In the Eye of a Storm

Submitted by Silverlight Asset Management, LLC on September 8th, 2017

"Are you going to evacuate?"

“No,” she replied.

“We were going to, but we can’t find gas. Plus, when I looked for a hotel room in Orlando a few days ago, they were totally booked. No one knows for sure where this storm is going. We even thought about going to Uncle Bob’s, but the Carolinas might get hit too. My fear is that we run out of gas on the way there and ride it out in the car on the highway.”

That’s a recap of a conversation I had last night with my mother who lives in South Florida.

Below is an image of what she will face in the coming days—Hurricane Irma.

***

The sequence of an evacuation involves several phases.

- Detection

- Decision

- Alarm

- Reaction

- Movement to an area of refuge

Risk management of hurricanes is tough for officials and residents alike after the third phase.

Thanks to modern weather technology, we can model the formation and projected path of hurricanes—we can prepare.

But we cannot precisely predict the outcome of storms beforehand, which makes how to react difficult.

Hurricanes are notorious for changing direction as they approach landfall. This presents a great deal of uncertainty for civic leaders tasked with the responsibility of issuing evacuation orders.

Residents must decide how to react, too. In the U.S., no one can be forced to evacuate. If a ‘mandatory order’ is given, it just means: Don’t expect emergency relief if you get stuck in a tough situation—we warned you.

The longer someone lives in a coastal area, the less likely they are to evacuate. These folks get used to forecasters “crying wolf” about impending storms and take evacuation orders less seriously.

Families across Florida and the Southeastern U.S. are weighing the costs and benefits of their different options.

From my parents’ perspective, the benefits of hunkering down outweigh the risks of travel, so they are staying put. That’s their personal decision.

Some of my clients also live in their area and have chosen to leave.

As investors, we too make personal decisions on how to navigate risks. We are wise to prepare for a range of scenarios, because we never know for sure when we will be in the eye of a storm. We can do this by using a financial tool called stress testing.

Auto manufacturers perform crash test simulations on new models to help ensure your safety. As a driver, you hope you never crash into a wall. But if you do, you want the airbag to work properly.

Similarly, it makes sense to crash test a portfolio.

Stress Test Example

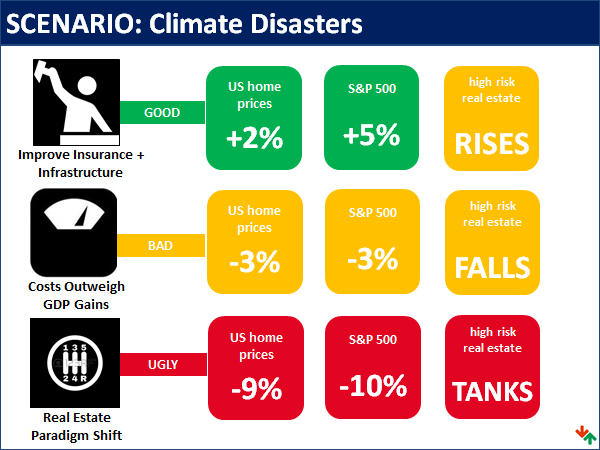

Every stress test begins with a hypothetical question, like the following: Will increasingly intense storms cause enough damage to derail the U.S. economy?

Source: HiddenLevers

In 2017, hurricane-related damages are already set to exceed 1% of GDP. That’s a first! And it does not even include damage from Irma—the biggest storm ever recorded in the Atlantic.

Total costs could rise to 2% of GDP after Irma and Jose—currently a Category 4—are added on. With the economy growing at a normalized rate of 2%, it begs the question whether a tip into recession looms on the horizon.

The calculus isn’t quite as simple as 2 - 2. There are other nuances to consider related to how major storms impact economic activity.

On one hand, as buildings, ports, and other facilities become incapacitated, real assets are destroyed.

Harvey's impact is already showing up in high frequency economic data. Headline Initial Jobless Claims just rose +62K to the highest level in over two years. +52K of the increase is attributed to Texas. Distortions like this will pervade macro data for the foreseeable future, complicating the picture for data dependent policy makers and investors.

On the other hand, there will also be a rebuilding effort, which is additive to GDP at some point down the road.

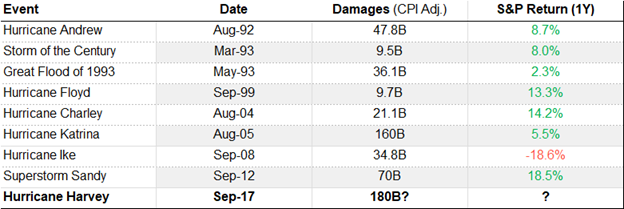

Offsetting forces such as these explain why there is little to no correlation between past storms and subsequent stock returns.

Sources: HiddenLevers, CNBC, Fortune

The only “down year” for the S&P was 2008. Hurricane Ike, while costly, was clearly not the catalyst for the Great Recession.

Will 2017 be an outlier given the scale of potential damages?

Stress testing is about modeling 'what-if' simulations. First, you decide which economic levers are pertinent to the scenario. Next, you forecast a best case (the good), base case (the bad), and worst case (the ugly) for those levers using historical analogs. Then you regress how levers interact to drive a portfolio's performance.

In the three "Climate Disaster Scenarios" highlighted above, the key economic lever is real estate. If storms like Harvey and Irma become the norm (perhaps due to rising sea level temperatures that provide fuel for the storms), then this could cause a reassessment of at-risk real estate values.

Consider the picture below. That is a Houston neighborhood where homes were worth approximately $2 million before Harvey. After the flood damages are repaired, if one of these homeowners decides to relocate, will a new buyer pay $2 million? Or will the flood be an albatross that suppresses the price a new buyer is willing to pay?

The Gulf and southern Atlantic real estate markets might see a substantial setback, and these regions are large enough to impact the national economy.

While an equity market impact would likely be mild even under the 'Ugly' scenario (-10%), the impact to certain real estate markets might be more serious.

We are all hoping the 'Ugly' scenario doesn't come to pass. In the meantime, my thoughts and prayers will be with my family, clients, and everyone else in Irma's path.

Ultimately, assets—like homes—are replaceable, but people aren’t.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX