How I Made A 30% Return Investing In NASCAR

Submitted by Silverlight Asset Management, LLC on August 16th, 2018

NASCAR has faced serious challenges over the last year.

- Dale Earnhardt Jr. and Danica Patrick retired.

- Bad weather depressed attendance figures.

- The CEO was recently arrested for DUI and drug possession.

And yet despite all of the above, shares of the parent company which hosts the races—International Speedway (ISCA), managed to appreciate roughly 30%. Below is a graph of the stock's comparative returns versus the S&P 500 during my recent holding period.

International Speedway cumulative total return vs. S&P 500 (7/19/2017 - 8/9/2018)

Why did ISCA outperform amid all these headwinds?

I’ll review three important lessons, which may help you with your next stock investment.

1. Valuation mean reversion produces opportunities

"In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

- Benjamin Graham

Market prices tend to be more volatile than underlying business fundamentals. This creates opportunities for investors who are able to correctly gauge the valuation multiple at which a security should trade. It’s an inexact science, of course.

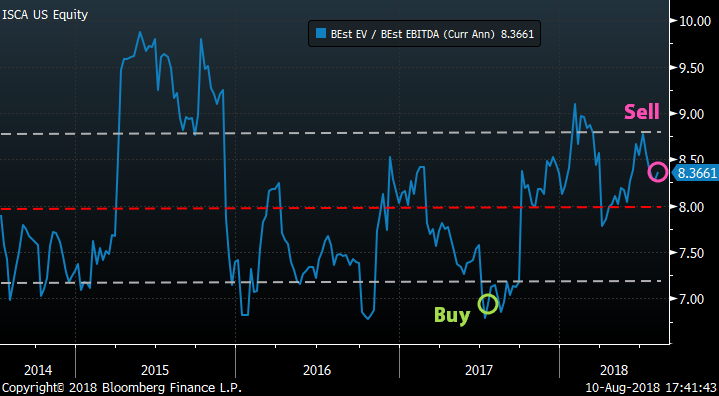

One method I use is to compare a stock’s current valuation to the trailing range. Last summer, ISCA was trading one sigma cheaper than the 5-year average. The valuation points where I bought and sold the stock are indicated in the following graph.

Source: Bloomberg LP. International Speedway Trailing 5-year EV/Est. EBITDA multiple

I didn’t time it perfectly. But the valuation re-rating, as an independent variable, still produced over a 20% return!

You can make a lot of money playing valuation adjustments in the stock market. In this vein, you’re using volatility to your benefit, rather than allowing volatility to use and abuse you.

If you like researching stocks and want to try this out, my advice is to check out Morningstar. They nicely organize key data on individual stocks, and make it easy to review historical ranges.

Tip: if you notice a company’s fundamentals (i.e. profit margins) and valuations tend to fluctuate wildly over the lookback period, it’s probably not a good candidate to assess this way. The method was appropriate for ISCA, because shares have historically had a reliable valuation floor around 7x forward EBITDA.

2. Markets always discount the future

Understanding that all widely known information is already reflected in current prices helps explain many of the counterintuitive things that transpire in markets.

For example, Dale Earnhardt Jr. was NASCAR’s biggest star. His retirement hurt the brand.

However, it probably hurt the stock well before his last race. He announced his retirement in April of 2017. That’s likely part of the reason why shares traded at a bargain valuation last summer.

I try to remain ever mindful that it’s surprises that move stocks, not the current events I’m reading about in the Wall Street Journal or some other publication.

Last summer, ISCA appeared well positioned for sentiment to improve, because it was already depressed, and the underlying business is not terribly volatile or risky.

3. It pays to have a specific investment thesis

I like to mix quantitative and qualitative analysis. Not everyone does this. But to me, it makes sense.

In his book, One Up on Wall Street, mutual fund legend Peter Lynch said buying stocks without research is like playing poker without looking at the cards. You wouldn’t do that, would you?

It may seem preposterous that people buy stocks without researching them, but it happens every day.

Research should ultimately lead to a specific investment thesis. This is your why for owning an asset. The thesis can be simple—a few sentences describing your key reason for entering the position.

I advise writing this down and storing it somewhere for future reference. Doing so establishes a foundation for future sell discipline. That’s important, because selling often proves trickier than buying!

An investment thesis allows you to objectively look back and evaluate how events unfolded relative to your original expectations.

A few months after taking a position in ISCA, I outlined my investment thesis in the stock spotlight video below (watch time: 6 minutes).

The video identifies “stability” as one of ISCA’s best attributes. The company’s racetracks function like regional monopolies. There’s risk the brand power of NASCAR suffers, but direct competition isn’t really a threat like it is for most businesses. The firm also has a lot of recurring revenue and maintains a strong balance sheet.

I’ve found steady firms like ISCA can make very good swing trades over a 12 to 18-month period.

For me, “Steady Firms” are a specific category, meant to be traded a specific way.

My playbook also includes other categories. For instance, there are stocks I call “Compounding Machines” (hat tip to Chuck Akre for coining that term). These are high growth firms I feel confident buying and holding for longer. With them, getting the starting valuation right isn’t as important as correctly diagnosing business quality.

Peter Lynch also had mental categories for stocks, so he'd know what to expect from them. Examples: Slow Growers (which he called "Sluggards"), Medium Growers (Stalwarts), Fast Growers, Cyclicals, Turnarounds, and Asset Plays.

You don’t have to adopt my categories or his. But if you’re serious about becoming a better stock picker, I’d encourage you to think about developing some categorical lenses you can repeatedly use. I promise it will make you a better investor.

Per my original investment thesis, ISCA isn't a stock where a long-term holder should expect to regularly annualize 30% returns. It's a slow growth business whose intrinsic value expands at only a moderate pace. The only time I buy such a stock is when it appears unusually cheap. Since that was no longer my view on ISCA as of last week, I decided to exit.

Originally published by Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX