It's Not 1999

Submitted by Silverlight Asset Management, LLC on June 9th, 2017

Are we witnessing Tech Bubble 2.0? A lot of people are comparing today’s market to the late 1990s, asking that question.

Today, tech shares were sold aggressively, as investors realized profits and moved money to other areas. Wall Street calls this a ‘rotation.’ One of the catalysts was a Goldman Sachs report issued this morning, which said the following:

“While FANG has dominated investor focus, the nature of the acronym has expanded more broadly to encompass mega-cap tech. Indeed, the bigger story in our view is FAAMG – Facebook, Amazon, Apple, Microsoft and Alphabet – a group of five stocks which have been the key drivers of both the SPX & NDX returns year-to date.

This outperformance, driven by secular growth and the death of the reflation narrative, has created positioning extremes, factor crowding and difficult-to-decipher risk narratives (e.g. FAAMG’s realized volatility is now below that of Staples and Utilities)."

That last part is important.

Technology firms’ earnings are more volatile than package food companies and electric utilities. Hence, tech shares are not supposed to be the least volatile group. Alas, they are—and that probably indicates temporary overcrowding and complacency permeates the sector.

At the height of the Tech Bubble Era, I was a student at Georgetown University. For three months, though, I had a front row seat at the epicenter of tech mania. Prior to senior year, I completed a summer internship at a venture capital firm in Boston.

One morning that summer, there was a noticeable buzz in the office. I asked a colleague what was going on? Management from a key early-stage investment was due to visit, he said.

Like many VC investments back then, the visiting company had a .com at the end of their name. The big idea? They were going to sell meat… over the internet. Meat.com.

If you visit meat.com today, you cannot purchase meat directly. But you can buy the domain. Timing is critical in tech cycles, and time ran out on them, as was the case for so many other ecommerce firms around the turn of the millennium.

Looking at this cycle, several disturbing signs make one wonder how much time is left.

- Technology shares trade at the highest multiple of sales since 2000

- Tech firms with negative earnings are up an average of 32% in the last year

- The group of well-known big caps—Facebook, Apple, Amazon.com, Netflix and Google has seen returns roughly triple that of the S&P 500 Index year-to-date

- The MSCI U.S. Momentum Index, which tracks companies with the most price appreciation in the last two to 12 months, rallied 11 straight days through last Friday; the longest stretch since October 1992

These statistics may be sobering, but not everyone is ready to call 2017 a repeat of 1999. Marc Andreessen is one of today’s preeminent venture capitalists. He believes technology companies have been undervalued since 2003, owing to investors’ memories of how the last boom ended. He recently discussed what’s happening in Silicon Valley:

Investors who were in the stock market in 1929 never went back into the stock market. If you live through one of these scarring crashes, you get psychologically marked. We have an entire generation of Depression Babies – including me – in Silicon Valley who went through the 2000 dotcom crash.

But enough time has passed since the crash that kids are coming to the Valley who don’t have a memory of the crash. They were like in 4th Grade when it happened. We get in these weird conversations where we’re telling them cautionary tales of what happened in 1998, and they look at you like you’re a Grandpa.

We have a new generation of people in the Valley who say, ‘Let’s just go build things. Let’s not be held back by superstition.’ It’s not that one is good or bad. But the balance is shifting.

***

My take—this cycle has its fair share of risks to manage—but there are enough investors who think like Marc does to avoid another epic tech bubble. Hardly anyone remembers Meat.com. But many do remember Pets.com, and others like it.

Here is a simple chart to illustrate that we are nowhere near the valuation extremes witnessed when I worked at the VC firm. Back then, tech outperformed huge almost purely based on valuation levitating higher. Nowadays, earnings justify the move much better (i.e. the white line and orange line are tracking similarly).

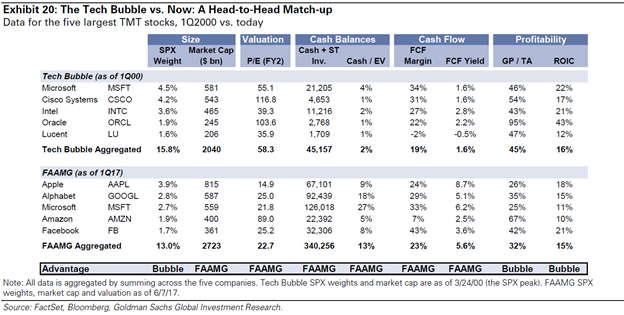

The Goldman report offers a more detailed head-to-head comparison. The table below compares the five largest Tech stocks at the last peak to the five biggest today on metrics including size, valuation, profitability and free cash flow.

During the Bubble, the five largest Tech stocks traded at almost 60x estimated earnings, with the “cheapest” stock (LU) trading at 36x. Currently, FAAMG trades at around 23x, with only one stock (AMZN) trading over 30x.

Surprisingly, on a free cash flow yield basis, FAAMG is presently cheaper than the broad stock market. That’s right. The group’s 5.6% yield exceeds the broad market at 4.6%.

Moreover, the sector is comprised of many high-quality businesses. The Economist recently found that as a group, the top ten tech firms have $8 of market value for every dollar sunk into net fixed and intangible assets. Those are fabulous economics for any business, anywhere.

Bottom-line: Don’t chase FANG to the moon or ignore opportunities that remain in tech and beyond. It's not 2009, but it's not 1999 either. Now is a time to be selective.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX