Stay Rich or Die Tryin'

Submitted by Silverlight Asset Management, LLC on April 11th, 2017

What do Johnny Depp, Mickey Rooney, Burt Reynolds, 50 Cent, and MC Hammer all have in common? (hint: it has nothing to do with pants or hairstyle)

The answer is they were all very good at wealth accumulation but very bad at wealth management. Whether it was from irresponsible spending, lawsuits, bad investments, divorce, or some other extraneous factor, everyone listed above has seen the inside of a courtroom for bankruptcy or for a lawsuit alleging wealth mismanagement.

What these entertainers learned the hard way is: making money and managing money are two very different things; even having millions of dollars in the bank is not a guarantee of long-term financial security. That, too, takes planning and work.

Case Study #1: Burt Reynolds

Burt Reynolds was once the King of Hollywood, but the sad reality is that he spent the better part of the last two decades in financial turmoil. His first encounter with bankruptcy happened in 1996, when he divorced Loni Anderson and launched an unsuccessful restaurant business. Years later, he ended up back in the exact same spot after divorcing his next wife.

‘The Bandit’ then faced more hardships. A few years ago, Mr. Reynolds found himself yet again in court, this time disputing the foreclosure of his estate in Hobe Sound, Florida. Merrill Lynch Credit Corp. foreclosed when he failed to make payments for nearly a year on a $1.2 million mortgage. Mr. Reynolds tried to contest the foreclosure, but the court found in favor of Merrill Lynch. Seemingly unaware of the gravity of his financial situation, Mr. Reynolds commented on ABC news that he was “as surprised as everyone. I thought my career and my life could not be going better.”

Either Mr. Reynolds' financial advisors were not adequately warning him of the reality of his financial situation, he wasn’t listening, or worse—he didn’t have a financial advisor at all.

Case Study #2: Mickey Rooney

Mickey Rooney had one of the most storied Hollywood careers of all time, spanning over 80 years. But it was reported that when he passed away on April 6, 2014, he had an estate valued at only $18,000. Not $18 million—$18 thousand.

Mr. Rooney’s financial problems had multiple layers. Poor spending habits was one of them, and divorce was also a major factor. In 1962, at the time of his first filing for bankruptcy, he was already married and divorced four times.

Mr. Rooney rebuilt his career and his net worth over the next few decades, but court documents showed that later in life Rooney made some unlucky decisions that resulted, unfortunately, in elder abuse. In the late 90’s, Rooney allowed his stepson, Christopher Aber, to manage his financial affairs.

Mr. Aber was not a financial advisor and had no wealth management experience. To make matters worse, he and his wife stole Rooney’s money for their own use, as well as “[keeping] him (Rooney) in the dark about his own finances, [using] threatening and abusive language and [refusing] him basic necessities, such as food and medicine.”

This is a far cry from how a Hollywood legend should have spent his final days.

Case Study #3: Johnny Depp

Captain Jack Sparrow may need to get back on the pirate ship…and quick. Earlier this year, Johnny Depp filed a lawsuit against his financial advisory group, The Management Group (TMG), seeking $25 million in damages. Mr. Depp alleged “gross misconduct,” which he believes cost him tens of millions of dollars in losses.

The Management Group’s counter-suit makes it clear that the “misconduct” was probably a two-way street. TMG claims that Mr. Depp spent uncontrollably, doling out excessive amounts of money on staff, real estate, wine, and a yacht. Per court documents, Mr. Depp lived a $2-million-a-month lifestyle. You may wonder—how is that possible? Well, if you spend $30,000 a month on wine and maintain 14 residences, like Johnny did, it adds up quick!

The details of the case are still emerging, but one of the biggest errors seems clear—spending too high a percentage of total liquid assets. When that happens, even a manager that delivers solid returns won’t be able to make up the difference. Mr. Depp may have benefited from more coaching to understand how withdrawal rates can impact a portfolio’s trajectory over time.

Making Wealth Management the Centerpiece of Your Financial Life

These case studies underscore instances where wealthy people severely underestimated the importance of wealth management. In each case, it meant reducing years of success into a single day in court (which also costs money). And each time, it happened unnecessarily.

The cases of Mr. Depp, Mr. Reynolds, and Mr. Rooney are more commonplace than one might think, and are also metaphors for how people approach wealth management in general. Americans grossly under-save (about 50% of baby boomers have saved less than $100,000) and many people that do save well do not seek advice for how to invest their assets.

Same Returns, Different Results

It's probably no surprise that retirement age and withdrawal rates seriously impact the longevity of retirement accounts. However, what is grossly underestimated are the timing and sequencing of these important events.

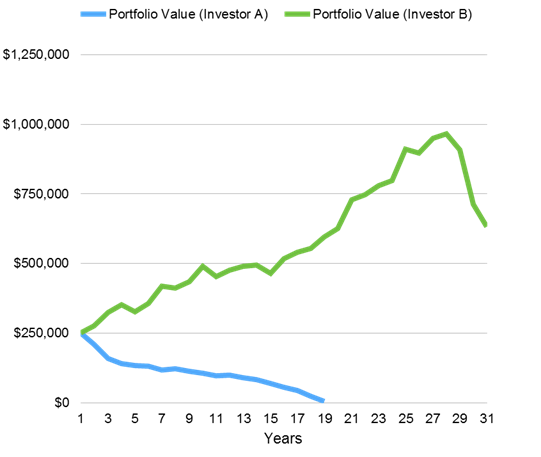

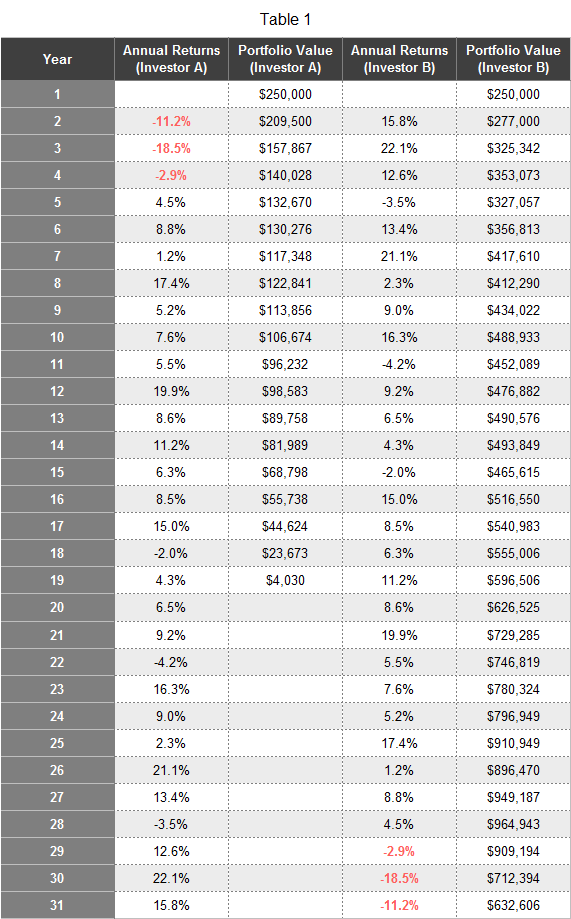

For example, assume two investors have portfolios valued at $250,000. They each withdraw $12,500 the first year, and increase the amount 3% annually to account for inflation. They both average a 6.6% return and expect to live another 30 years.

Despite all these similarities, the two investors end up in radically different places. Investor A runs out of money in 18 years, while Investor B has plenty left over.

Why such different results?

The investors experienced the same exact annual returns, just in reverse order. In other words, Investor A’s returns were negative the first three years, while Investor B didn't see a string of bad luck hit until the last three years. Based on the laws of compounding, sequence makes all the difference in this example.

We can’t eliminate 'sequence risk,' but there are ways to mitigate it. If you're nearing retirement or are recently retired, and justifiably nervous about the extended age of this bull market, here are a few ideas to consider:

Dynamically adjust withdrawal rates

This means spending less during bad market environments and spoiling yourself a little more after a strong bull run. If you have been invested in stocks over recent years, now may be a good time to take that dream vacation you've always thought about.

Start low, end high

Conventional wisdom says you should progressively get more conservative in how you invest as you age. That's not necessarily true. People are living longer and longer. To help ensure your money lasts, it may be prudent to front-load risk reduction in the early retirement years, when sequence risk can potentially do the most damage. If things go alright early on, asset survivability will be more ensured. You can take more risk later to grow assets for your heirs, in accordance with their time horizon.

Invest in quality assets

This idea isn't fancy, but it never goes out of style. Quality assets tend to compound healthily over the long-term, with below average volatility. Whether you invest in stocks, bonds or alternatives, astute asset selection can help reduce portfolio draw downs, and improve the odds for a comfortable retirement.

Per Gallup Poll, the number one financial fear of Americans is not having enough to retire. Yet many fail to do anything about it. Making wealth management just as high a priority as wealth accumulation can help avoid falling into the "celebrity trap" described above.

Wealth management doesn't have to be an intimidating exercise. Really! It isn't necessary to fill out 20-page questionnaires, or precisely forecast what your utility bill looks like in 25 years.

Just relax, guess and commit. That is, commit to the process of guessing. Just because one can't accurately predict all of life's twists and turns, does not mean it is wise to simply avoid planning. Ultimately, wealth management comes down to discipline, intelligent choices, and fluid communication with your advisors.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX