A Bull Market For Billionaires Is Great News For Madison Square Garden Sports

Submitted by Silverlight Asset Management, LLC on December 29th, 2020

Stock markets are surging and billionaires are benefitting.

The world’s 500 richest people saw their combined net worth jump 31% in 2020. The $1.8 trillion annual gain was the largest in the eight year history of the Bloomberg Billionaires Index.

Source: Bloomberg

When billionaires do well, so do prices of things they like to buy. That includes professional sports franchises. The ability to own a sports team isn’t restricted only to billionaires, however.

Madison Square Garden Sports (ticker: MSGS) is a publicly traded company with two main assets: the New York Knicks and New York Rangers. After spinning off various live entertainment assets into Madison Square Garden Entertainment Corp. (ticker: MSGE) in April 2020, MSGS became a pro sports pureplay.

Even if you’re not traditionally a fan of New York, or its sports teams, or sports in general, you can still be a fan of MSGS.

Why invest in the NBA and NHL?

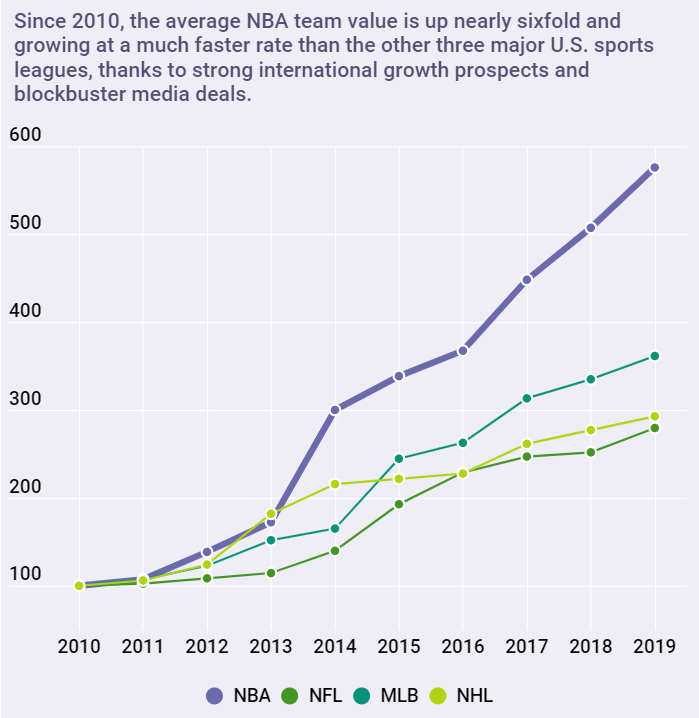

NBA and NHL franchises are quality assets that have produced attractive returns over time. Since 2010, the NBA has particularly outperformed compared to other major sports.

Source: Forbes

Forbes ranks the New York Knicks as the most valuable NBA franchise. Despite a lackluster win/loss record in recent years, the franchise still enjoys one major structural advantage over other teams: New York City.

If I’d lived in Roman times, I’d have lived in Rome. Where else? Today America is the Roman Empire and New York is Rome itself.”

- John Lennon

New York has been America’s largest city for over 200 years.

Despite all the havoc from Covid-19, New York isn’t going anywhere. It will remain a top media market long into the future. That’s important when considering the investment merits of MSGS, because the main revenue driver for sports teams are the media rights to broadcast games. Teams from major cities receive premiums because they have a relatively larger audience.

This season, MSGS is scheduled to receive $160 million from MSG Networks in exchange for regular season broadcasting rights. The contract includes two features investors covet. First, there is recurring revenue because it’s a long-term deal with 15 years remaining. Second, there is evidence of substantial pricing power, as the deal also includes 4% annual price escalators.

There are not many businesses whose customers are willing to pre-agree to 4% annual price hikes a decade out.

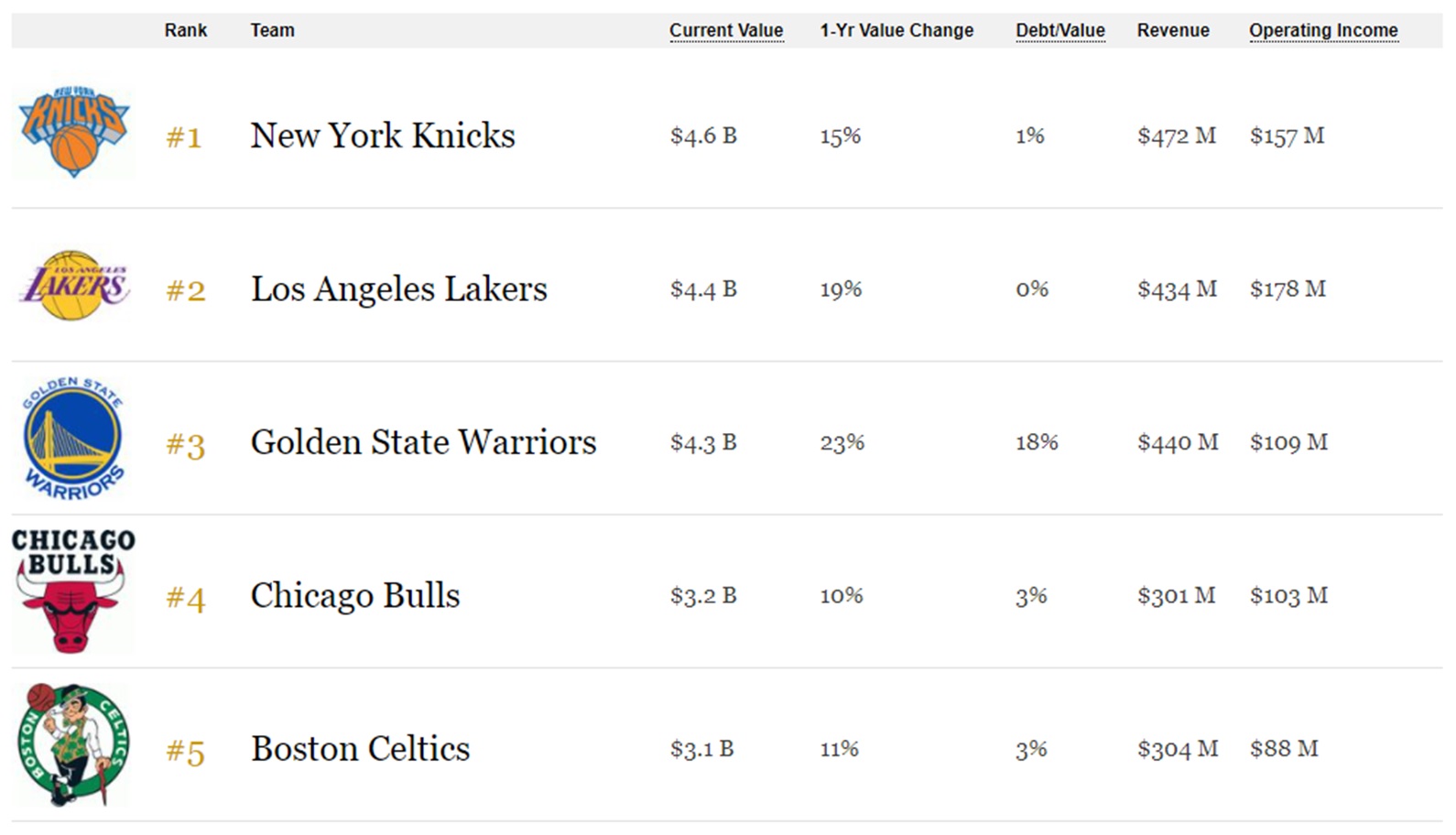

Forbes values the Knicks at $4.6 billion. The Knicks’ value has grown at a 16% CAGR since 2005, outperforming the league average of 14%. As shown below, teams from other major cities round out the top five.

Source: Forbes

NBA teams also share revenue derived from national media rights. The next renewal for that contract will follow the 2024-2025 season. The last time that contract reset was after the 2016-2017 season, when it jumped from $925 million to $2.67 billion.

Competition among giant streaming platforms will likely continue to push prices materially higher at the next renewal. Not only will deep pocketed players, such as Amazon and Apple, be vying to secure exclusive broadcasting rights, but so will traditional cable providers like the Turner Network and ESPN.

The NBA’s demographic appeal makes it uniquely attractive to broadcasting partners, because fans skew younger compared to other sports. This bodes well for the NBA’s brand continuity in the future.

Source: JPMorgan, Alexia's Sports Rights Almanac, 2020

The NBA is also thriving internationally. For example, the league’s growing popularity in China recently helped land a $1.5 billion deal with Tencent. Games are broadcast in 215 countries total, and the league attracts players from all around the world.

Alexia Quadrani, a JPMorgan analyst, wrote in a recent report, “While basketball is today considered America’s 2nd most popular sport (behind Football and ahead of Baseball) many have argued the NBA is the professional sports league best positioned for the future.”

The National Hockey League has also generated attractive returns. Over the last 15 years, the average NHL team appreciated at a 10% rate. The Rangers, ranked by Forbes as the #1 most valuable NHL franchise with an estimated worth of $1.65 billion, returned 13% per annum over that time.

Media deals are also a key factor in valuing pro hockey teams. The NHL has a $200 million contract with NBCU that runs from 2011-2021. The next deal renews after the 2020-2021 season, at which time JPMorgan expects to see a step-up between 2x to 3x.

Like the Knicks, the Rangers have struggled to make the playoffs in recent years. Yet, the future looks brighter. The Rangers had the number one pick in the most recent NHL draft, which the team used to select Alexis Lafreniere (profiled below).

As teams win more games, their franchise value tends to improve. Thus, the fact that the Knicks and Rangers are in rebuilding mode can be viewed positively, because it makes them potential value-plays.

The Knicks have several key young players, such as RJ Barrett and Obi Toppin. It’s unclear if they will develop into future stars. But even if the Knicks’ record doesn’t improve much this year, fans and investors can at least look forward to a talent-rich crop of potential draftees in 2021.

Valuation Analysis

While Madison Square Garden Sports may be publicly traded, most sports franchises are not. Billionaires and their investment groups typically purchase teams through private market deals. Hence, the more billionaires there are, and the more money they have, the higher the potential bids can go on the rare occasion a franchise is available.

Teams normally trade based on multiples of revenue and transaction-based comps. If we use similar criteria to evaluate Madison Square Garden Sports, it appears to be trading at a discount to the sum of its parts.

- Forbes values the Knicks at $4.6 billion (February 2020) and the Rangers at $1.65 billion (December 2020).

- Estimated combined value is $6.25 billion.

- Current enterprise value for MSGS is $5.33 billion.

As an investor, I’m always looking for quality at a discount. MSGS fits this criteria given that shares trade at almost a billion dollar discount to estimated private market value.

There may also be an extra margin of safety baked into the current valuation, because recent deals were completed at significant valuation premiums compared to Forbes estimated value.

Examples:

- Los Angeles Clippers sold for $2 billion in 2014 vs. Forbes est. $575 million

- Houston Rockets sold for $2.2 billion in 2017 vs. Forbes est. $1.65 billion

- Brooklyn Nets sold for $2.35 billion in 2019 vs. Forbes est. $1.8 billion

Over the long-term, the variance between Forbes fair value estimates and actual transactions has been much smaller than what is depicted above. Unorthodox monetary policy in the prior decade may have something to do with it.

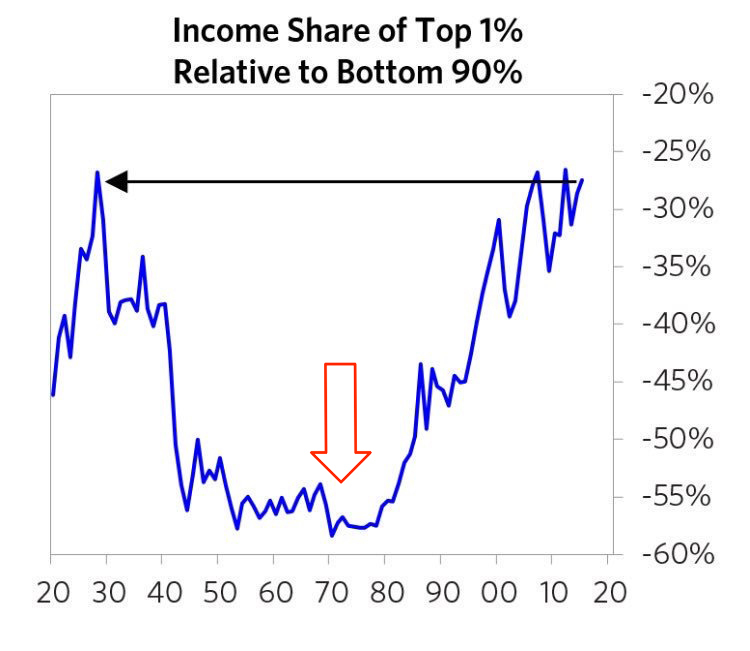

From 2010 onward, the Federal Reserve engaged in repeated rounds of quantitative easing (QE). Many have criticized this policy for exacerbating wealth inequality, because of an obvious positive correlation between QE and rising asset prices. While asset prices have soared, median real wages have not. That’s frustrating for the average worker who lacks much in the way of financial assets. But it’s been great news for billionaires, because they own most of the assets.

https://wtfhappenedin1971.com/

The arrow in the above chart points to 1971 for a reason. On August 15, 1971, President Nixon abandoned the gold standard, ushering in a new era of fiat money.

QE programs in the last decade, and MMT programs that may typify this decade, are essentially doubling-down-versions on what started back then. We are moving farther and farther away from a hard money currency system in favor of currency debasement.

If we keep repeating the same policies, why should we expect income inequality to turn the other way?

Take Elon Musk, for example. Just this year, his net worth has risen over $100 billion.

Today, as I’m writing this post, Microsoft’s stock closed up 1% and Steve Ballmer, former CEO of Microsoft and now the proud owner of the Los Angeles Clippers, added $619 million to his net worth, which now resides at $75.9 billion. Does it really matter if he paid a few billion dollars extra for the Clippers?

What if Ballmer paid the right price? Or even got a steal of a deal? Maybe fair value nowadays is a lot higher than it used to be.

After all, there are only 30 NBA teams. And only a precious few reside in major cities where a billionaire may want to spend a lot of their time.

This is why the bull market for billionaires is really only part of the MSGS investment thesis. The other part involves supply.

In a world of unconstrained money printing, that which is scarce will become extra valuable.

This may explain why hedge fund billionaire, Steve Cohen, recently bought the New York Mets and a company called Collectors Universe. Treasure assets, whether they be high-end collectibles, autos, yachts, or sports teams, are status symbols with scarcity features.

In 1973, a 42-year old shipbuilder from Ohio named George Steinbrenner led a group that purchased the New York Yankees from CBS for $8.7 million. Today that franchise is worth $5 billion, according to Forbes.

Since 1973, the U.S. money supply (M2) has risen 2,190%. Meanwhile, there are still only two professional baseball teams in New York.

Going forward, investing fads will come and go. Investor demand for most things is fickle and fleeting. But treasure assets that are in scare supply—like Madison Square Garden Sports—are enduring.

Originally published by Forbes. Reprinted with permission.

Disclosure: I own shares of Madison Square Garden Sports personally and in accounts that I professionally manage. This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX