As The Dinosaurs Retire, The U.S. Energy Industry Is Evolving

Submitted by Silverlight Asset Management, LLC on April 24th, 2019

Can you imagine JR Ewing sitting on a mat saying “Namaste”?

Most people would not associate oil executives or the energy industry with yoga. But at Hart Energy’s DUG Permian Basin conference last week, yoga sessions were offered on the agenda for the first time. Attendees got to practice their downward dog pose before learning about the latest drilling practices.

“We’ve got a bunch of old dinosaurs that are retiring,” Matthew Hembree told Bloomberg. The owner of several mineral and land companies then added, “I think our industry is evolving.”

Mr. Hembree is right—energy is evolving. And nowhere is that more apparent than in the Permian Basin.

America’s evolution into a major oil exporter

According to a report by the International Energy Agency (IEA), the U.S. is poised to overtake Russia in oil exports by 2024, and be nearly on par with Saudi Arabia. It’s a mind-boggling development. In less than a decade, growth in U.S. shale has catapulted the U.S. to the center of the global energy stage.

“These are times of extraordinary change for the oil industry,” says Fatih Birol, Executive Director of the IEA. “Everywhere we look, new actors are emerging, and certainties of past years are fading."

The IEA forecast projects the U.S. to account for about 70% of the total increase in global capacity by 2024. Other countries joining the U.S. in adding supply growth include Brazil, Iraq, Norway, UAE and Guyana. Meanwhile, Iran and Venezuela are expected to lose share.

At the epicenter of the shale boom lies the Permian Basin. Oil production in the region stretching from West Texas to Southeast New Mexico is expected to top 4 million barrels per day this month. That represents roughly one-third of total U.S. output. Much of the new supply is sourced via fracking—a technology that uses high-pressure liquids to crack rock formations deep in the earth.

According to Shale Magazine, several traits make the Permian uniquely attractive.

1. Huge territory. The Permian is so big that many folks in the industry call it “Saudi Texas.”

2. Stacked shale formations. Most major shale regions, such as the Eagle Ford and Bakken, consist of single oil and gas bearing formations. In the Permian, multiple formations are stacked on top of each other, which creates excellent cost efficiency since multiple formations can be accessed in a single wellbore. For example, a Permian well can be profitable with WTI crude at $35. Breakeven is closer to $50 in the Eagle Ford or Bakken regions.

3. Favorable politics. Most of the acreage resides in the “Lonestar State.” Texas regulators appreciate the oil and gas industry and maintain some of the most accommodative policies in the world.

One challenge the Permian faces is bottlenecks. There aren’t enough pipelines to transport all the crude from the fields to refineries and export terminals. Analysts expect new infrastructure to start alleviating that problem by the end of 2019.

In the meantime, big oil companies underexposed to the region are not hesitating to invest. Chevron recently announced a $33 billion bid to buy Anadarko Petroleum, which controls Permian drilling rights across an area twice the size of Los Angeles. The acquisition would help Chevron meet its goal to more than double production in the Permian to 900,000 barrels a day.

Exxon Mobil also plans to boost its Permian output by 80% over the next five years. Management likes the region’s risk/reward setup, estimating that returns on investment could still average 10 percent even if crude futures fell to $35 a barrel. Currently, WTI trades at $65 a barrel.

Oil’s 40% rally this year and rising M&A interest in the Permian may foreshadow a consolidation wave. At last week’s 13D Monitor Conference, hedge fund manager Keith Meister called Diamondback Energy, Concho Resources, and Pioneer Natural Resources “must own” takeover targets—saying he would be “shocked” if these were still independent companies in a few years.

Better capital discipline points to better shareholder returns

Over the last ten years, the energy sector has been a dismal relative performer. Poor investment standards by the companies are largely to blame. Many players spent at a feverish pace to expand shale operations. U.S. oil and gas production subsequently exploded. However, balance sheets became stretched as projects failed to deliver adequate returns.

Investors are more the wiser. Different metrics are now being used to evaluate U.S. exploration and production firms. Per Bloomberg:

In a recent report, analysts at Tudor, Pickering, Holt & Co., a boutique energy bank, noted investors were switching up the metrics they use to track E&P performance. Previously, the favored ones were enterprise value-to-EBITDA and net asset value, or NAV, essentially a modified discounted cash flow figure. These days, according to TPH, investors are more interested in price/earnings multiples, free cash flow and return on capital employed. The shift from NAV towards earnings or cash-based metrics, in particular, suggests a shift from a startup-like phase — grabbing land and burning cash — to a (hopefully) more mature, self-funding model.

Certain energy CEOs seem to get it

For instance, Chevron is now generating positive free cash flow. Chairman and CEO, Michael Wirth, recently told CNBC, “It’s a good time to be Chevron. Our portfolio is stronger than it’s ever been, and you don’t have to look any further than the Permian to see that. We’re delivering strong production with low risk and disciplined spending, which leaves plenty of money to be returned to shareholders.”

In the firm’s recent Investor Day presentation, Chevron highlighted that 70% of 2019 capex is expected to deliver positive cash flow within 2 years.

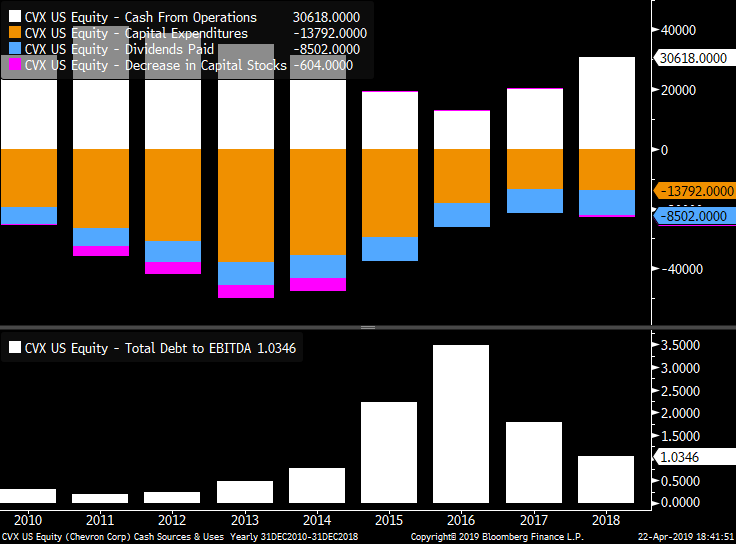

Emphasis on capital discipline is a change in focus compared to a few years ago. From 2013 - 2016, many energy firms relied on friendly capital markets to fund shaky budgets. Operating cash flow was insufficient to cover dividends, stock buybacks, and capital expenditures.

A lot of firms, including Chevron, had to rely on debt. As shown in the graph below, cash flow dynamics began to improve in 2017.

Yet investor skepticism persists. Consensus is underweight energy and valuation for the sector resides near a multi-decade low. The 2016 energy debacle clearly left a lot of investors bruised and battered.

Earlier this month, analysts at JPMorgan argued that energy offers one of the best sector risk-reward setups in the market. I tend to agree. After being virtually naked the sector since 2014, I began upgrading my exposure toward the end of last year and am now modestly overweight.

Even though energy has outperformed year-to-date, the pace of gains pales in comparison to oil’s ascent. According to JPMorgan, this disparity puts the price-to-oil ratio for the exploration and production index at a record low. In other words, E&P stocks are cheaper today—relative to the underlying commodity—then during the 1990s, financial crisis, and 2016’s energy bear market.

The investing scavenger hunt is all about trying to find improving fundamentals not already discounted. Keeping that thought in mind, investors ought to give U.S. energy stocks another look.

Originally published by RealClearMarkets. Reprinted with permission.

Disclosure: I own shares of Pioneer Natural Resources and Chevron. This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX