Silverlight's Strategy for Risk Managing the Coronavirus

Submitted by Silverlight Asset Management, LLC on February 26th, 2020

It is now becoming obvious to everyone the Coronavirus will put a big strain on global commerce, and markets are quickly discounting that.

In my last post, I said stocks may be on the verge of a correction. It didn't take long to arrive. Since last Wednesday, the S&P 500 is down 7.6%.

Below is a synopsis of our current outlook, recent performance, and strategy going forward.

Fundamental Outlook

A spate of weak economic data is coming, which will provide fodder for perma-bears and politicians to cry foul on the economy.

The response will likely be more stimulus. Futures markets are already pricing in three more Fed rate cuts by year-end.

Short-term, it's impossible to make precise earnings or GDP estimates. But thankfully, the value of common stocks isn't based only on the next quarter or two. Equity value is based on the long-term cash generation of a company.

From purely a market perspective, we can look at the virus as similar to a non-recurring expense item for an individual company. Analysts adjust for those during earnings season, because they want to know a company's true earning power. This helps explain why markets have been resilient to past pandemic scares. They were temporary disruptions. Things eventually normalize, and markets anticipate that.

Recent Performance

Since the market peak on February 19th, Silverlight strategies have held up better than the broad market. Below is a comparison of model portfolios (a close proxy for client accounts) to the S&P 500.

S&P 500: -7.6%

Silverlight Core Equity: -4.9%

Silverlight Core Balanced: -3.5%

Silverlight International Equity: -6.3%

Dobermans of the Dow: -6.7%

Prior to the recent selloff, we were fortunate to exit several travel-related companies, including: Royal Caribbean Cruises, Southwest Airlines and Booking Holdings.

Silverlight's Strategy

According to JPMorgan strategist, Marko Kolanovic, there is evidence that commodity trading advisors (CTAs) were carrying heavy equity exposure, much of which they just unloaded. CTAs are part of a fast money crowd that can exacerbate price swings. CTA's equity exposure fell from the 85th percentile last week to near the 40th percentile.

The data below illustrates why "buying the dip" may continue to work, as it has throughout this bull market.

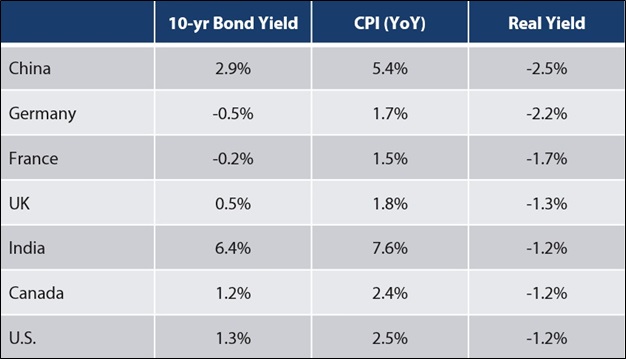

A flood of money rushing into bonds is once again producing negative real yields around the world. When that happens, investors have a choice. They can either buy bonds and lock in a decline in purchasing power, or they can buy stocks with a shareholder yield that beats inflation. The more the market falls, the greater the yield disparity tilts in equities' favor.

Source: Bloomberg

Since there are no major changes to our intermediate-term outlook, we are maintaining a comfortable balance of cyclical and non-cyclical positions. A "barbell approach," basically.

If the correction continues, we have room in our risk budget to be opportunistic buyers of weakness. Long-term clients know we strive to be at our best when markets are at their worst, and that remains our focus.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX