Introducing The 2022 Dobermans Of The Dow

Submitted by Silverlight Asset Management, LLC on January 5th, 2022

Four years ago, I introduced Forbes readers to a stock strategy called the Dobermans of the Dow. This is my annual strategy update.

The Dobermans of the Dow is a screen I invented as an alternative to the widely followed Dogs of the Dow strategy. The Dobermans screen favors high quality companies trading at attractive valuations. The selection criteria consists of two steps:

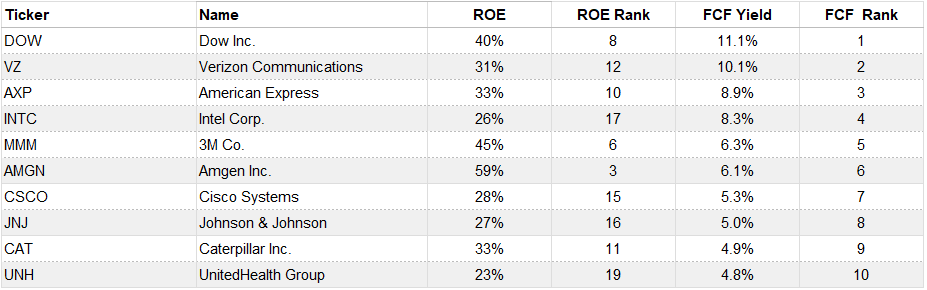

1) Rank the 30 Dow stocks by Return on Equity (ROE), keep the top 20.

2) Rank the remaining 20 names by Free Cash Flow Yield, keep the top ten.

Those final ten stocks are your Dobermans.

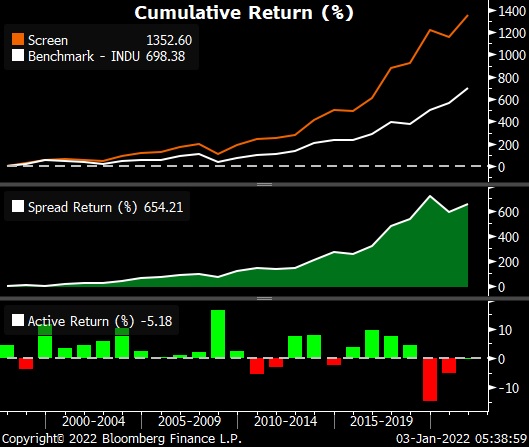

Historically, a hypothetical Dobermans of the Dow portfolio has outperformed the Dow Jones Industrial Average (DJIA). Since 1998, the Dobermans portfolio rebalanced annually has generated a cumulative return of 1,352% compared to 698% for the Dow index.

How did the Dobermans do in 2021?

Last year, the Dobermans of the Dow averaged a total return for the year of 15.8% compared to a 21.0% return for the Dow Jones Industrial Average (DJIA). The table below shows how the individual names on last year’s list performed.

In the last two years, the strategy has underperformed. Is this a cause for concern?

Not necessarily, because no strategy outperforms every year. Like I said in my Dobermans update two years ago, “I’m sure there will be future years when the strategy falls short. It’s inevitable.”

Here’s how I think about it: If you like the idea of owning a ten stock portfolio of highly profitable companies that are reasonably priced in relation to their underlying cash flow, the Dobermans of the Dow strategy makes a lot of sense. It’s easy to self-manage because you can rebalance just once a year, and the historical performance following this simple strategy has been quite good.

That said, if your primary goal is to outperform the market, there’s also nothing wrong with diversifying across a number of strategies. For example, you can combine a fundamental strategy like the Dobermans with more of a flows-based-momentum strategy. That would have helped performance in recent years partly due to a significant trend in passive investing that is worth highlighting.

The Passive Investing Bubble

Global inflows to exchange traded funds (ETFs) surpassed $1 trillion in 2021 for the first time ever. Much of this money flowed into passive investment products that mimic a market index for a minimal fee.

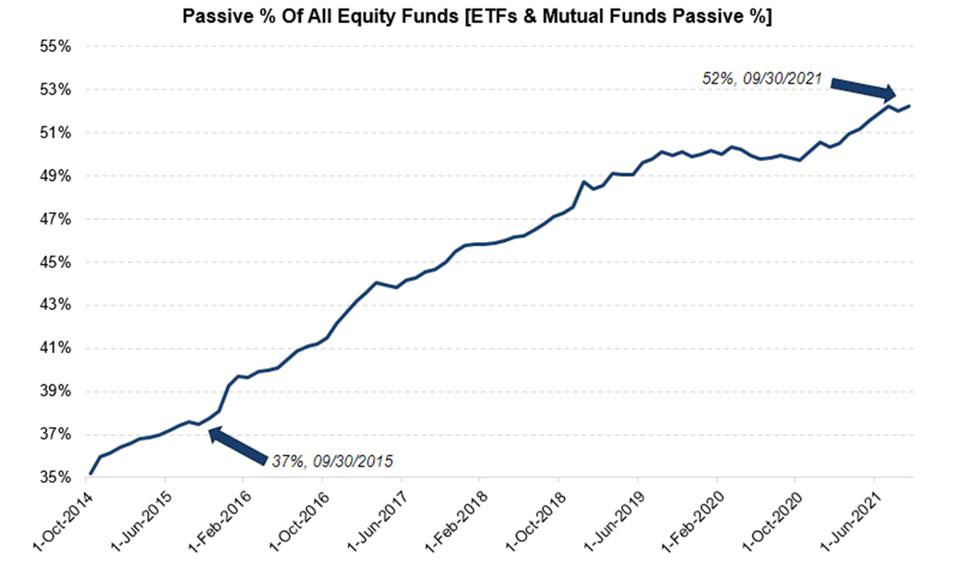

Regulatory tailwinds and cost advantages have led to sizable market share gains in recent years for passive investing giants Vanguard, BlackRock and State Street. These three firms have an oligopoly that controls over 75% of US ETF assets. As their market share has levitated higher over recent years, the overall passive share of US equity funds has risen from 37% to 52%.

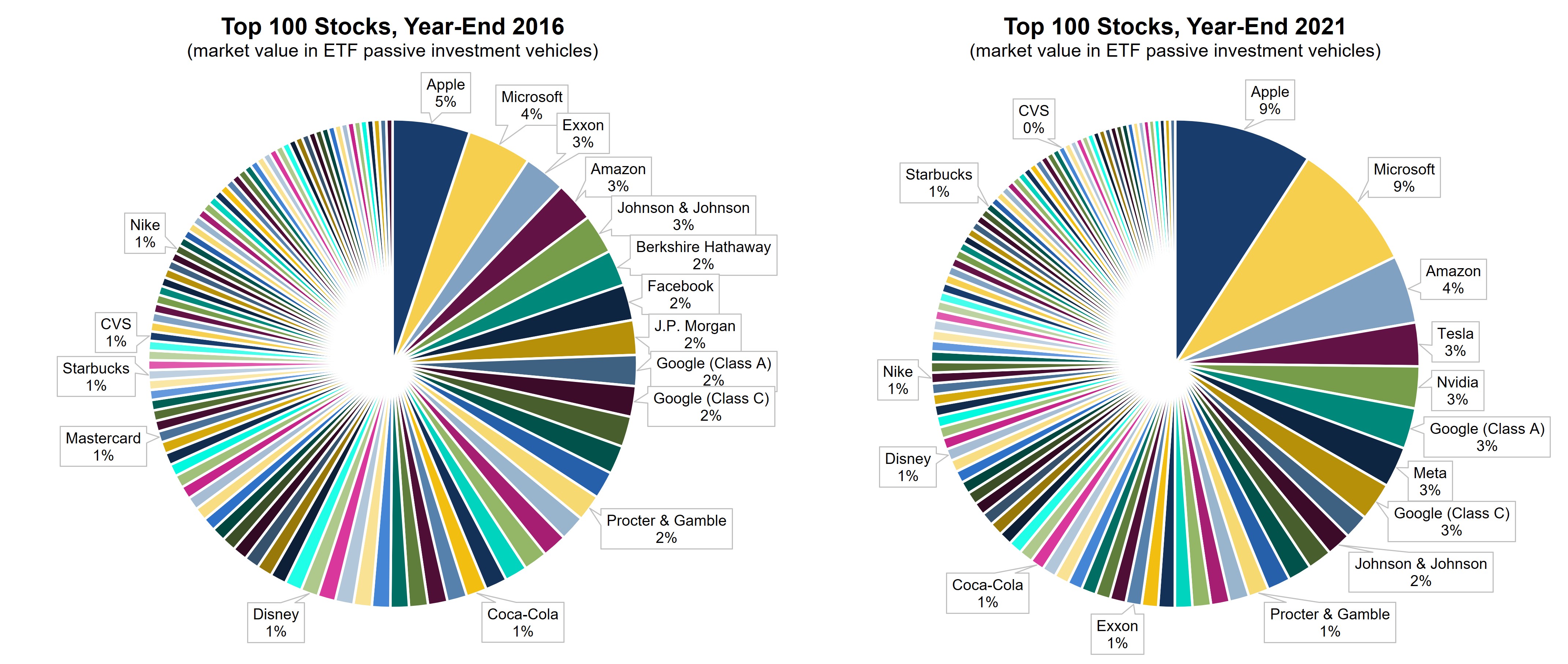

As more of the market turns passive, more capital is automatically allocated to the biggest and most valuable companies. This is part of the reason the market is becoming more concentrated with companies like Apple and Microsoft taking up a progressively higher share.

For every dollar invested in the S&P 500, whether it be directly through an ETF or indirectly through something like a target date fund, the bottom-line is firms like Apple, Microsoft, and Google receive a disproportionate share of those funds. Passive flows systematically enhance the valuation premium being assigned to mega cap companies.

This dynamic is fundamentally changing what’s rewarded by the market, because passive portfolios are mainly weighted based on existing market capitalization. Thus, size is starting to matter a lot more than a company’s earnings and valuation metrics.

In a paper titled, “Tracking Biased Weights: Asset Pricing Implications of Value-Weighted Indexing,” Hao Jiang, Dimitri Vayanos and Lu Zheng found that “Flows into funds tracking the S&P 500 index raise disproportionately the prices of large-capitalization stocks in the index relative to the prices of the index’s small stocks.”

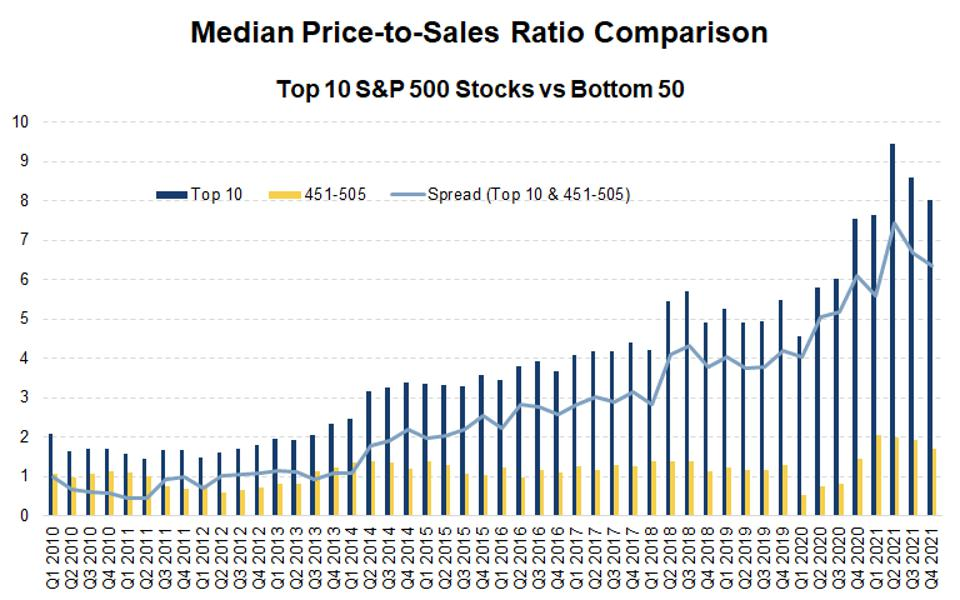

One way to see how this is happening is to compare the valuation change for the biggest firms in the S&P 500 to the smallest firms in the index.

- Since 2010, the median price-to-sales multiple of the ten largest companies in the S&P 500 index has risen from 2.1 to 8.0 (+281%).

- Over the same period, the bottom 50 names in the S&P 500 index saw their price-to-sales multiple rise from 1.1 to 1.7 (+55%).

In the graph above, notice how close the blue and yellow bars were back in 2010 compared to the giant gap that exists now? It’s probably no coincidence this valuation premium has grown in tandem with the rise in passive market share.

Why does this trend matter to the Dobermans of the Dow?

The Dobermans is a fundamental investment strategy that uses free cash flow yield as one of its two inputs. That’s a value metric.

Passive investors don’t care about value metrics like free cash flow. They invest purely based on past price momentum.

Thus, if the passive market share keeps rising beyond 52%, it may be a long time until market prices reflect fundamentals again. That’s not a forecast, but it is a possibility you may want to hedge.

One easy way to do that would be to combine your fundamentally attractive Doberman stocks with another sleeve of stocks that are the biggest beneficiaries of passive flows. In other words, instead of owning “The Passive 500” like everyone else, you could just own the top ten in market cap (i.e., “The Passive Princes”).

As of 12/31/2021, the ticker symbols for the ten largest US companies by market capitalization are: AAPL, MSFT, GOOG, GOOGL, AMZN, TSLA, FB, NVDA, BRK/B, and UNH.

Below is a look at how a 50/50 combination of the Dobermans/Princes portfolios would have performed versus the DJIA since 2011. Here, the backtest assumes an investor owns twenty equally weighted stocks at the beginning of every year, and follows the same annual rebalancing schedule as the Dobermans.

Diversification truly is the only free lunch in investing. And in today’s market, part of diversifying well means mixing and matching your factor exposures.

If the passive bubble keeps inflating for years to come, you can benefit by owning the stocks most likely to benefit. And when the market starts to favor fundamentals over flows again, the Dobermans strategy should prosper.

Whether you decide to own ten, twenty, or however many stocks is ultimately up to you. But until we meet again next year, here’s the official lineup for the 2022 Dobermans of the Dow.

Originally published by Forbes. Reprinted with permission.

Disclosure: I own shares of DOW, VZ, AXP, INTC, MMM, AMGN, CSCO, JNJ, CAT and UNH in client accounts I professionally manage. This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX