Best Bubble Stock For 2021: Zoom Or Tesla?

Submitted by Silverlight Asset Management, LLC on January 26th, 2021

Zoom and Tesla are two hot stocks minting millionaires at a feverish pace.

In 2020, Zoom shares rose 396%. The catalyst was a worldwide pandemic that fueled an unprecedented work-from-home revolution, which became so powerful it made the company’s name a verb.

In 2020, Tesla shares soared 743%. The catalyst was a worldwide pandemic that fueled an unprecedented day-trading revolution, which became so powerful it made Elon Musk the richest person in the world.

Based on their parabolic moves and high valuations, both Zoom and Tesla fit the criteria commonly associated with asset bubbles. However, that doesn’t make them terribly unique. In 2021, stocks and bonds are expensive across the board compared to history.

The main dilemma for most investors is deciding which bubbles to own and which to avoid.

Bubbly Times

Repeated bond purchases by the Federal Reserve have suppressed interest rates. This distorts the risk-free rate investors use to discount future cash flows. As a result, many assets are inflated.

Seth Klarman, a well-respected hedge fund manager, summed up the situation in a letter cited by the Financial Times. “With so much stimulus being deployed, trying to figure out if the economy is in recession is like trying to assess if you had a fever after you just took a large dose of aspirin,” he wrote. “But as with frogs in water that is slowly being heated to a boil, investors are being conditioned not to recognize the danger.”

Investors like Klarman built careers using fundamental analysis to steer portfolios away from risks and toward opportunities. That playbook may still be prudent, but it’s also out of fashion. Case in point: the average public company’s annual report is downloaded just 28 times right after 10-K filings, according to one academic paper.

Poor fundamental research explains a lot of market oddities. For example, there is suddenly a huge bull market in unprofitable technology stocks.

Another factor that Klarman eludes to is monetary policy. It’s no coincidence the bull market in profitless techs started when the Fed dramatically increased its balance sheet. As money supply surges, so do financial assets.

Source: Bloomberg

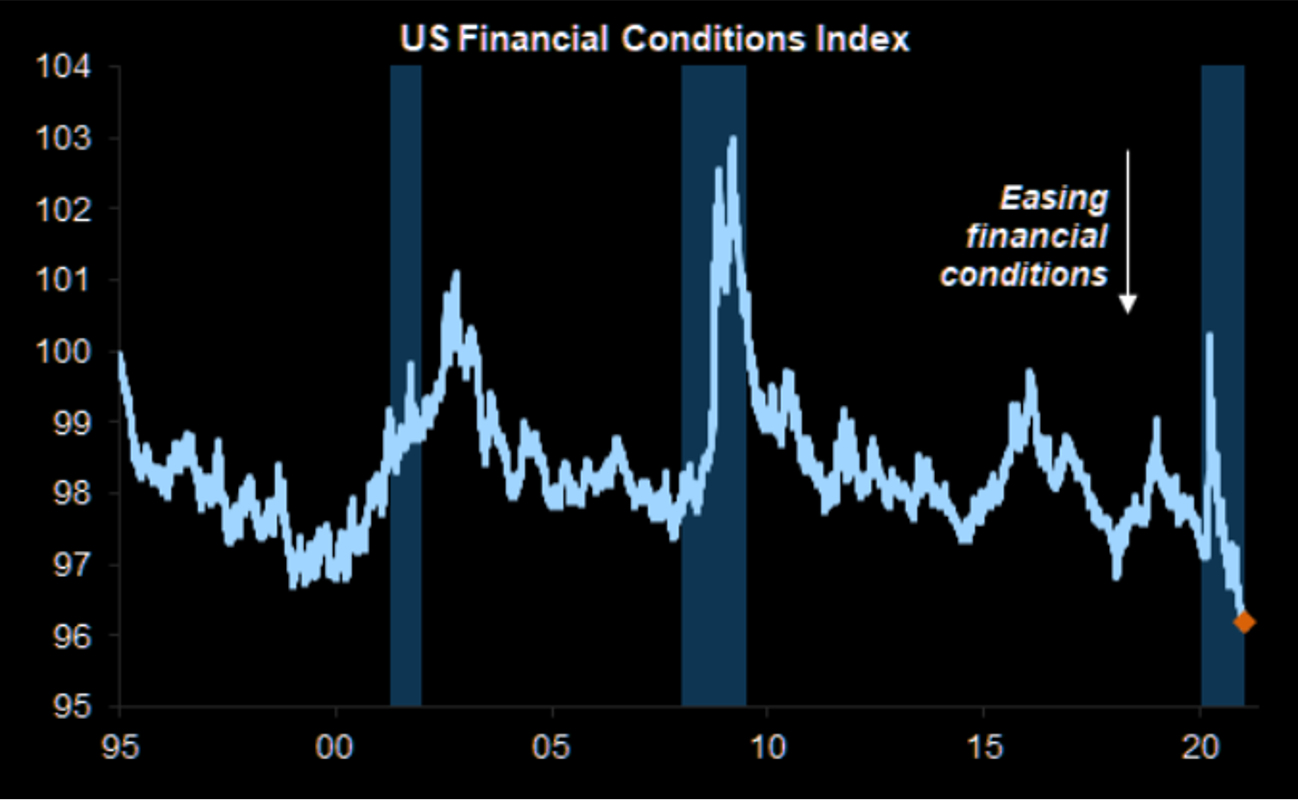

Financial conditions usually tighten during recessions. To paraphrase Warren Buffett, when the tide goes out, we see who has been swimming naked. In other words, this is when credit in the economy retracts, bubbles and frauds are exposed, and markets clear.

But that didn’t happen this time around. In this recession (last shaded bar below), the tide went the opposite direction.

Source: Goldman Sachs

Financial conditions have never been easier. That is all you need to know to rationalize bitcoin’s rise, the SPAC boom, and why just about everything other than cash is going up lately.

Is capital being misallocated? Almost certainly.

Yet, investors still face the question of what to do about it?

Sitting in cash is a tough game to play when that cash is being perpetually devalued. That’s why getting through this “Everything Bubble” will be a tricky affair for us all.

In my view, the ‘best’ bubbles to own in 2021 are those with ample room to expand and reliable fundamental support to cushion against downside risk. As a case study for how to apply this criteria, we can run through a scenario analysis comparing the respective setups for Zoom and Tesla.

Scenario #1: Flows Outweigh Fundamentals

Academic studies are beginning to validate what some investors have known for awhile now: we are living in a ‘Passive Bubble’.

A mix of regulation and clever marketing has convinced millions of people to passively manage their wealth. But the passive boom rests on a misguided assumption that an unlimited number of people can invest this way without degrading capital allocation efficiency.

In their paper titled, “Tracking Biased Weights: Asset Pricing Implications of Value-Weighted Indexing,” Hao Jiang, Dimitri Vayanos and Lu Zheng show evidence of price distortions attributed to passive investing. According to their research, “Flows into funds tracking the S&P 500 index raise disproportionately the prices of large-capitalization stocks in the index relative to the prices of the index’s small stocks.”

Imagine a teacher telling a class it’s okay to copy one another during exams. If the majority of the class stops studying and most students just copy the person sitting next to them, the class will flunk. That metaphor is the simplest way I can think of to describe the long-term hazard of passive investing. If too many do it, the wisdom of the crowd is lost, capital gets misallocated, and the economy becomes less productive.

Another key issue is passive investing systematically rewards only price momentum. So by design, this style naturally encourages bubbles.

In 2020, Tesla became a posterchild for everything that can go right for a single company in a “flows over fundamentals” market. After a 700% rally, Tesla was added to the S&P 500, which prompted another wave of forced buying estimated at around $85 billion. For more on that, you can read this Forbes post.

As the S&P 500 drama was unfolding, Tesla’s factor profile also got a boost. Specifically, its ‘momentum’ score improved. That helped Tesla become a top holding in a slew of popular ETFs, including the $20 billion ARK Innovation ETF (ARKK), which is now larger than all other actively managed ETFs combined.

There is a possibility 2021 will continue to be an environment that favors flows over fundamentals. If so, investors want to own stocks with an optimal factor mix to attract fund flows. Under this scenario, Zoom looks better situated than Tesla, because Zoom has more future passive flow potential.

Tesla has already run the gauntlet in terms of attracting fund flows. Recently, it went from not being in the S&P 500 index at all to becoming the fourth biggest member after Apple, Microsoft and Amazon. And in the ARKK ETF, Tesla is already a concentrated position (9.2% weight). How much bigger can it get before there’s a risk management concern?

In terms of factor exposures, Zoom and Tesla aren’t exactly twins, but they are closely related. Both rank in the top 1% of U.S. stocks for growth and momentum, per Bloomberg data. That means they should attract similar fund flows.

However, in most ETF products, Zoom is a much smaller weight than Tesla. For example, Zoom is currently a 2% weight in ARKK and not yet a member of the S&P 500.

Even though Zoom’s market capitalization is big enough to qualify for the S&P 500, the company is excluded because it has a multi-class share structure, which the S&P committee is not a fan of. If Zoom keeps outperforming, though, there will be pressure to include it—particularly because S&P has already overlooked other dual-class listings, such as Berkshire Hathaway and Facebook.

If and when Zoom is admitted, it may spark a frenzy of pre-buying, like we saw with Tesla. That isn’t something any Zoom investor should bank on happening, but it offers meaningful upside optionality.

Scenario #2: Fundamentals Outweigh Flows

An opposite scenario to consider is: what happens if we return to a fundamentally-oriented market?

Under this scenario, Zoom and Tesla would both probably get dinged for their aggressive valuations. But my guess is the penalty would be less severe for Zoom, because Zoom has better fundamentals to go with its high valuation.

First, even though both companies are ‘hyper growth’ stories, one is growing much faster than the other.

- Zoom’s trailing 12-month sales growth is +262%

- Tesla’s trailing 12-month sales growth is +15%

Second, as I described in a prior article profiling Zoom, the video chat company already boasts a highly profitable business model.

- Zoom has gross margins of 70% and operating margins of 22%

- Tesla has gross margins of 21% and operating margins of 7%

Third, Zoom has a cleaner balance sheet than Tesla.

- Zoom’s debt/equity ratio is 9%

- Tesla’s debt/equity ratio is 221%

Finally, Zoom also has a more focused CEO, which is important when trouble invariably hits.

Before founding Zoom, CEO Eric Yuan worked his way up as an engineer for Webex—a video chat service acquired by Cisco in 2007. In 2010, Yuan left so he could leverage his expertise in video chat to design a better product, which became Zoom. Today, Yuan is a proven thought leader, running a thriving business, in an exciting niche he has long been 100% committed to.

Elon Musk is the most gifted capital raising talent on Planet Earth. But he also has his hands full now as the CEO, founder, inventor, and/or adviser of many companies, including: SpaceX, Tesla, SolarCity, Starlink, The Boring Company, Hyperloop, OpenAI, Future of Life Institute, and Neuralink.

***

No one can predict the future, but we can prepare by positioning our portfolios for multiple outcomes. Two scenarios worth considering now are: (i) asset bubbles getting bigger and (ii) asset bubbles popping.

Either way, Zoom looks like a better bubble than Tesla.

Originally published by Forbes. Reprinted with permission.

Disclosure: I own Zoom and am short Tesla. This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX