The Dobermans Of The Dow Have Outperformed In Bull And Bear Markets

Submitted by Silverlight Asset Management, LLC on January 3rd, 2023

Five years ago, I introduced Forbes readers to a stock strategy called the Dobermans of the Dow. This is my annual strategy update.

The Dobermans of the Dow is a screen I invented as an alternative to the widely followed Dogs of the Dow strategy. Whereas the Dogs of the Dow only ranks stocks by their dividend yield, the Dobermans screen favors high quality companies trading at attractive valuations. The selection criteria consists of two steps:

1) Rank the 30 Dow stocks by Return on Equity (ROE), keep the top 20.

2) Rank the remaining 20 names by Free Cash Flow Yield, keep the top ten.

Those final ten stocks are your Dobermans.

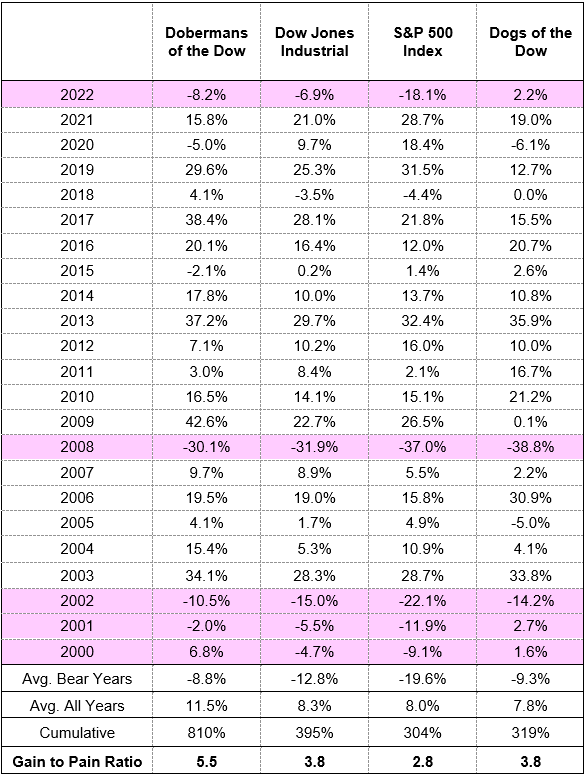

Historically, a hypothetical Dobermans of the Dow portfolio has outperformed the Dow Jones Industrial Average (DJIA) and the S&P 500 Index. Since 2000, the Dobermans portfolio rebalanced annually has generated a cumulative return of 810 percent, which is more than double the long-term performance of the Dow, S&P 500, and the Dogs of the Dow.

Backtest performance from 12/31/1999 - 12/31/2022. Source: Bloomberg.

How Did The Dobermans Perform In 2022?

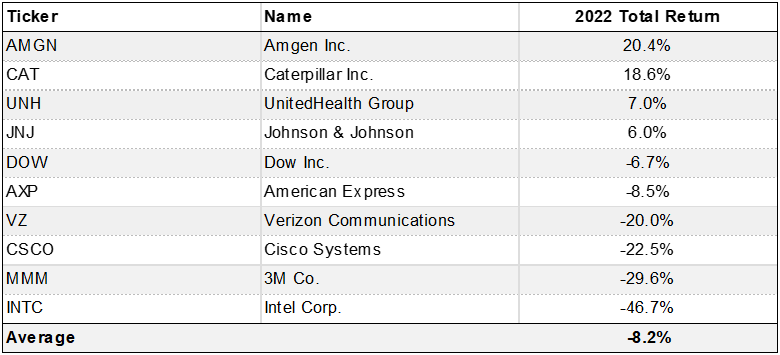

Last year, the Dobermans of the Dow averaged a total return of -8.2%. I consider that an OK relative return in a tough year. By comparison, the Dow Jones Industrial Average (DJIA) fell 6.9% in 2022, while the S&P 500 index lost -18.1% and the Nasdaq Composite declined -32.5%.

The table below shows how the individual names from last year’s list performed.

Source: Bloomberg

The last year has reminded investors why it’s important to have an investing approach you can rely on over a full market cycle.

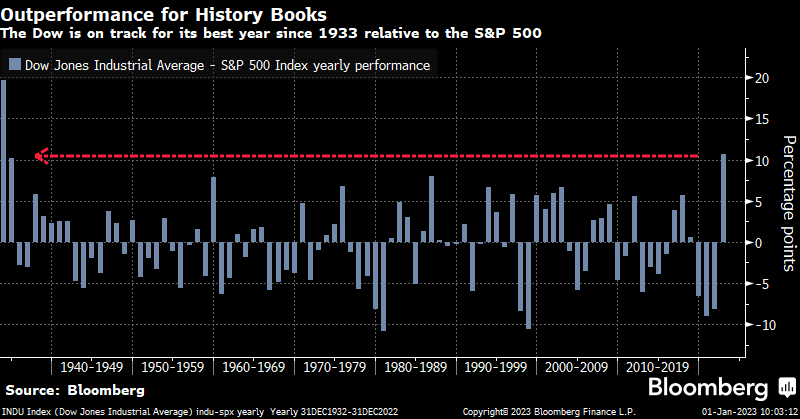

Many of the speculative stocks that were supercharged by a Fed-driven liquidity surge in the pandemic got pulverized in 2022. Meanwhile, tried and true cash flow generators—like many of the stocks populating the Dow Jones Industrial Average—outperformed.

Interestingly, as financial conditions tightened in 2022, the Dow outperformed the S&P 500 by the widest margin since 1933.

The Dobermans Have Outperformed In Bear Markets

One of the things I like about the Dobermans of the Dow strategy is that it has done well in bull and bear markets. That’s important to me as an investor because bear markets are tough enough as is. Outperforming during volatile markets helps smooth out the investing journey.

Since 2000, equity investors have traversed five particularly challenging years that occurred during bear markets. Those years include: 2000, 2001, 2002, 2008, and 2022. As shown in the table below, the Dobermans of the Dow strategy averaged an annualized return during those years of -8.8%, which was better than the Dow (-12.8%), S&P 500 (-19.6%), and Dogs of the Dow (-9.3%).

Source: Bloomberg

There are a variety of risk-adjusted return measures for comparing investments. One metric I prefer is called the ‘Gain-to-Pain Ratio’, which measures the amount of gain an investment produces relative to the amount of downside pain required to achieve that return.

In the case of the Dobermans, we can look at the Gain-to-Pain ratio by calculating the sum of all the yearly gains divided by the sum of all the losses from negative years. Since 2000, the Dobermans have beat the Dow, S&P 500, and Dogs of the Dow with a Gain-to-Pain ratio of 5.5.

Why have the Dobermans outperformed on a risk-adjusted basis? In my view, it’s because of the factors in the screen.

The first factor is Return on Equity. The Dobermans screen favors companies with high profit margins, which is a fundamental trait investors covet in economic downturns.

The second factor is Free Cash Flow Yield. The Dobermans screen favors companies that produce high amounts of cash flow relative to their market value. This bias toward value can help during bear markets, because the majority of losses are usually attributed to valuation corrections.

So, if you’re worried the 2022 bear market will continue in 2023, the Dobermans of the Dow offers a potentially prudent way to stay invested through the storm. And since the screen has also done well in bull markets, you can consider it an “All Weather” type of portfolio strategy.

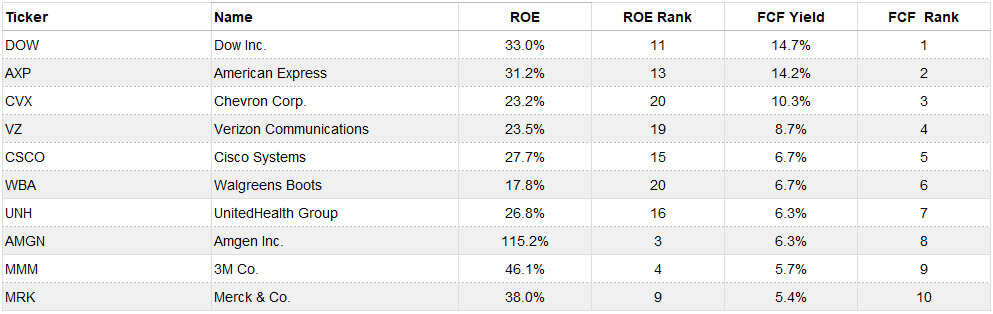

Meet The 2023 Dobermans of the Dow

Finally, let’s meet the the official lineup for 2023.

New members to this year’s list include: Chevron, Walgreens Boots, and Merck.

Source: Bloomberg

* Originally published by Forbes. Reprinted with permission.

Disclosure: I own shares of DOW, AXP, CVX, VZ, CSCO, WBA, UNH, AMGN, MMM, and MRK in client accounts that I professionally manage.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX