Worried About Higher Taxes Post-Election? Here’s What Investors Need To Know

Submitted by Silverlight Asset Management, LLC on October 26th, 2020

Elections have consequences and tax policy is ever-evolving.

Here’s what investors need to know about potential tax changes after the November election.

Election Momentum

Joe Biden’s chances of becoming the 46th president of the United States have risen to 87%, according to FiveThirtyEight’s latest projection. Meanwhile, PredictIt has the odds of Democrats sweeping the White House and Congress at 58%.

These outcomes are by no means assured. Odds-makers and polls are known to get it wrong — sometimes by a lot.

Still, there is no downside to gaming what a Biden White House and a ‘blue wave’ could mean for policy going forward, particularly with regards to the tax code. Markets always look ahead and investors should think similarly.

Biden’s Individual Tax Policy

Like any candidate, Joe Biden aims to foster a fairer economy through the eyes of his supporters. His vision is for the government to play a more active role in regulating the economy and redistributing wealth.

Individual Policy Highlights:

-

Income Tax: Raise the top individual rate from 37% to 39.6%. This would apply to taxpayers with taxable income over $400,000 (~2% of Americans).

-

Payroll Tax: Increase payroll taxes for high-earners. The 12.4% Social Security tax is not currently collected on income over $137,700, but Biden’s plan would create a barbell like structure — keeping the cap at $137,700, then applying the tax again to income over $400,000.

-

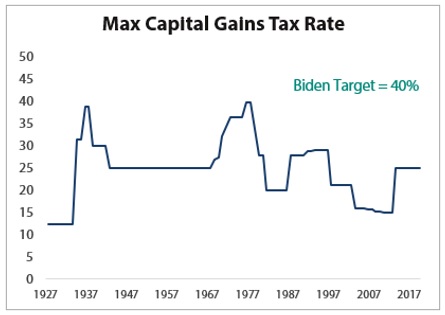

Capital Gains Tax: Increase rates on long-term capital gains and qualified dividends from 20% to 39.6% — the same top rate as ordinary income — but only for households with income over $1 million.

Pushing the maximum capital gains rate to 40% would be on par with the highest levels ever and make the U.S. a global outlier. However, keep in mind this rate would only apply to the small percentage of Americans whose annual income exceeds $1 million.

Source: Bloomberg

Biden’s Corporate Tax Policy

A ‘blue wave’ could also lead to higher corporate tax rates. The following table compares Joe Biden’s corporate tax proposals to President Trump’s policy.

Source: Credit Suisse HOLT

Corporations have taken a hit in the pandemic, so Biden may opt to delay the phase-in of higher corporate tax rates to 2022 or beyond.

Biden’s 28% target also holds a silver lining: policy debates in the future will now likely use 28% as the high-water mark, instead of the 35% rate in place before Trump’s cuts. The goal posts have semi-permanently moved to the downside – a positive for corporations.

Tactical Considerations

Here are some broad tactical considerations to be thinking about.

Election Uncertainty. The viability of Joe Biden’s tax plan depends on Democratic control of the House and Senate—hardly an assured outcome.

Democrats need a net four seat gain to reach 51, but with a Biden win they could raise taxes in a 50-50 Senate (the vice president casts the tiebreaking vote). The Senate races to watch in November are Alabama, Arizona, Colorado, Georgia, Iowa, Maine, Montana, and North Carolina.

Timing. Even with the ‘blue wave’ outcome, changing the tax code is incredibly complex and time-consuming, so investors will have time to plan.

“The Ryan Blueprint” for lowering corporate tax rates was ready on Day 1 of the Trump Administration, but it still took a year to push through the changes.

Ronald Reagan talked a lot about tax reform in his campaign against Jimmy Carter in 1980. Yet, it took another six years for his administration to pass The Tax Reform Act of 1986.

Capital Gains. The last time the capital gains rate ticked higher – a marginal move from 15% to 20% in 2013 – investors rushed to realize gains at the lower rate.

If high net worth investors perceive a strong chance Biden will follow through in doubling the capital gains rate, it could spur a more aggressive effort to realize gains ahead of the change, which could mean a December to remember.

That said, capital gains tax hikes have not historically foreshadowed major dips in subsequent returns. Since 1927, the median annual advance for the S&P 500 is +10.8% compared to +9.2% in years when the capital gains rate increased (source: Bloomberg Intelligence).

A Biden administration may also pursue eliminating the stepped-up basis for capital gains at death, which could significantly increase tax burdens for heirs. These changes would almost certainly warrant adjustments to tax and estate planning strategies on an individual level, but they seem far less likely to impact the market’s direction in either the short or the long-term.

Corporate Tax Rates. If implemented in 2021, Bloomberg Intelligence estimates the Biden plan could shave 15% from aggregated S&P 500 EPS over the next three years. If delayed to 2023, the effect could be far lower—3% by Bloomberg estimates.

The biggest sustained increase to corporate tax rates occurred in the 1940s and 1950s, with the tax rate topping 50%. In those decades, equity returns vastly exceeded the returns from cash and bonds. During the 1940s, the S&P 500’s total return was +143.10%. During the 1950s, the index catapulted +467.40%.

Currency. One key takeaway from the final Presidential Debate was that Biden and Trump are both committed to deficit spending. This may lead to a weaker greenback. When the dollar has experienced bouts of secular weakness in the past, commodities and international equities have outperformed.

***

For investors, it’s always hard to make a clear heads or tails assessment of tax proposals. Taxes matter but are never the only thing that matters. A confluence of reflexive factors drive investing outcomes.

Investors also discount the future differently, based on their own unique time horizons and tax rates.

* Originally published by Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX