The S&P 500 Faces Tougher Growth Comps In 2018

Submitted by Silverlight Asset Management, LLC on April 16th, 2018

Danny Hurley knows about tough comparisons.

Before becoming the starting point guard at Seton Hall University, Danny grew up in the shadow of an older brother named Bobby. Bobby Hurley led the Duke Blue Devils to consecutive national championships and is the NCAA’s all-time assist leader.

Brothers who play the same position, in the same sport, are naturally compared to one another. In Danny’s case, that created an impossibly high base rate to be evaluated against. Tired of the comparison, he quit the team his junior season.

Playing second fiddle can also be a headwind in markets when comparison figures become more challenging. That will be the case in upcoming quarters with a lot of key data. Three such examples are real GDP, corporate earnings, and consumer confidence.

Real GDP. Hedgeye Research does as good a job as anyone on the Street assimilating rate of change analysis into their macro forecasts. They think this quarter represents peak growth in the U.S. economy.

Hedgeye finds that approximately 70% of the time, the marginal rate of change in the two-year average real GDP growth rate flips to the opposite sign of whatever the base rate compare is. In other words, since GDP is measured over sequential periods, strong data eventually sets the stage for bad data and vice versa.

Recently, economic growth has been on an upswing. Real growth has accelerated for six consecutive quarters, creating a powerful tailwind for risk assets. However, it's worth noting that this growth phase was setup by a low base number following five quarters of weakness.

When growth tops out and sputters, corporate fundamentals and sentiment usually follow.

Corporate Earnings. According to FactSet, earnings for S&P 500 firms are expected to grow +17.3% in the first quarter. That would mark the fastest rate of growth since Q1 of 2011.

There is good news and bad news if these rosy expectations come to fruition. The good news is over time stock prices generally follow earnings. The bad news is blowout earnings could create a difficult backdrop for profits to rise further. Especially in a mature economic cycle.

Last week, co-head of global equity strategy at Wells Fargo’s Investment Institute, Sean Lynch, wrote in a report, “We expect earnings growth for the S&P 500 Index to decelerate, or slow, throughout the remainder of 2018. A high bar has been set for U.S. earnings growth rates, and we believe it will be difficult to exceed that bar going forward.”

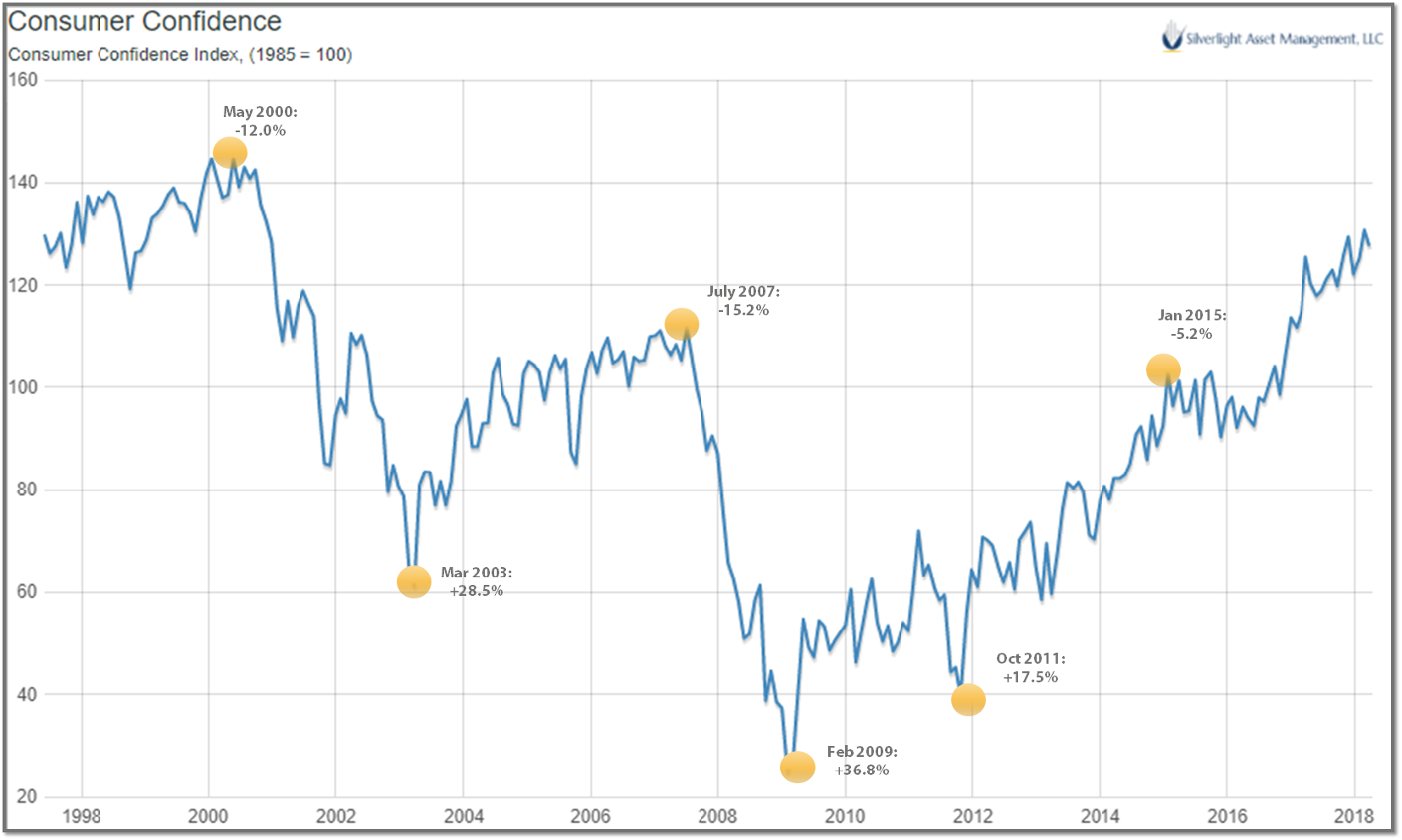

Consumer Confidence. Confidence among U.S. consumers has been trending higher since 2009. Recently, the Conference Board's consumer sentiment reading hit its highest point in the cycle. If you presume that to be a bullish omen for the S&P 500, you may want to sanity check the assumption. That's because Main Street and Wall Street often run in conflict. They both prosper over time, just rarely at the same time, which trips up investors.

To illustrate, below is a graph of consumer confidence. There are three high points identified and three low points. The forward 1-year returns for the S&P 500 were better at the low consumer confidence points than the high ones. The average one-year return at the three peaks was -10.8% compared to +27.6% at the three lows.

Of course, we don't know that consumer confidence is going to top out right away. We just know the higher the present number, the less remaining room to the upside there probably is.

***

Point guards rack up assists by seeing the basketball floor well—anticipating where other players will be before they get there and setting their team up to score.

Investors who score well embrace a similar mindset. They anticipate where the action is going, not where it stands presently. Base rates and rate-of-change analysis help do that. Surveying current macro data through those two lenses, it seems a better time to "protect the ball" and play more conservatively. Bulls are already well ahead in this game.

By the way, the Danny Hurley story has a happy ending. After a hiatus, Danny returned to Seton Hall. During his senior year, he averaged 14.3 points and 5.2 assists per game. Not as good as Bobby, but certainly respectable figures.

After college he migrated to coaching, where he has steadily ascended up the ranks. Ironically, the tables turned at Wagner College between 2010 - 2012. There his brother Bobby, who was brand new at coaching, served as his assistant coach.

Today, both brothers are NCAA head coaches. Bobby (pictured left) is head coach at Arizona State, while Danny (right), was recently hired as the new coach at the University of Connecticut.

Originally published by Forbes. Reprinted with permission.

Disclosure: This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX