History Says That Apple's Outperformance Run Is Finite

Submitted by Silverlight Asset Management, LLC on June 15th, 2018

If you’re are an active investor with a goal to outperform, history says the biggest company in the world is not a good bet.

Why?

Because the #1 stock in the world has always—I repeat always—gone on to underperform.

Maybe not right away. But eventually it happens.

It must be that way, or the biggest firm would eventually swallow the whole market.

In an insightful Barron’s interview, head of Research Affiliates, Rob Arnott, offered the following comment:

“History tells us that of the top 10 stocks in the world, eight will disappear over the next decade—if history is any guide Apple might be in the Top 10, but won’t be No. 1. That means it would underperform the market. The rest will fall off the list. So if your investment horizon is 10 years, those top stocks have about a 90% chance each of underperforming. Why would you want that?”

I did a little research to sanity check Mr. Arnott’s statement. And he’s right. There is a high turnover rate in the top ten.

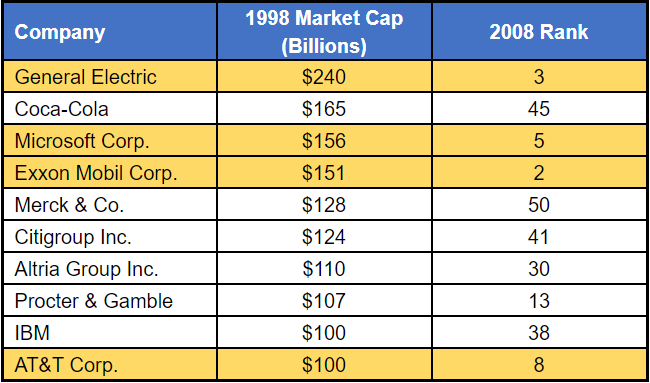

Here are the top ten largest stocks on U.S. exchanges as of 1/1/1998, along with their respective rankings ten years later. Those who remained in the top ten are highlighted.

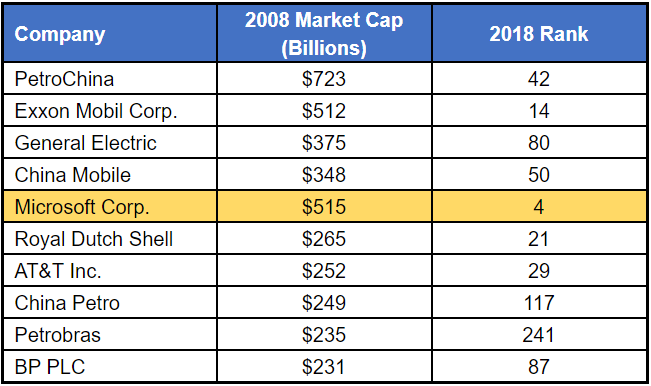

Here are the ten biggest firms trading on U.S. exchanges as of 1/1/2008, and their respective rankings ten years later. Microsoft is the sole survivor.

Now, here is the top ten at the beginning of this year. Where will these companies rank in ten years? If history is any guide, some will remain on the list, but most will fall off.

Surveying these lists also reveals what a dramatic swing we’ve seen in sector and country leadership. For example, as the last cycle was nearing its end, energy firms were prevalent on the top ten list. Microsoft was the only technology sector name.

Currently, seven out of the top ten names are companies people normally associate as technology firms. Not a single energy stock appears on the list!

Lesson: cycle leadership undergoes dramatic swings. It’s often the case that the last bull market’s heroes are replaced by a new group in the subsequent cycle.

Relating that back to the present moment, it seems likely that among current big-cap tech leaders, a couple will likely prosper in the coming years to the detriment of competitors.

Will Google erode the economic moats of Apple or Microsoft between here and 2028? Or vice versa?

Will Chinese tech giants—Tencent and Alibaba—overtake Facebook and Amazon in the derby for global market share?

Time will tell. All we can bank on is the list will change.

One reason why changes are natural relates to ‘The Law of Large Numbers’. Put simply, it is the idea that big entities that are growing fast cannot maintain high growth rates in perpetuity.

***

Today, Apple is the biggest company.

Back in 2008, the company sold 76.2 million units across its suite of products, including iPhones, iPods, Macs, etc.

By fiscal year 2015, that number grew to 306.7 million units. That’s a 22% annual growth rate.

However, 2015 also marked a peak in units sold. The company sold 280 million units last fiscal year. That’s a negative growth rate.

Growth is harder to come by now as the law of large numbers catches up with the company. They must ship a ton of product just to stay even with the prior year numbers.

To double from here, Apple would have to sell a gargantuan number of iPhones and iPads. That’s a tough climb, which is why the company is focused on ramping its services revenue stream.

The services side of the business enjoys a high growth rate. The only problem is—in the near-term at least—services revenue constitutes only approximately 10% of Apple’s overall revenue.

If you are bullish Apple, that’s fine provided you’re clear on why you own it.

Apple is a very profitable cash flow machine. The company generates a return on equity north of 40% and trades at 18 times free cash flow. Pristine fundamentals at a reasonable valuation.

If you are an absolute return focused investor—there is a lot to like. I perceive the stock as relatively low-risk because many customers have an inelastic relationship with the company. Meaning: come rain or shine in the economy, when someone’s iPhone breaks down, they’ll get another one. There’s a chance they’ll be lured away to a competitor, but Apple’s ecosystem makes for sticky customers.

I’m guessing this a big reason why Warren Buffett likes the stock so much. Apple’s brand equity is a powerful competitive advantage, which means the company’s intrinsic value will almost surely rise over the next ten years. Plus, the company is steadily shrinking its equity float, which helps keep the stock price afloat.

Even though Apple has strong absolute return prospects, it doesn’t mean the stock will necessarily outperform, however. If you’re a relative return focused investor—meaning you want to own stocks with above-average performance potential, you ought to carefully consider how much Apple you own. Or whether you should own it at all.

That’s because competition and the law of large numbers will both be working to ensure the company’s growth rate and profit margins mean revert closer to the market average in the coming years. Negative trends in those numbers make for an upstream swim in terms of alpha generation.

Passive index investors own more of a company the greater the market cap weight is in relation to the rest of the market. Someone who owns an S&P 500 Index fund, like SPY, has about a 4% weight in Apple.

I own Apple shares in strategies I manage, but I own less than half the index weight. For me, it’s a safety position that cushions other ideas I own for excess return potential.

There will probably be years between here and 2028 where Apple shares outperform. However, such years are likely to be the minority. Apple’s campus resides on a street called Infinite Loop, but the stock’s outperformance run is finite.

Originally published by RealClearMarkets. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX