The Long-Term Market Odds Call For You To Stay Invested

Submitted by Silverlight Asset Management, LLC on September 13th, 2019

In a headline driven, volatile market like we’ve been traversing, it’s easy for investors to try to overcorrect their positioning. I’m referring to the whole “risk on, risk off” mentality.

A casual market observer probably sees a binary narrative. It seems like everything rides on a U.S./China trade deal.

President Trump sends a negative tweet about China, the market plummets.

A few days later, a meeting is announced, and the market reflexively bounces to the upside.

Yes—it’s annoying. But it’s also easy to forget that markets have always been emotional.

It’s important to not overreact to short-term market noise. Even if you think the market setup is binary, and strongly believe you know how events will unfold.

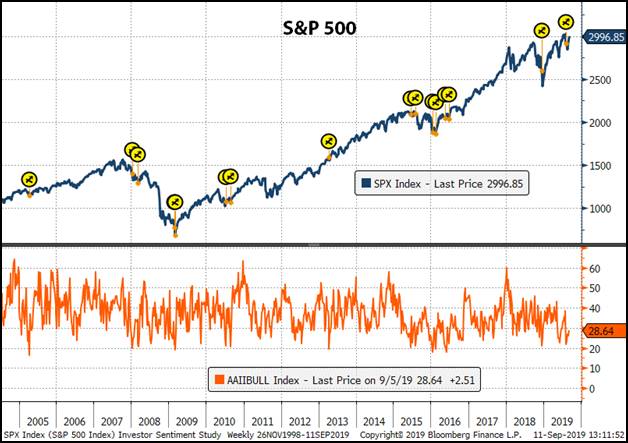

Case in point: the second week of August was an easy time to be a seller. Lots of negative headlines swirling and investor sentiment was depressed. A mere 21% of those polled in AAII’s Investor Sentiment Survey reported a bullish outlook on U.S. equities

Considering the S&P 500 was then only a few percentage points off the all-time high, it’s surprising sentiment was so dire. Yet the market bounced, as it often does when bearish sentiment is lopsided.

At extremes, sentiment surveys can be an excellent contrarian indicator. Out of curiosity, I did a study analyzing historical S&P 500 performance when sentiment dipped to similar levels as reported in August. Since 2004, it has happened on 15 separate occasions. If you fast forward three months later, the market was at a higher level 80% of the time with an average return of 7.3%.

Takeaway: Warren Buffett is right about the whole “Be greedy when others are fearful” thing.

You don’t have to be contrarian to do well as an investor, though. Simply sticking with a sound long-term strategy during rocky times is enough.

Problem is, many folks tend to overcorrect their positioning after they get stung by a volatility surge. Some may even liquidate their entire portfolio. I’ve seen it happen, usually at the wrong times.

Reactionary market timing moves like that are a dangerous proposition for several reasons.

First, the market rises more frequently than it falls. The S&P 500 has finished positive in 32 of 39 years since 1980, averaging over an 11% return.

Second, there are taxes and other expenses to consider.

Third, even if you happen to exit at a good spot, almost no one gets back in near a bottom. People like to wait until things “settle down,” which usually means buying back in after prices are higher.

If you want to actively manage your asset allocation, the best way to do it is by making modest tactical adjustments within a predefined strategic risk range.

A Lesson from the Golf Range

Like investing, golf is a complex game.

“Shank” is a particularly dreaded word among golfers. A shank is where a shot goes directly sideways—often out of bounds.

I’ve been golfing since I was 11 years old. And I’ve never had “the shanks.” Until recently.

The weirdest thing about it is you feel like you’re swinging normally. The ball just doesn’t go where it’s supposed to.

I tried to self-correct the problem by watching YouTube videos and experimenting with swing adjustments. But it only made me more confused and compounded the problem.

Finally, I signed up for a lesson with a pro. He advised me to disregard the YouTube videos and just show him my natural swing. I hit a couple good shots. The third was a shank.

“Why does that happen,” I asked?

“You’re hunching over too much, which breeds inconsistent ball-striking,” he said. “Do everything the same, just stand up straighter and pull your shoulders back.”

I did as he instructed and smashed five perfect shots in a row. Haven’t shanked a ball since.

Turns out, I was overthinking the whole thing, and overcorrecting as a result.

How to Hedge the Risk of Getting Whipsawed by the Market

Getting whipsawed in the market can feel a lot like shanking a ball on a golf course. It’s frustrating, confusing, and bad for your scorecard.

If you want to avoid getting whipsawed by getting too bearish at the wrong time—like many of the folks AAII polled in August—try using a risk range. Similar to the tip I received on the golf range, it’s a way to make modest tactical adjustments.

I think of a risk range as a strategic boundary for market exposure that aligns with your long-term goals. It handcuffs you from tilting too aggressive or defensive at the wrong time. In other words, it safeguards you from yourself.

For example, in my U.S. equity strategy, I target an ex-ante beta of 1.0 when I sense opportunity and want to be aggressive. That means my expected portfolio volatility is equal to the market.

Conversely, when I see a lot of risk and want to be cautious, I move toward the low end of my risk range, which is an ex-ante beta of 0.75 (meaning I’m about 25% less volatile than the market).

A solid financial advisor can help you identify the right risk range for you.

Why don’t I go to 50% exposure when I’m bearish? Or zero?

Anytime you fade the market you’re swimming upstream. That’s because the long-term odds favor staying invested.

It’s also hard to call bear markets. They’re rare and there’s no perfect checklist to forecast them.

The Present Market Environment

In January, I shared my market outlook with RCM readers. I’ve already achieved my expected return for 2019. And since I perceive the current environment as riskier, I’m tilting closer to the low-end of my risk range.

However, I also still maintain some cyclical exposure because there are upside risks that would be foolish to ignore.

Improving market breadth. A dramatic performance reversal this week favoring small-caps and cyclical stocks has market breadth improving, which is normally a good sign for bulls.

No investor euphoria. Depressed sentiment readings the past few months show the “Wall of Worry” bull markets tend to climb is still standing.

Election Cycle supports the Q4 outlook. During the third year of a President’s first term, stocks have historically finished higher 77% of the time, averaging a 4.2% gain (source: Bloomberg).

Bottom-line: we don’t know what the future holds. So, it makes sense to position for multiple potential outcomes. A risk range can help you do that in a disciplined manner, while staying true to the target you were originally swinging for.

Originally published by RealClearMarkets. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX