Lebron James' Mega-Deal Shows Why Globalization Is Here To Stay

Submitted by Silverlight Asset Management, LLC on July 8th, 2018

America celebrated Independence Day this week, while Lebron James celebrated a new $154 million-dollar contract with the Los Angeles Lakers.

Whether you’re a “King James” fan, hater, or don’t even know who he is, he's the American Dream personified.

His ability to fulfill his version of the American Dream can be traced to an NBA contract signed 30 years ago, a revolt against a King 242 years ago, and the spread of globalization.

The Freedom of Free Agency

Prior to 1988, NBA players were essentially held hostage by their original teams. “There was no such thing as free agency,” recalls Tom Chambers, basketball’s first high-profile free agent. “If a team had you, then you had to sign with that team, unless they traded you. You really couldn’t move. There was no movement at all. Therefore, contracts were kind of locked into what you could make.”

Chambers was fortunate. The year his contract was up, the players’ union successfully negotiated unrestricted free agency.

As was the case in other sports leagues, free agency improved NBA players' marketability, and salaries have since skyrocketed.

By the end of Lebron’s deal with the Lakers, his career on-court earnings will likely approach $400 million, the most in NBA history.

Modern sports stars’ reach extends beyond the arenas they fill, and country borders. Like multi-national corporations, top athletes are building global brands.

In 2015, Lebron signed a lifetime endorsement deal with Nike, likely to pay him over $1 billion by the time he's 64. The unprecedented deal shows Lebron has become much more than just a basketball player. The boy from Akron has become an economic miracle.

Mobility is Leverage

Since the 1980’s, both labor and capital have become progressively more mobile. As Lebron James’ contract illustrates, mobility is leverage.

A few years ago, Lebron famously “took his talents to South Beach,” because he wanted to win his first NBA championship.

In the corporate sphere, firms are attracted to areas with skilled labor pools and low taxes.

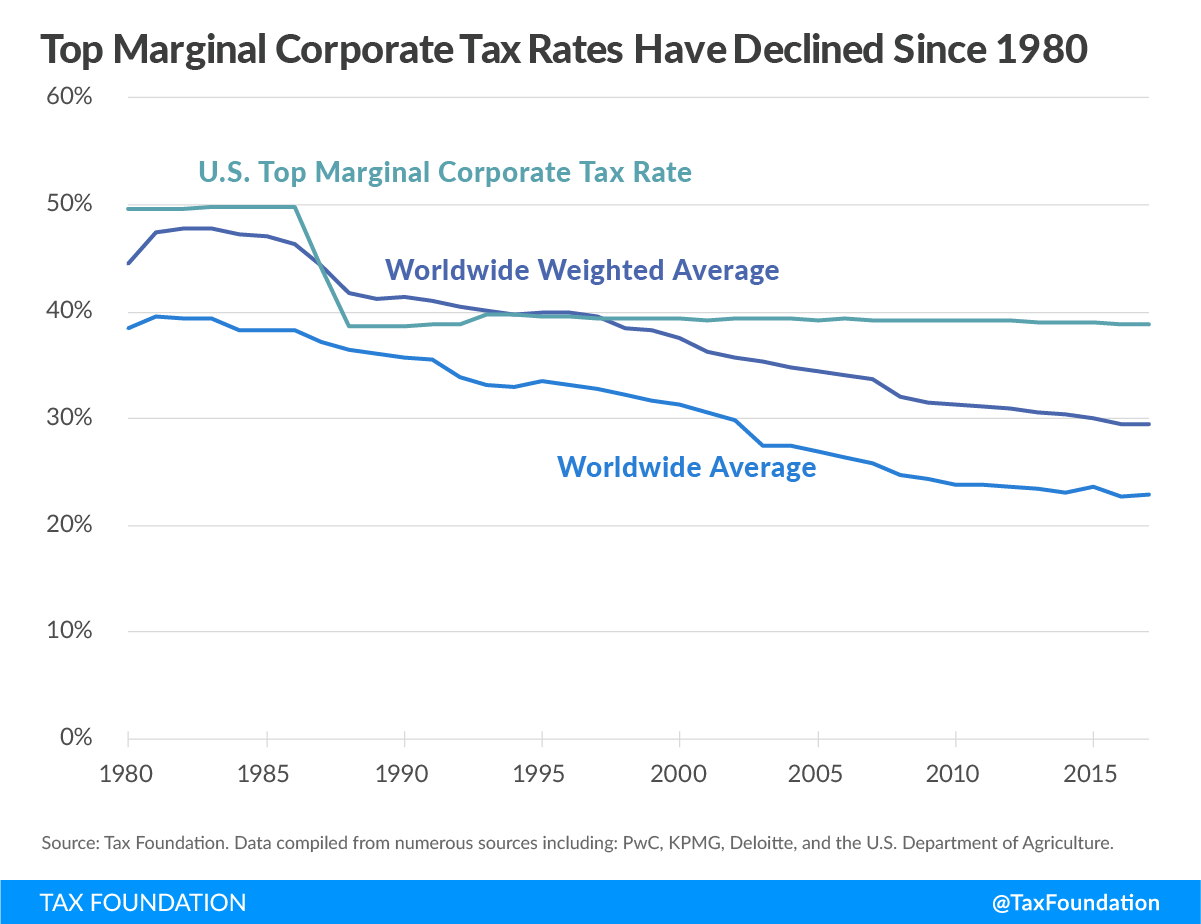

Similar to NBA teams that must now pay higher sums to secure the best players, countries have to maintain low enough tax rates to attract and retain the best talent. The Tax Foundation’s chart below illustrates how worldwide corporate taxes have trended lower in recent decades.

Tariffs create trade barriers, and function as a tax because they raise prices at the cash register.

With the U.S. implementing tariffs against China this week, and China vowing retaliatory measures, there’s a lot of anxiety overhanging capital markets. It has to do with fear the multi-decade globalization trend may be ending. Both countries are effectively raising taxes and disrupting trade.

All any of us can do is guess how things will play out. That said, I’d be really surprised to see globalization reverse.

Why?

Mobility.

I just don't think politicians can put the mobility genie back in the bottle for long. It's a form of financial alchemy that makes the world wealthier. And at a fundamental level, most people want to be free to pursue prosperity.

When you stop to think about it, it’s easy to see why mobility is a tax depressant. John Tamny summed it up in his book, Popular Economics, stating, “Taxes are the price we charge people to work, and that price affects where they work and whether they work at all.”

After British tax rates exceeded 80% for the highest bracket in the 1970s, Rolling Stones guitarist Keith Richards described it in his autobiography as “being told to leave the country.” And leave they did—the band relocated to France. Meanwhile, they kept selling plenty of albums.

If Lebron wanted to, he could sign a deal tomorrow to play ball overseas. His individual talent is mobile, and his reach is global.

Companies are similar. Today, approximately 40% of the S&P 500’s revenues are derived abroad. This makes many multi-national firms independent free agents.

If a big trade war erupts, it would mean several things: (i) a regressive tax on consumers in the form of higher prices for everyday goods, (ii) a recession, (iii) less corporate dollars flowing to the coffers of politicians deemed responsible, and (iv) angry voters.

The system self-corrects.

What that means for investors, in my view, is there’s likely a reasonable cap on how far this tit for tat tariff game goes.

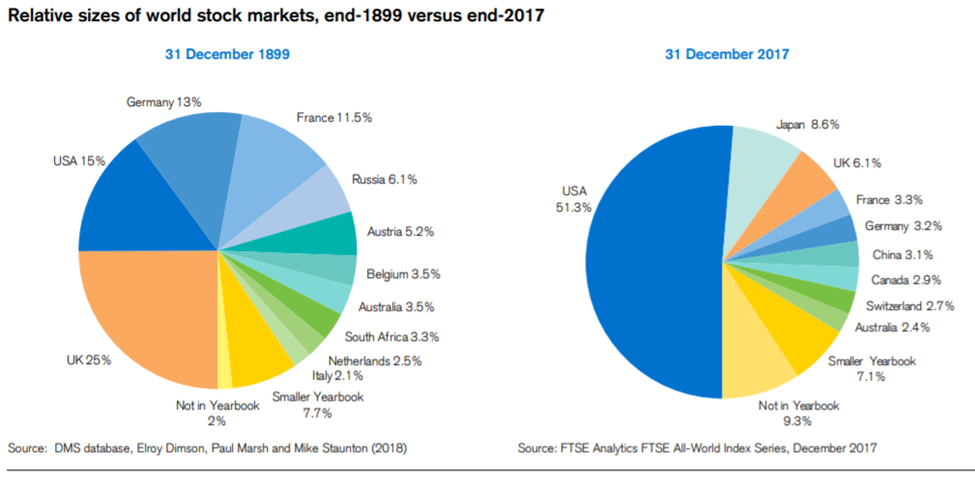

The long, steady march toward expanded freedom and mobility has led to unprecedented prosperity in the U.S.—in both absolute and relative terms. The magnitude of U.S. outperformance during that march is plainly evident in the chart below, courtesy of Credit Suisse.

Remembering What the Fourth of July Celebrates

Transportation efficiency is only going to keep improving. So will mobile connectivity. Governments must adapt. They can’t swim counter-stream for long before the prevailing trend—in place for hundreds of years—likely reasserts itself.

The perspective I’m offering relates to a very long-tail trend, which stretches all the way back to the founding of America.

The Tea Act, passed in 1773, allowed the British East India Company to sell tea to the colonies duty-free, but still tax the tea once it reached colonial ports.

The act’s main purpose was not to raise revenue from the colonies but to bail out the floundering East India Company, a key actor in the British economy. The British government granted the company a monopoly on the importation and sale of tea in the colonies.

The colonists had never accepted the constitutionality of the duty on tea, and the Tea Act rekindled their opposition to it. Their resistance culminated in the Boston Tea Party on December 16, 1773, in which colonists boarded East India Company ships and dumped their loads of tea overboard” (source: History.com).

Whether it’s tea or steel, tariffs and other trade gimmicks have not proven to be lasting solutions. After the Boston Tea Party, tea smugglers found ways to get Americans their tea, the East India Company teetered on bankruptcy, and Britain lost control of the colonies.

Investor sentiment is fickle in the short-term. Anything can happen any day in the stock market.

That said, I believe long-term investors should avoid letting gloomy trade war headlines dictate their investment strategy. The degree of negative sentiment surrounding the trade issue probably exceeds the true risk. With sectors and stocks, pick your spots carefully. Just don't lean too bearishly overall.

Exports matter, but they're only 8% of U.S. GDP. Plenty of other factors also influence business cycles, including corporate earnings, interest rates, and currencies.

Finally, I want to mention a downside aspect of modern mobility. Today, most people carry a mobile phone, and live constantly connected to the Internet. That means it's on us, as individuals, to risk-manage overexposure to hyperbolic headlines. Fear produces clicks. But the truth is, there’s never been a better time to be alive.

Wherever the free market has been permitted to operate, wherever anything approaching equality of opportunity has existed, the ordinary man has been able to attain levels of living never dreamed of before. " - Milton Friedman, Free to Choose: A Personal Statement

Originally published by Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX