Money Market Yields Are Attractive And Investors Are Taking Notice

Submitted by Silverlight Asset Management, LLC on June 4th, 2023

There’s a faint but growing sucking sound permeating Wall Street. That is the sound of money being gradually sucked out of traditional investments like stocks and bonds and into money market funds.

A money market fund is a type of mutual fund that invests in highly liquid instruments including cash, cash equivalent securities, and high-credit-quality debt with a short-term maturity (such as U.S. Treasuries).

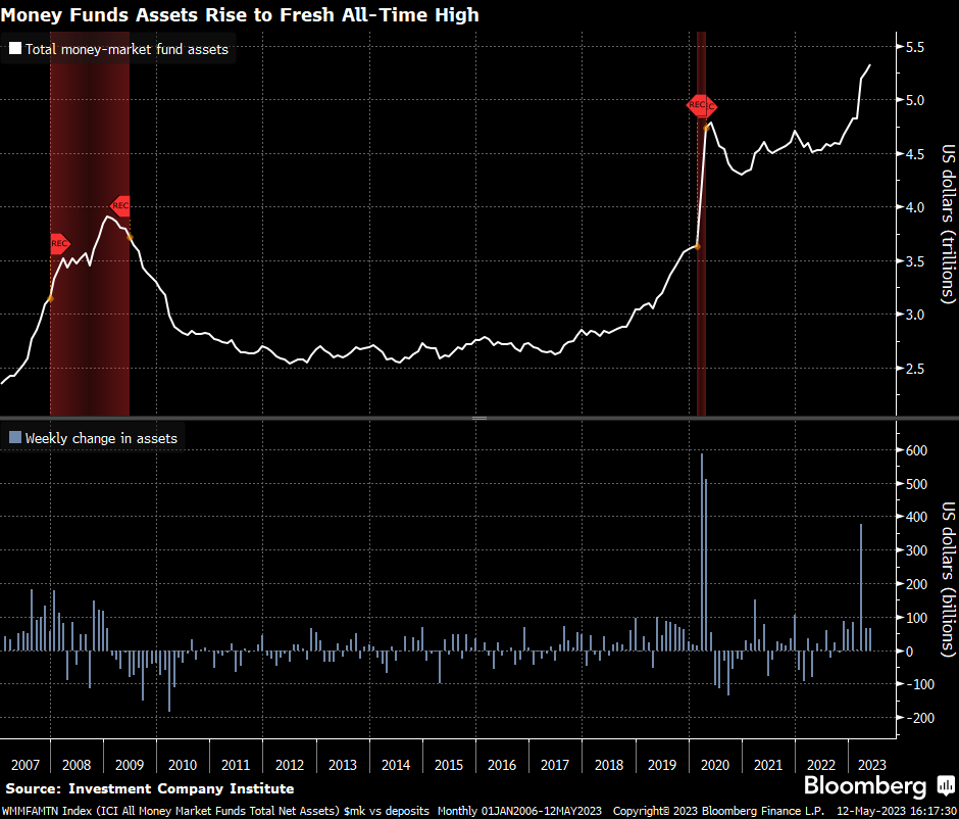

The amount of money stashed in money market funds recently rose to an all-time high of $5.4 trillion. After a string of positive weekly fund flows, it’s clear that more investors are noticing they can achieve satisfactory yields with minimal risk via money market funds.

The last two instances when money market fund flows accelerated this dramatically were in the leadup to the Covid market crash in 2020, and at the onset of the Great Financial Crisis in 2008. Both were recessionary environments.

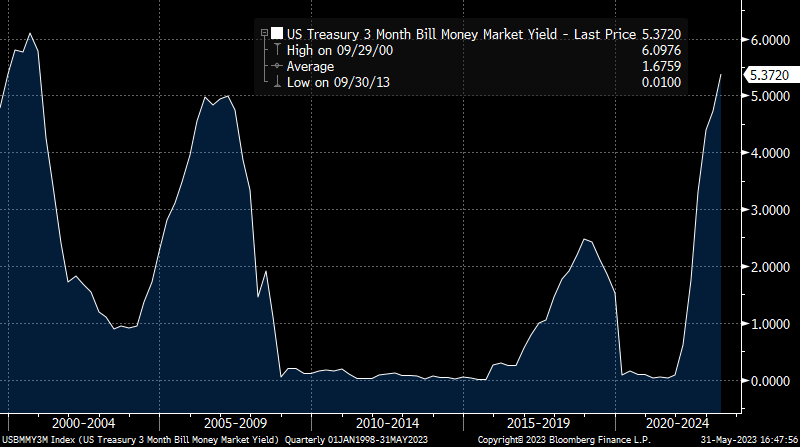

Money market yields are largely guided by the Federal Reserve’s policy actions. Over the last year, the Fed has been rapidly pushing short-term interest rates higher to combat inflation. 3-month treasury bill rates are a useful proxy for money market yields. As you can see in the chart below, the current T-bill rate is near the highest level in twenty years.

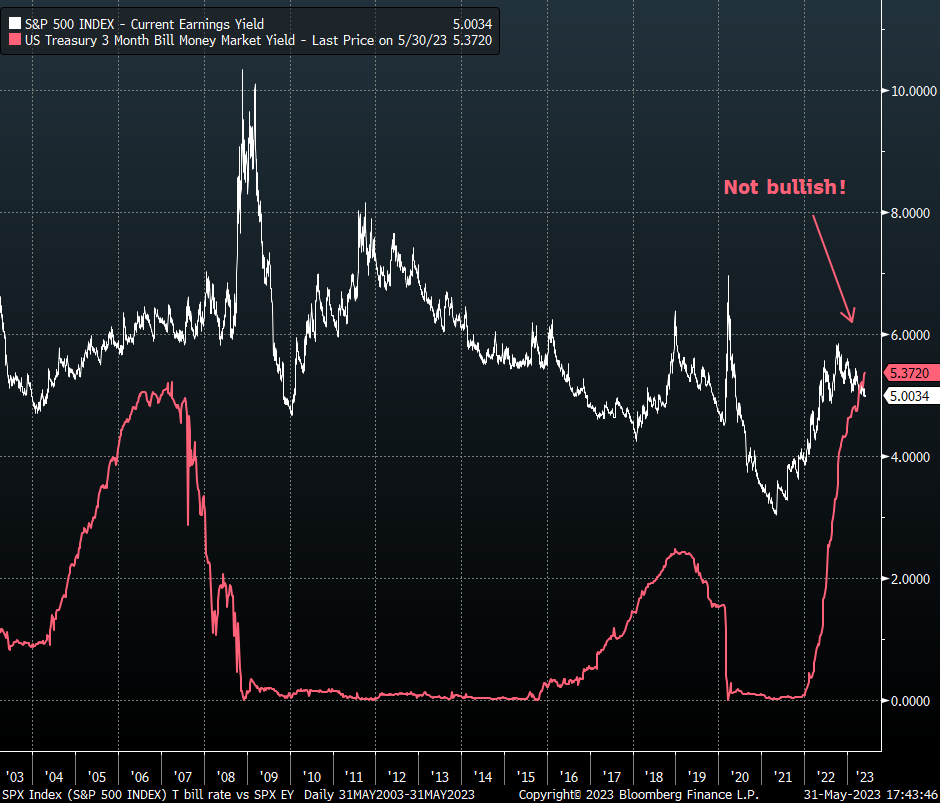

High money market yields typically act as a headwind for risk assets. This is because capital flows to wherever it is likely to receive the best risk-adjusted return over time. High money market yields provide investors with a relatively safe alternative for their investment dollars.

When yields on money market instruments like Treasury bills, certificates of deposit, and commercial paper rise, active investors are more tempted to shift their capital from risky assets to safer options. This dampens the demand for risk assets and, in turn, puts downward pressure on their prices.

For example, in the months leading up to the 1987 Black Monday crash, investors were able to secure high single-digit yields on Treasury bills, which partly caused the shift out of equities into fixed-income instruments.

In the 1994 bond market massacre, the Federal Reserve unexpectedly raised interest rates multiple times, causing a sharp increase in money market yields. This led to a significant sell-off in both the bond and stock markets as investors shifted their assets to cash and cash equivalents, seeking safety from volatile markets.

More recently, money market flows accelerated when Silicon Valley Bank failed, which led to a cascade of solvency concerns across the broader regional banking landscape. If banks keep losing deposits to money market funds, this will certainly promote a ‘risk-off’ economic environment, because it increases the probability banks will dial back lending. That invariably slows money velocity throughout the financial system, which could be the catalyst that brings about the next economic recession.

A dash to cash is broadly evident.

“Cash is no longer trash,” says Jim Bianco. “That was a two-decade old meme that doesn’t apply,” the Bianco Research president told CNBC earlier this year. “Cash could actually be somewhat of an alternative where it was just a waste of time throughout the 2010s. It’s no longer that anymore.”

“You are going to get two-thirds of the long-term appreciation of the stock market with no risk at all,” added Bianco. “That is going to provide heavy competition for the stock market. That could suck money away from the stock market.”

Case in point: The Vanguard Real Estate ETF (VNQ) consists of many different REIT holdings. One of the main reasons investors have historically gravitated to REITs has been their above-average dividend yields. However, VNQ presently only yields about 4%. Why take the risk to invest in a basket of REIT stocks when you can obtain nearly a 5% yield in a money market fund? REITs make little sense, particularly if you consider how dire the outlook is for commercial real estate with office vacancies in major cities sitting at multi-decade highs.

Corporate bonds also have a hard time competing with 5% money market yields. The iShares Investment Grade Corporate Bond ETF (LQD) presently yields 3.9%. Why take the credit risk to own corporate bonds if you can get a percent higher in cash?

How about the favorite passive investment on the planet—the S&P 500? The S&P 500’s dividend yield is only a paltry 1.7%. But since many investors buy the broad stock market for its earnings growth potential, we could also look at the earnings yield. On this measure, the S&P 500 currently yields 5.0%. If you care about valuation risk, it’s worth noting the S&P 500’s earnings yield just dipped under the 3-month treasury yield for the first time in the last twenty years.

Takeaway: the S&P 500 looks richly priced versus cash.

The same can be said for most bonds and other risky investments, and this is by design. Part of the Fed’s job to squash inflation is to incentivize investors to migrate their funds out of economically sensitive assets. A negative wealth effect is part of the recipe for how we get back to 2% inflation someday.

Fight the Fed if you like. Valuation has never been a great timing catalyst, so maybe it will work out for you.

Personally, I’m not entirely out of the stock market. But I am certainly being a lot more selective nowadays. And I am loving the current opportunity to earn decent returns in a low-risk investment. It’s been a while since we’ve been able to do that.

* Originally published by Forbes. Reprinted with permission.

Disclosure: This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX