Remember, Selling Into Strength Is How You Make Money In The Stock Market

Submitted by Silverlight Asset Management, LLC on May 1st, 2021

Buy low, sell high. It sounds so simple, right?

Selling “high” (whatever that means exactly) is tricky to execute, though.

Recently, the stock market has been on a tear. The S&P 500 index rose 5% in April with record-setting breadth. Over the course of 18 trading sessions this month, 95% or more of the S&P 500’s members traded above their 200-day moving average. According to Bloomberg, that’s double the previous monthly record set in September 2009.

Broad-based participation in a rally is normally a bullish signal. It signifies a healthy advance with broad momentum. But when a market becomes one-directional, smart investors have a risk radar that sounds an alarm bell.

“The fact that 95% of the S&P 500 is now above its 200-day moving average is NOT a bullish sign,” wrote chief market strategist for Miller Tabak, Matt Maley, in an April 26th note. “Yes, a high number of stocks above their 200 DMA’s is usually positive, BUT it is NOT bullish when the number becomes extreme (like it is now... at 95%).

From March 23, 2020 through April 30, 2021, the S&P 500 has gained 90% on a total return basis. The torrid pace of gains foreshadowed the current state of positive earnings and economic reports. Investors should not ignore such positive fundamentals. But it’s also wise to remember a lot of the positive data we’re seeing now is what the market has already been discounting over the last year.

This week, I decided to book some meaningful profits in client portfolios for the first time in a long time. Why?

Here are five ‘risk-off’ signals that make me a little more cautious heading into May.

#1: Seasonality Shift

“Sell in May and go away” is one of those market adages that resurfaces every year.

The saying relates to a Stock Trader’s Almanac finding that shows the best 6-month rolling period for stock returns has historically been November through April. Since 1945, the S&P 500 has gained an average of approximately 2% from May through October. That compares to an average return of about 6% from November through April, according to Fidelity.

So, seasonality favors de-risking around now, independent of the fact US stocks are up 90% over the last 13 months.

#2: Sector Rotation

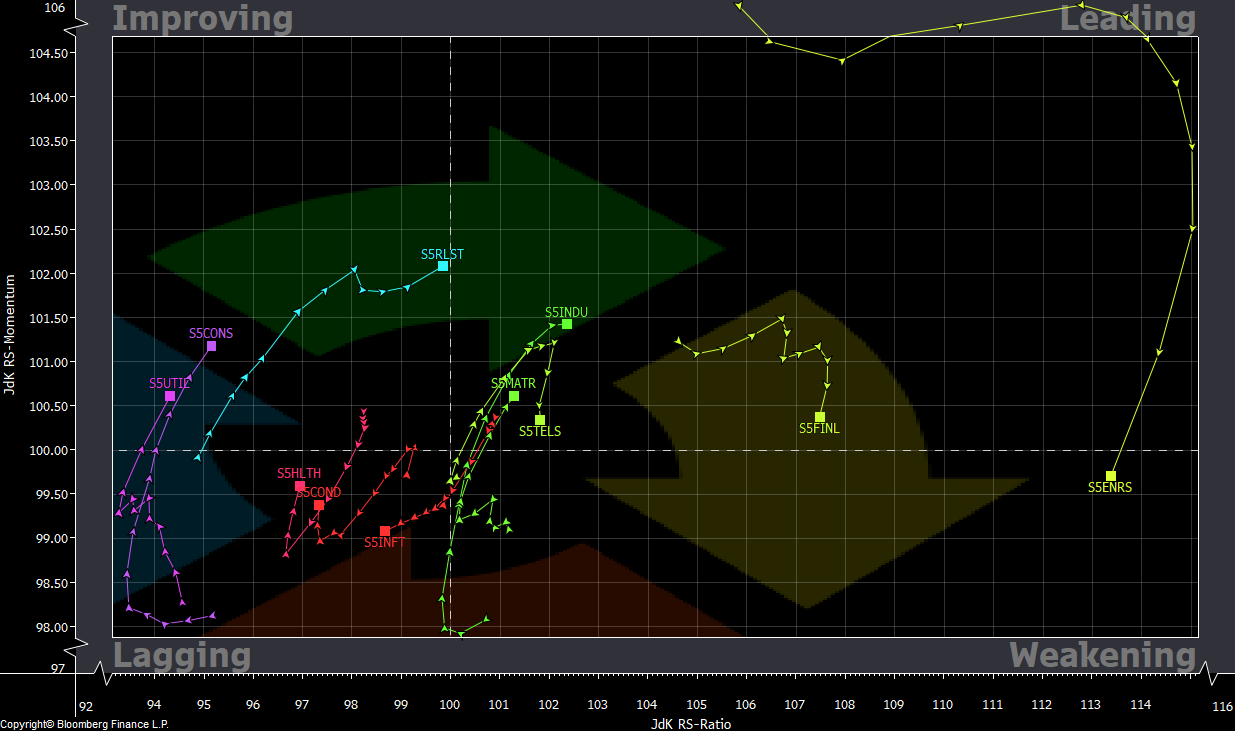

Investors are starting to rotate toward lower risk sectors. One way to see how this trend is evolving is the Relative Rotation Graph. In the graph below, the vertical y-axis measures momentum and the horizontal x-axis measures relative strength. Momentum trend changes happen before relative strength changes, which is why the weekly tails evolve in a clockwork-like pattern.

When investors start rotating more into a sector, its tail trends up and to the right. Up and to the right is good. Conversely, when a sector is underperforming, the tail moves down and to the left.

Currently, the defensive pockets of the S&P 500 are seeing relatively better inflows, including Consumer Staples, Utilities and REITs. Previously strong sectors with slowing momentum include Energy, Financials, and Technology.

The last time I flagged a bearish development in the RRG graph was February of 2020 in this Forbes post. Back then I wrote, “The S&P 500 is trading about 11% above the 200-day moving average, and there may be a correction soon.”

Little did I know at the time, the Coronavirus was weeks away from walloping the global economy. The severity of the economic shutdowns was a big surprise to me and I think most investors. But it’s interesting looking back at how the sector rotation trend provided an early warning that risk was around the corner.

It’s not always the case, but defensive sector rotations often foreshadow broader market corrections.

#3: Bullish Sentiment

One of Warren Buffett’s most famous sayings is, “Be greedy when others are fearful, be fearful when others are greedy.”

One way to track investor greed and fear is the AAII Investor Sentiment survey. Yardeni Research tracks the weekly ratio of bulls to bears, noting that when the reading is over 3 or under 1, sentiment is lopsided in a statistically significant way.

Before the 90% rally in the S&P started last year, the Bull/Bear spread shown above dipped just under 1. Currently, bulls outnumber bears by over a 3-to-1 ratio.

#4: Prices Paid Index

Inflation is a hot topic lately. Supply constraints and unprecedented levels of monetary stimulus have created a mismatch between supply and demand around the world. With more money chasing fewer goods, prices are bound to go up.

A broad range of commodities have soared in price over the last year. Consequently, many firms are reporting higher input cost pressure this earnings season.

One way to track input costs is the ISM Prices Paid Index. The index recently climbed above 85, recording the second highest reading since 2000. The previous high was in June 2008.

Per the Leuthold Group, the prices paid index has only been higher than 75 about 22% of the time since 1948. The S&P 500 has historically delivered below-average returns when the index goes above 75.

#5: Technical Exhaustion Signals

On March 31, 2020, I wrote a piece advising investors to “Stay Agile Investing In the Ides of March.”

At the time, sentiment was heavily bearish. It was hard to see how things could get better anytime soon.

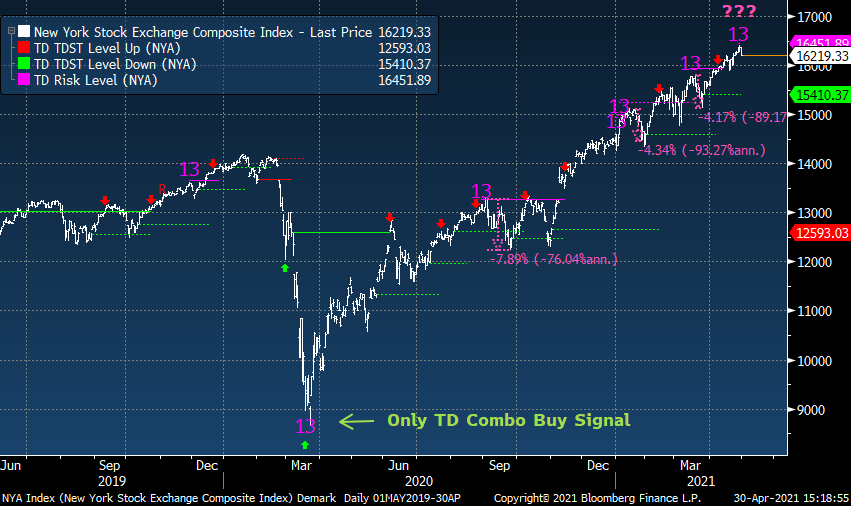

Technical indicators are most useful when they are both counterintuitive and accurate. Like the DeMark Indicators.

Last March, I wrote, “If you incorporate technical analysis into your decision-making, use trend exhaustion signals. They are the best tactical guide for a climate like this, where the greatest risk is getting whipsawed. Don’t get whipsawed... One tool that is excellent at spotting potential trend inflections is called TD Combo.”

As I profiled in that note, in March 2020, several broad equity indices printed daily Demark TD Combo buy signals. That turned out to be an excellent time to buy low.

Since then, numerous equity indices have recorded several TD Combo sell signals. For example, below is a daily chart of the New York Stock Exchange, which shows several 13 upside exhaustion signals, which were followed by shallow corrections ranging 4% to 8%.

On April 28th, 2021, the NYSE Composite Index recorded another 13 combo sell.

Maybe an important inflection is coming.

Maybe just another shallow consolidation.

Maybe nothing can stop this bull market from charging higher.

Whatever your overall market view is, I think it’s worth at least considering downshifting a gear here.

Originally published in Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX