Forget About Dogs Of The Dow In 2019, Upgrade To Dobermans

Submitted by Silverlight Asset Management, LLC on January 4th, 2019

"The Dogs of the Dow" is a popular screening technique many employ at the start of each year. To follow the strategy, investors buy the top ten dividend-yielding stocks in the Dow Jones Industrial Average (DJIA).

It's an okay method to hunt for bargains, but I think there's a better way.

A year ago, I introduced to Forbes readers my Dobermans of the Dow screen. It's simple to employ, and the historical returns far exceed the traditional Dogs of the Dow.

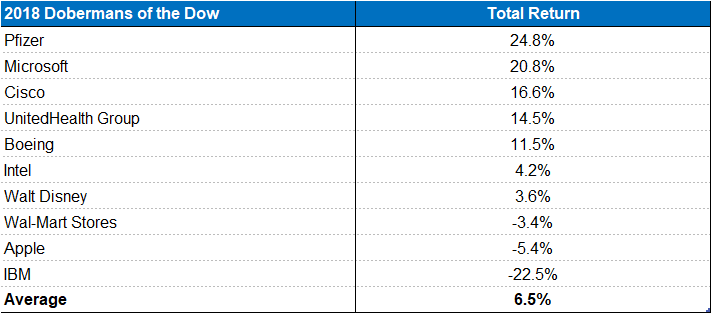

Using the Doberman criteria, I shared ten investment ideas. The 2018 Dobermans returned 6.5%, beating the Dow (-3.5%) by 10%.

The Dobermans also outpaced the Dogs of the Dow, which were essentially flat in 2018.

Here's an excerpt from my previous article, highlighting how the two strategies differ in their criteria:

The Dogs of the Dow strategy only asks one question: how cheap? And it makes a narrow comparison in delineating that by only considering dividend yields.

The Dobermans of the Dow is a better companion tool for investors, because it’s more dynamic. It starts by sorting Dow constituents by a quality metric (ROE). Then, among those higher quality names, it compares prices in a more universally applicable way (FCF yield).

Both strategies benefited in 2018 by including several of the Dow's top-performers, such as Pfizer and Cisco.

A key difference which drove their respective performances involved a name the Doberman list passed over—General Electric (GE). GE declined a staggering 55% in 2018, shedding approximately $90 billion of value.

That was enough for the 126-year old company to get bumped from its longstanding spot in the Dow Index. GE was replaced in mid-2018 by Walgreens Boots Alliance. Prior to that, GE was the last remaining original member of the Dow Index from 1896.

GE has faced a litany of problems, including write downs associated with GE Capital, ill-timed investments in the energy sector, and wasteful spending.

As GE's stock price wilted, the dividend yield climbed—exceeding 4% by the end of 2017. That was enough to qualify for the 2018 Dogs of the Dow.

GE did not make the Doberman list, however, because GE's profit woes resulted in a negative return on equity (ROE).

Dividends are important. But they can be deceiving, if viewed myopically.

Firms avoid cutting their dividend as long as possible. But unprofitable firms can only pay dividends for so long. After all, dividends are a residual of profits.

GE's dividend yield lured in many investors, who subsequently lost money in the stock. Like the mirage of an oasis in a desert—it was a false signal. An optical illusion.

This became apparent when management sliced GE's quarterly dividend in half in November 2017, from 24 cents to 12 cents. The dividend was cut again in October 2018, all the way down to 1 cent a share.

Takeaway: if a dividend yield seems too good to be true, it probably is.

The 2019 Dobermans of the Dow

To sort this year's Doberman list, I use the following criteria.

Step 1: Rank Dow constituents by ROE, keeping the top 20.

Step 2: Rank remaining names by FCF yield, keeping the top 10.

Those top 10 are your Dobermans.

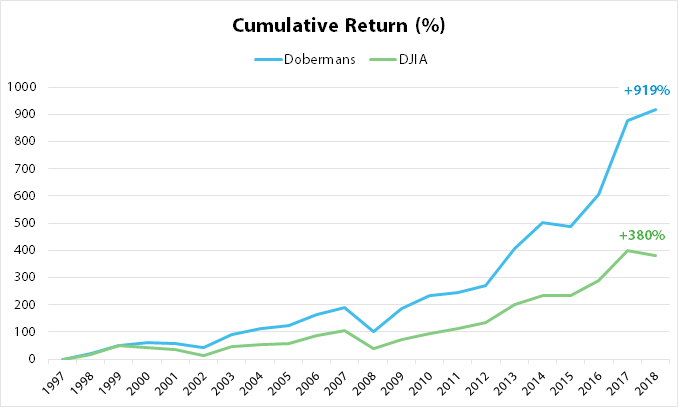

This approach beat the Dow in 17 of the last 21 years, averaging 3.9% excess return per year. The Dobermans' cumulative return of +919% trounces the Dow index (+380%).

Dobermans of the Dow (12/31/1997 -12/31/2018). Annual rebalancing. Data source: Bloomberg.

The Dobermans also outperformed the Dogs of the Dow by almost 4% annually, and did so with less volatility (16.3 standard deviation vs. 17.3).

Here are the 2019 Dobermans. One newcomer—perhaps fitting given the earlier discussion surrounding GE—is Walgreens Boots.

2019 Dobermans of the Dow. Data source: Bloomberg.

Originally published by Forbes. Reprinted with permission.

Disclosure: I own AAPL, AXP, DIS, IBM, INTC, JPM, PFE, UTX, VZ and WBA in client accounts I professionally manage. This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation. Past performance is not always indicative of future returns.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX