Here Is How To Decide Whether To Buy Or Rent A Home

Submitted by Silverlight Asset Management, LLC on March 2nd, 2020

Getting major financial decisions right makes up for a lot of little misfires. And one of the biggest decisions people face is deciding when to buy a home.

To make the right call, it’s important to avoid common misconceptions that surface when people try to compare the benefits of owning a property versus renting.

Is a Residence An Asset or Liability?

Many folks consider their home an ‘asset’ on their personal balance sheet, but that’s not automatically true. Here is a simple litmus test:

-

Assets put money into your pocket.

-

Liabilities take money out of your pocket.

It’s all about cash flow.

Your residence is a liability, because it costs money to live there.

An investment property that generates positive cash flow is an asset.

If the property is vacant and cash flow turns negative, it becomes a liability.

Real Estate Returns

Over the long run, real estate has generated mediocre returns. Yale economist, Robert Shiller, found that from 1915 to 2015, U.S. home prices appreciated 0.6 percent per year net of inflation.

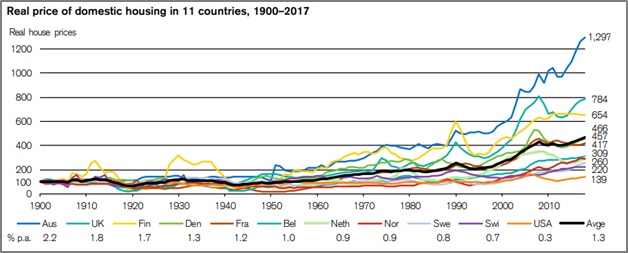

Credit Suisse completed a separate study in 2018, comparing real estate returns across 11 countries since 1900. They found the average annualized return was 1.3%.

For perspective, U.S. equities have delivered a 6.5% annualized real return since 1900.

Source: Credit Suisse Global Investment Returns Yearbook 2018

“House prices did not grow at a steady rate... over the first half of the 20th century, average house prices did not move at all in real terms,” per the Credit Suisse report.

“Prices started to rise in the 1950s, with an even stronger showing in the 1960s. However, the highest period of growth was from the mid-1990s until the eve of the Global Financial Crisis, when real house prices rose by 6.2% per year.”

What caused home prices to rise faster?

Falling interest rates were one major tailwind.

Government legislation also played a role. Back in 1930, the home ownership rate in the U.S. was 47%. Most mortgages were balloons, rates were variable, and down payment requirements were high.

The FHA and GI Bill subsidized mortgages and made it easier to buy a home. This helped increase the national home ownership rate to 55% in 1950. And by 1970, it reached 63%.

A couple points worth noting:

-

Recency bias likely inflates perceptions of what constitutes “normal” real estate appreciation.

-

Since interest rates now reside at 100-year lows, this historical tailwind may no longer apply, which could hinder future appreciation potential.

It’s also easy to overlook the role of leverage. The average retiree would never lever their stock portfolio five times. But if they have a mortgage on a home, that’s a levered investment. And that means higher returns if a property appreciates, and higher risk if it doesn’t.

Benefits of Owning a Home

There are a variety of benefits associated with owning a home. Most obvious is the opportunity for price appreciation.

Mortgages can also act as an invisible, forced savings account. Amortizing mortgages were the primary form of wealth accumulation for America’s middle class over the past century. By steadily paying down principal while prices rose, people built equity.

There are also tax deductions for mortgage interest. Although, President Trump instituted changes limiting the amount of tax deductions available.

Of course, monetary factors aren’t the only reason to buy a home. For many, owning a home also has experiential perks, including a feeling of stability and freedom to make property improvements.

Hidden Costs

If someone sells a house for $500,000 and they originally paid $400,000, it may seem like a 25% return. But under the surface, there are a slew of costs taking a bite out of that return.

Take transaction costs, for example. To overcome the typical 5% broker fee and moving expenses, every prospective buyer should carefully consider their time horizon. As a general rule, you should only buy a property if you will be content living there for at least five years. This provides time for appreciation to help offset the upfront costs.

Other hidden costs to be mindful of:

- Property taxes

- Maintenance costs

- Opportunity cost of not being able to invest a down payment

After properly accounting for all the relevant costs, you can more accurately compare the monthly cost of owning to renting. And when you run that analysis, you’ll find it varies a lot by region.

The nation’s top 50 metropolitan areas are about evenly split on the rent versus own calculation. A study by CJ Patrick Company using DataTree by First American, looked at median rent prices, median home sale prices, and taxes and insurance.

They found cities in the Midwest and South generally favored buying. For example, Memphis, Tennessee had a monthly rent cost of $914, which was almost double the cost of owning.

In California, where property prices are much higher, it is generally cheaper to rent than own.

***

When it comes to real estate, every region has its own set of supply and demand factors to weigh. Take your time and make sure you’re properly informed.

Ultimately, buying a home isn’t something to fear. Nor is it something you should feel required to do. It’s a big step you should make when you’re ready—financially and based on your station in life.

Originally published by Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.