How Trump Could Make A Deal With The Dow

Submitted by Silverlight Asset Management, LLC on April 19th, 2018

“The stock market is way up again today and we’re setting a record literally all the time,” President Trump proudly proclaimed back in January. As Wall Street’s so-called “cheerleader-in-chief,” CNBC tallied over 60 Trump tweets about the stock market since the election in 2016.

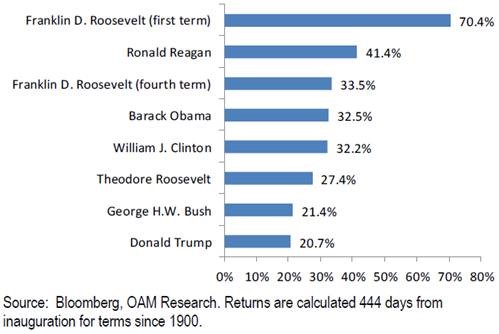

Someone should tell President Trump his ranking as a “stock market friendly president” is slipping. Seven previous administrations had better numbers this far into their terms.

Fundamentals are in the President’s corner. Corporate profits increased 15% in Q4 and are forecasted grow at a similar pace in Q1. The employment picture is constructive and wages are percolating. Consumer confidence is at a multi-year high.

Yet after a strong January, the market has been in a sideways correction. That’s because valuations have compressed. The forward price/earnings ratio for the S&P 500 has slipped from above 20x earnings at the start of the year to about 17x now.

The market P/E is an expression of the investment community’s confidence about the future. Uncertainty saps confidence. Lately, there has been an increase in policy uncertainty emanating from Pennsylvania Avenue.

“The Trump slump is the result of his tweets and his seemingly unwillingness to listen to his advisers on global trade," says Sam Stovall of CFRA Research.

With midterm elections around the corner, the President should consider adjusting his rhetoric. That’s because around the time the stock market topped out in January, so did Republican sentiment. According to RBC Capital Markets, there’s an 89% correlation between the stock market and GOP consumer sentiment.

Republicans are setup to capture more votes in November if the Dow Jones Industrial Average is closer to 30,000 than 20,000. Here are 3 tactics from The Art of Deal the President could modify to help nudge the market multiple higher.

Think Big. President Trump is all about doing things ‘bigly.’ Big tax cuts. Big wall, etc. This is consistent with the first of eleven tactics championed in The Art of the Deal. That is: Think Big.

While “Bigger is Better” may be a wonderful motto in the private sector, in the world of government, less is more.

That’s because government does not create wealth or prosperity. Rather, the public sector confiscates resources from producers in the real economy, then reallocates those resources in suboptimal ways.

President Trump’s proposed tariffs exemplify a measure that would expand the role of government in all the wrong ways.

If you want to make a deal with the Dow, Mr. President, think small.

Know Your Market.

"One thing I've learned about the press is that they're always hungry for a good story, and the more sensational the better...The point is that if you are a little different, a little outrageous, or if you do things that are bold or controversial, the press is going to write about you." – Donald Trump, The Art of the Deal

The above passage provides insight into the President’s Twitter obsession. It’s a convenient vehicle to stir the pot.

President Trump also likes to go off script. Before giving a recent speech, he looked at his notes and cast them aside. “Prepared remarks are boring,” he said.

In politics though, boring is ok. Really, it is. If that weren’t the case, how would Mitch McConnell get reelected so many times?

The President’s “market” has changed now that he’s a public official.

Stability has its virtues in the halls of government. Clear rules of the game promote a healthy environment for capital investment. That’s how jobs are created and productivity gains accrue, which improve everyone’s standard of living.

If you want to make a deal with the Dow, Mr. President, play to your market.

Deliver the Goods. President Trump loves to create suspense and keep people guessing. For example, he writes in The Art of the Deal, “I got a call from a reporter asking whether or not it was true that Prince Charles had purchased an apartment in Trump Tower… I refused to confirm or deny the rumor… That was all the media needed.”

Creating buzz certainly has its merits on the campaign trail. But once in office, it’s time to ditch the hyperbole and deliver the goods in terms of the policy agenda.

The President delivered a tax cut and has rolled back regulations. The market applauded these moves.

More recently, however, the President has been inconsistent in his messaging.

- He’s touted tariffs which seem out of alignment with his other economic principles.

- It’s unclear if he favors a weak or strong dollar—he talks out of both sides of his mouth on the issue.

- He randomly betrays his “pro-business” reputation by singling out those he might like to regulate—i.e. recent tweets criticizing Amazon’s tax practices.

- The Trump Administration has also been aggressive in its antitrust pursuits, interfering on shaky grounds with the proposed Time Warner/AT&T and Broadcom/Qualcomm deals.

Point is: he’s all over the place with his economic agenda.

One of the reasons Ronald Reagan was known as ‘The Great Communicator’ is because people knew what he stood for. There weren’t smoke screens on policy issues. Like him or not, Reagan was able to articulate a clear, consistent vision.

Newly appointed head of the National Economic Council, Larry Kudlow, recently wrote a book on Reagan. Kudlow has clear principles. He favors a strong and stable currency, low taxes, and is a strong advocate for free market capitalism.

If you want to make a deal with the Dow, Mr. President, listen to your economic advisors and deliver the goods.

Originally published by RealClearMarkets. Reprinted with permission.

Disclosure: This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX