How To Maintain An Emotional Edge During Market Corrections

Submitted by Silverlight Asset Management, LLC on October 20th, 2018

Investing is about 80% psychology and 20% mechanics. If you let the environment control your psychology, you’re not going to win.

The S&P 500 is down 5% so far in October. Whether you're a market pro or novice, this sort of environment can be difficult. Here are three tips to help you maintain an emotional edge during market corrections.

1. View corrections as speed bumps

Anyone who invests in stocks should know these facts.

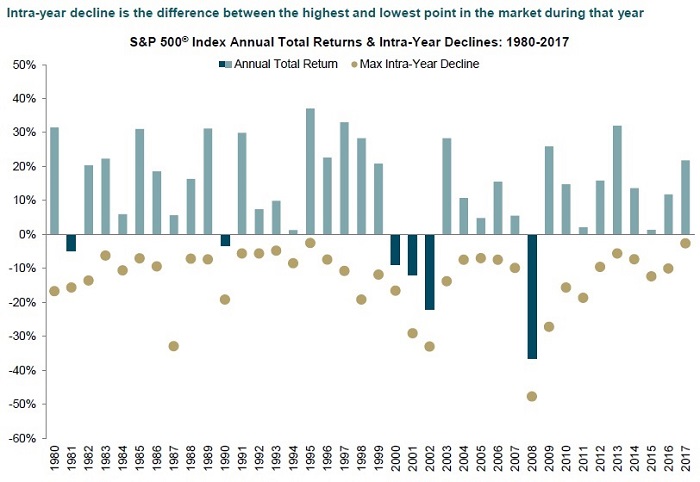

- Between 1980 - 2017, the S&P 500 experienced an average intra-year decline of roughly 13%.

- Stocks still finished positive in 32 of those 38 years (i.e. 84% of the time), averaging a 13% total return.

Takeaway: corrections are normal! Although it never feels that way in the heat of the moment, it's reality.

Source: Fidelity

2. Avoid anchoring to high water marks

What you anchor to influences your feelings, and feelings are notoriously unreliable for making investing decisions.

'Anchoring' is a behavioral bias where a market participant overly relies on a psychological benchmark in their decision-making process. One common anchor is a high-water mark or peak value.

This year, many investors celebrated all-time highs in their portfolio. As emotional beings, we can't eliminate our natural tendency to anchor to previous highs. But we can counter this bias by adjusting the goalposts we use.

For instance, an Amazon investor could lament that the stock is down 13% from its all-time high in September, or celebrate that shares are still up 51% year-to-date.

Similarly, Netflix may be down 17% from its high, but shares are still up 80% year-to-date.

Broadening the scope, the S&P 500 is down 5% from its closing high, but still up almost 400% from the March 2009 bottom.

Look at any long-term graph of the stock market, and think about how many high-water marks came and went. All proved temporary, up until the last one.

Tip: if you want to keep score, as most investors do, try to balance how you measure performance. For example, you could focus on 1, 3 and 5-year trailing returns, or the probability of still achieving your long-term financial goals (if you have access to financial planning software).

3. Play offense when most investors play defense

"Feel the fear and do it anyway." - Susan Jeffers

To be a superior investor, you must invest differently than others.

One way to rise above the crowd is to recondition how you react when you feel fear. It's a huge advantage.

If you're watching your stocks decline and getting nervous, guess what? So are most of the other investors out there.

Even though I'm a professional, I'm still human. If I wake up and my Bloomberg monitor is a sea of red in the morning, sometimes the hairs on the back of my neck start to rise. Sometimes I feel a little squeamish in my stomach. These are important cues I listen to. But they are a cue to fade my feelings. That means I either sit tight, or start looking for things to buy.

It's unwise to try to evacuate during a hurricane. You leave before, or you ride out the storm.

I view corrections similarly.

As described earlier, corrections are frequent events in the stock market. Since 1980, only a few have turned into full-fledged bear markets (i.e. prolonged drawdowns of at least 20%). Since the market finishes most years higher, it usually pays to either sit tight, or use intra-year declines as buying opportunities.

Warren Buffett articulated why many people should embrace selloffs in his 1997 shareholder letter:

"If you expect to be a net saver during the next five years, should you hope for a higher or lower stock market during that period? Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. In effect, they rejoice because prices have risen for the 'hamburgers' they will soon be buying. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices."

Bottom-line: market corrections are never easy. But they are part of the journey and nothing to fear.

Originally published by Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX