Rumors of Inflation's Demise Create Opportunity

Submitted by Silverlight Asset Management, LLC on December 18th, 2019

It seems mythical that Thomas Jefferson and John Adams took their final breaths hours apart on July 4, 1826.

The odds anyone dies on Independence Day are just 1 out of 365. But two of America’s Founding Fathers, both pulling the same pinball? On the same day, in the same year?

Come ‘on…

Another interesting fact: 3 of the first 5 U.S. Presidents passed away on the Fourth of July. The third was James Monroe in 1831.

While not as eerie, it’s at least ironic that former Fed Chair, Paul Volcker, passed away in 2019—the same year Businessweek ran a provocative cover story regarding his former nemesis—inflation.

In April, when Businessweek ran a story questioning inflation’s demise, it set off a contrarian alert. Many compared it to a now infamous cover from 1979.

Inflation in 1979

The very same month BusinessWeek proclaimed, “The Death of Equities,” Paul Volcker was appointed chairman of the Federal Reserve.

Equity market sentiment was in the gutter. Inflation had averaged 7.1% in the 1970s—more than double the previous decade. Rising inflation weighed on equity valuations. The Dow Jones Industrial Average, which traded near 1,000 in 1966, finished 1979 at 838.

In 1979, consensus didn’t care that the Dow’s dividend yield was 6%. Nor did consensus care that P/E ratios were the cheapest in 45 years.

There wasn’t much appetite for fixed income, either. Bonds were widely dubbed: “certificates of confiscation.”

Precious metals and commodities were the popular investments people discussed at cocktail parties.

Then Paul Volcker came along.

Mr. Volcker was apolitical. To promote a more stable economy over the long run, he mustered the courage to do the hardest thing in the world for any central banker—he raised interest rates. A lot.

The fed funds rate shot up to 20% in 1980.

Inflation peaked at 14.8% in March 1980.

The Dow bottomed in 1982.

The rest, as they say, is history.

Inflation Today

Just like it was wrong to overly extrapolate the high levels of inflation in the late 1970s, it’s probably unwise to overly extrapolate today’s low inflation.

Earlier this month, Jason Bloom, an Invesco strategist, was speaking to around 150 financial advisors. He polled the room to see who how many were concerned about inflation. Not a single hand went up.

“I almost sprinted back to my desk to buy TIPS,” he told Bloomberg.

‘TIPS’ stands for: Treasury Inflation-Protected Securities. Bonds with an inflation hedge, essentially. “The market is probably really offsides right now, leaning too far in one direction,” Bloom said.

Bloom appears right based on fund flows. Despite a sharp rise in equity markets this year, fund flows have still favored bonds. According to Refinitiv Lipper, individual investors are slated to withdraw over $135 billion from equity funds and ETFs in 2019, the most since 1992. Conversely, bond funds and ETFs will likely to see record inflows exceeding $250 billion.

Much of the demand for bonds is based on demographics. It’s no secret Baby Boomers are aging, and with that comes a desire to rotate toward a more conservative asset allocation. However, bonds have risk too, including inflation.

Here are reasons why inflation may surprise to the upside next year.

Base effects. Many of 2019’s market trends relate to how 2018 ended. Risk assets were aggressively sold in Q4 2018, as a deflationary chill spread across the global economy. That created a low hurdle for subsequent data.

Inflation is reported on a rate of change basis, and several of the forces that caused inflation to slow last year are likely transitory. For instance, energy and many other commodities will likely exhibit double-digit year-over-year gains over the next six months. There is a tight correlation between commodity prices and inflation gauges.

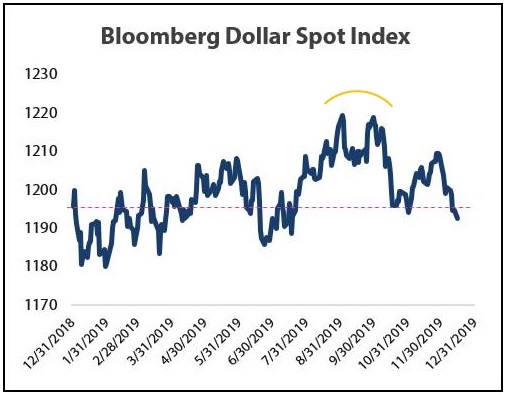

Weakening dollar. One thing RCM Editor, John Tamny, has taught me is that U.S. Presidents get the currency they want.

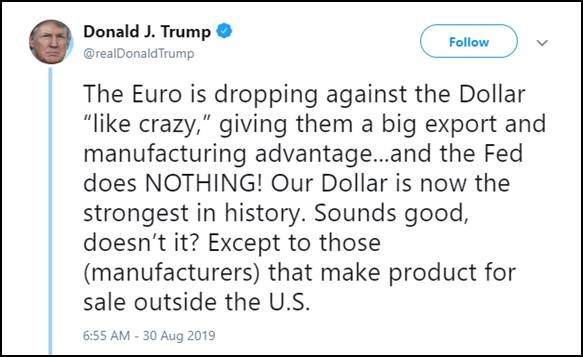

Most of President Trump’s tweets, such as the one below, argue in favor of a weaker dollar.

Technically speaking, it looks like the dollar is in a bearish trend. Since the end of September, the dollar has registered a series of lower highs and lower lows.

Perhaps the President is getting what he wants?

The manufacturing slowdown has weighed on the economies of several key election swing-states. If the dollar stays weak through next November, the President’s re-election odds likely go up.

Another thing that would likely go up under that scenario is inflation, because commodities are priced in dollars.

Price discipline returning to Silicon Valley. Aftershocks from the WeWork debacle are still reverberating through the Valley. Gone are the days of unicorns easily gobbling up market share by undercutting established rivals’ prices.

“Profit” isn’t yet a buzzword in Silicon Valley, but it’s becoming more of a priority. Cash-strapped unicorns will try to raise prices to avoid future funding squeezes. If that becomes a broader theme in the tech/consumer space, it could help nudge inflation higher.

***

Vital signs vary depending on how you measure, but inflation is certainly alive. And we don’t need to see a dramatic rise in inflation for performance trends to change.

If you’re a retiree and want to protect your purchasing power, now is a good time to sanity-check your asset allocation. The percent you allocate to bonds should not go up blindly based on your age. Interest rates and the inflation outlook should also factor into your positioning.

Meanwhile, rumors of inflation’s permanent demise have also created pockets of opportunity in the equity market. On a rolling three-year basis, the S&P technology index has outperformed energy by almost 100% - the widest gap in 20 years.

Originally published by RealClearMarkets. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX