Johnson & Johnson: Quality At A Discount?

Submitted by Silverlight Asset Management, LLC on October 31st, 2019

Lawyers are loving Johnson & Johnson (J&J) in 2019. Investors… not so much.

J&J shares have lagged amid mounting legal woes. The health care giant faces over 100,000 lawsuits in total, which some analysts estimate may cost over $20 billion to settle.

However, the litany of bad news may provide an excellent opportunity for investors to buy a world-class company on sale. J&J epitomizes what I call “Quality at a Discount.”

Quality at a Discount

Weighing quality against price is a pragmatic way to shop for anything, including common stocks.

A high-quality asset is one whose intrinsic worth reliably grows at an attractive rate.

Note: intrinsic value is an estimate of what an asset is worth; not the market price.

Quality assets generate quality returns over the long-term.

If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return—even if you originally buy it at a huge discount.

Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result.

- Charlie Munger, The Art of Stock Picking

We can measure business quality by looking at profitability and leverage metrics. To help showcase the utility of such factors, let’s assume an investor only buys stocks from the Russell 3000 Index that rank:

- In the top-half of the index for Return on Equity (ROE), and

- In the bottom-half of the index for Debt/Equity ratio

That simple two-factor quality screen trounced the market over the last 20 years.

Backtest results from 12/31/99 - 9/30/19. Monthly rebalancing. Source: Bloomberg.

Running the same quality screen today, J&J is one of 644 firms that make the list.

- J&J sports an ROE of 23%

- J&J’s Debt/Equity ratio is 52%

Another dimension of quality is consistency. Return on invested capital consistently hovers above 20%, and J&J has raised its dividend for 57 consecutive years.

Takeaway: J&J is a high-quality firm.

Now, let’s consider valuation.

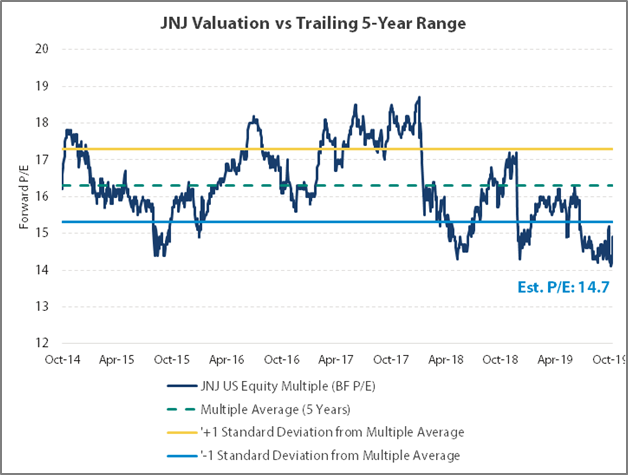

J&J shares trade at a forward P/E of 14.7. That’s a discount to the S&P 500, and is 1.5 sigma cheaper than the 5-year trend.

Source: Bloomberg.

The overall health care sector is also relatively cheap. According to Fidelity, health care is one of just two sectors where the current earnings yield exceeds the trailing 10-year average, with the other being financials.

Takeaway: J&J likely trades at a discount to fair value.

“Quality at a Discount” may seem like a straightforward prism to evaluate stocks. But when do such opportunities arise?

Normally, there must be a temporary uncertainty overhang. A narrative that depresses short-term sentiment, and creates an opportunity to buy at a discounted valuation.

Theoretical market price and value comparison.

Assuming the positive economic drivers of a business stay intact, buying quality on sale can accentuate an already strong return profile. There’s also less risk with this type of approach, because if an investor overpays, a quality asset will usually bail them out by growing into the valuation.

J&J Outlook

It’s impossible to forecast precisely when the headline risk surrounding J&J will recede. What we do know is litigation comes with the territory of being a health care giant, and this isn’t J&J’s first rodeo.

Some readers may recall the Tylenol Crisis from 1982. Back then, J&J’s Tylenol was the top-selling pain reliever in the U.S. After a series of deaths were linked to capsules laced with cyanide, Tylenol’s market share plummeted from 35% to under 8% in a matter of weeks. J&J responded with a massive recall, and the stock took a dive. A few years later, however, J&J’s reputation was restored, and the stock was back to fresh new highs.

The potential legal liabilities now facing the company may appear daunting, but J&J has sufficient scale and resources to weather the storm. Cash reserves exceed $16 billion. And in the first half of 2019 alone, J&J raked in operating cash flow of nearly $9.5 billion.

Going forward, J&J will benefit from a diverse revenue base, including a top-tier pharma division. According to Bloomberg Intelligence, four key drug franchises (Darzalex, Imbruvica, Stelara and Tremfya) should help add $13.3 billion in sales between 2018-2023.

J&J’s overall business produces free cash flow exceeding 20% of sales. That should enable the company to manage legal liabilities, keep raising the dividend, and maybe even complete tuck-in acquisitions along the way.

Originally published by Forbes. Reprinted with permission.

Disclosure: I own shares of Johnson & Johnson in accounts I professionally manage. This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.