.

What propelled the aerospace giant into the stratosphere?

Follow the firm's free-cash flow and you'll find your answer.

Boeing's Cash Flow Surge

Boeing is a modern manufacturing marvel.

In 2018, top-line sales were $101 billion. 60% was derived from the commercial jet aircraft division, with most of the remainder coming from defense, space and security work.

Boeing was on my Dobermans of the Dow list in 2018. The stock has been a steady fixture, making the screen in 5 out of the last 7 years.

To qualify as a "Doberman," firms must rank highly on two criteria: Return on equity (ROE) and free cash flow yield.

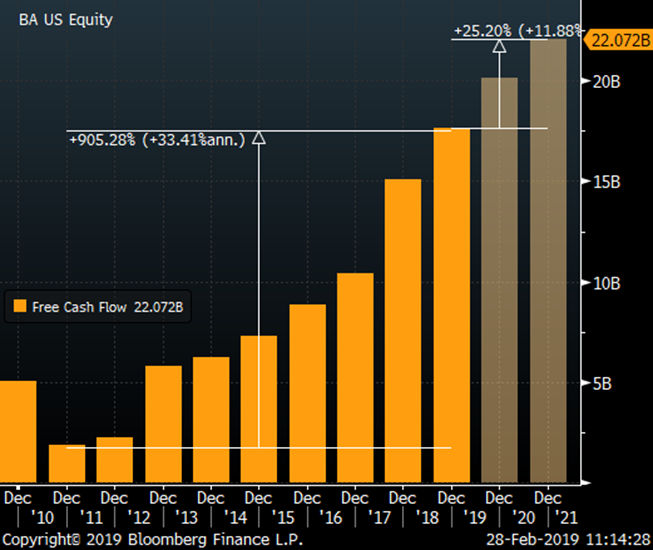

Surging cash flow is the main reason Boeing leads the Dow pack. Boeing shares returned 25% annually from 2011 - 2018. If you think that means the shares must be overvalued by now, think again. Free-cash flow rose 33% per year over the same period.

In other words, Boeing's stock followed the fundamentals.

Boeing currently sports a free cash flow yield of 7.3%. Wall Street projects the company to keep generating more cash over the next two years, estimating free cash flow will rise to $22.07 billion (+11.9% annual growth).

Boeing free cash flow by year. Source: Bloomberg.

Comparing Boeing's yield profile to something like investment grade bonds, which yield around 4% without any prospect for growth, it's easy to understand why investors are still bidding up Boeing shares in 2019 (+37% year-to-date).

Boeing's Investment Cycles

To better understand the story behind the numbers, investors should know that revolutionary products—like the 787 or air-taxi prototype shown below—don’t just come from a few people sketching ideas on notepads. It takes an army of engineering talent and premier technology to bring the future into the present.

Boeing invests a lot into R&D. Far more than most companies.

The intensity of the company's investment cycles vary, though. For instance, after the 777's launch in the mid-1990s, management focused on harvesting the existing portfolio. For a decade, there were no major aircraft development programs.

The strategy shifted when the 787 program launched in 2004. The jetliner was built with a unique blend of composites and included an innovative electrical system. It took eight years and approximately $32 billion to develop.

In the last five years, management has ratcheted down the R&D budget, focusing more on incremental innovation. Newer models, like the 737 MAX, are derivatives of existing aircraft.

In 2019, Boeing is expected to increase 737 production rates from 5 to 57 per month, which should add close to $3 billion in annual revenue at the full run rate.

With a mature production process now installed across its major products, Boeing is in a position to flex operating leverage and investors are benefiting from a strong cash conversion cycle.

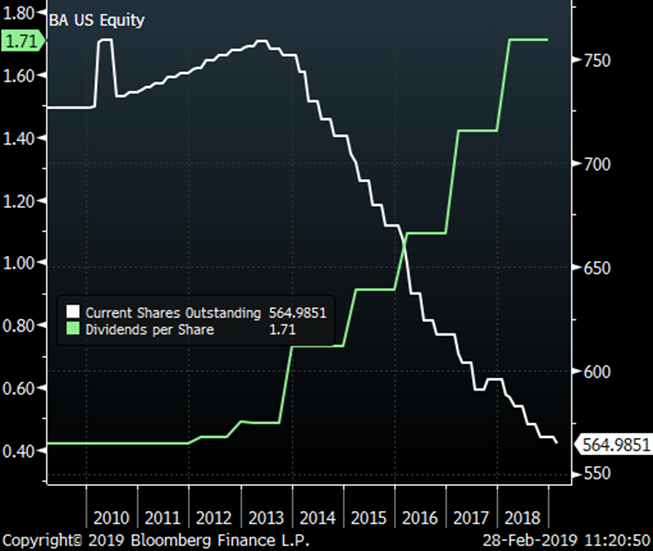

As investment needs have receded, Boeing has been returning more cash to shareholders.

-

In 2015, the company bought back 47 million shares for $6.8 billion and paid out $2.5 billion in dividends.

-

In 2016, $7 billion was spent on stock repurchases and the dividend was raised by 30%.

-

In 2017, $9.2 billion was spent on stock repurchases and the dividend was again raised by 30%.

-

In 2018, $9 billion was spent on stock repurchases and the dividend was raised by 20%.

Net effect: Boeing's dividends-per-share steadily drift higher while the share count steadily drifts lower (enhancing per share earnings yield to remaining owners).

Boeing dividends per share and shares outstanding. Source: Bloomberg.

Going forward, Boeing will likely continue to distribute a lot of cash back to its shareholders.

Yet the company must also keep investing in order to stay ahead of the competition. In 2019, Boeing may launch a new midsize aircraft likely to have a development cost exceeding $18 billion.

How can we apply lessons from Boeing to how we're investing today?

There are two key takeaways for investors.

First, be on the lookout for companies or industries that may be turning the corner on cash conversion related to past investments.

Second, beware of the limitations of investing purely based on quantitative screens.

I still own Boeing, even though the stock did not qualify for this year's Dobermans of the Dow. Reason: Boeing has spent over $100 billion cumulatively on designing aircraft, which according to GAAP accounting rules, doesn't count as an asset. This artificially suppresses the shareholder equity figure.

Adjusting for that accounting nuance, Boeing remains attractive even at present heights.

Also published by Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX