The Coronavirus Won’t Kill The Bull Market, But It Will Impact 2020

Submitted by Silverlight Asset Management, LLC on February 16th, 2020

Investing well isn’t about certainty or possibility. Rather, it’s an exercise in probability.

This is especially important to remember in the current climate.

Only 45 days into the new year, investors are already dealing with several curveballs. Who could have envisioned a manic short squeeze in Tesla? Or a bear market in oil right out the gate?

Topping the list of “Things That Are Hard to Wrap Your Head Around in 2020,” though, is the Coronavirus, which has already taken the lives of more than 1,000 people and prompted the world’s largest-known quarantine effort.

Total cases in China jumped by nearly 15,000 after the Hubei province — epicenter of the outbreak — revised its method for counting infections. The estimated number of cases was at 63,851 as of Friday morning.

Clearly there will be an economic impact. But how big?

“I didn’t put on a mask because I want to be beautiful for my husband,” said a 23-year-old bride.

Last week, roughly 30,000 people gathered in South Korea to attend a mass wedding ceremony. Some of the 6,000 couples tying the knot that day wore masks. Others were willing to risk it.

During the event, Unification Church staff dispersed hand sanitzer and surgical masks, while taking peoples’ temperatures.

This scene typifies where we are with the coronavirus. People are still going about their lives, but treading a lot more cautiously. Even on their wedding day.

So, it wouldn’t be surprising if citizens and CEOs alike postpone certain purchases.

"The mind has a strong natural tendency to overreact to negative things as compared to positive things.”

- Roy Baumeister, author of The Power of Bad

A simple behavioral lens tells you most of what you need to know about the likely economic impact from all this.

Whatever your economic growth estimate was coming into 2020—mark it down.

Also, markdown your inflation outlook. A lot of people acting a little more cautiously is enough to send a deflationary impulse into the real economy.

Economic Outlook

A pragmatic way to risk manage through this period of uncertainty is to isolate what the economic setup was before the Coronavirus surfaced as a risk overhang.

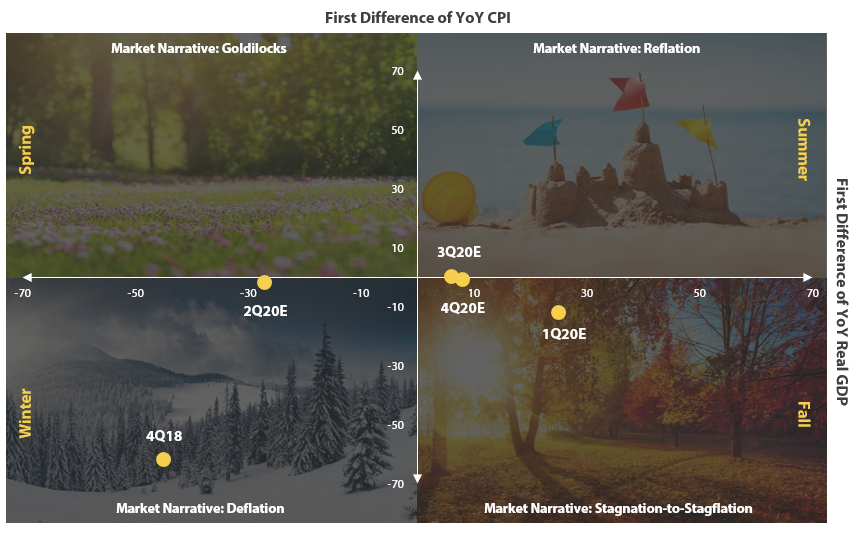

The two most important factors to forecast future market returns are the rate of change in growth and inflation. Coming into this year, I was forecasting lower inflation and flat growth for Q2.

However, the data I was using to make that projection runs on a lag, and the predictive tracking algorithm has yet to incorporate any impact from the Coronavirus. We know it’s coming, though. And it’s certain to put a dent in the data.

This is sufficient evidence for me to conclude we’re likely heading for Macro Winter in Q2, as the yellow dot for 2Q20E in the graph below appears destined to head south.

Macro Season Monitor

Data source: Hedgeye Risk Management

In my macro framework, there are four distinct economic regimes.

- Macro Spring: growth accelerating, inflation slowing

- Macro Summer: growth accelerating, inflation accelerating

- Macro Fall: growth slowing, inflation accelerating

- Macro Winter: growth slowing, inflation slowing

Note: macro winter (i.e. what’s coming in Q2) is historically the least hospitable environment for risk assets. It’s normally a good time to own high quality bonds and bond proxies.

The last time growth and inflation both contracted in a meaningful way was in Q4 of 2018, which readers may recall saw a sharp market correction.

It appears the market is already starting to discount this unfolding economic reality, as investors are rotating more defensively.

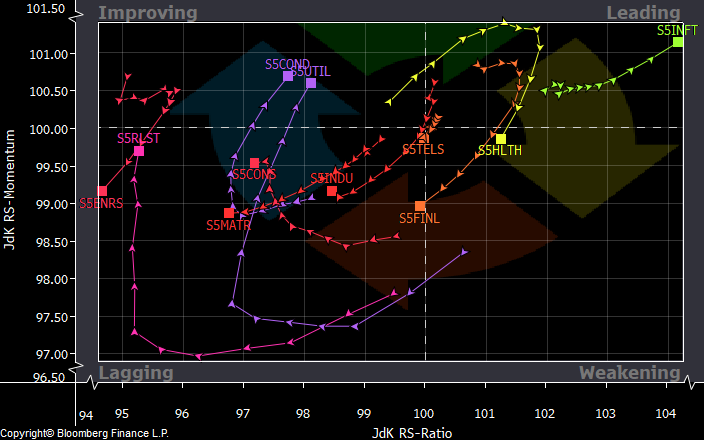

One of my favorite tools for monitoring sectors is the Relative Rotation Graph, shown below. The vertical y-axis measures momentum, while the horizontal x-axis measures relative strength. Momentum shifts normally occur before price action changes, so the weekly tails often follow a clockwork-like pattern.

S&P 500 GICS Sector Relative Rotation Graph

Source: Bloomberg

The best place to be on the chart is up and to the right (in terms of absolute positioning and trend). On this criteria, Information Technology looks great for now, but also a bit extended.

A new wave of potential outperformers is ascending on the left side of the graph. Utilities, Consumer Discretionary, and REITs are all moving into the ‘Improving Quadrant.’

Sectors with negative momentum? That list includes Energy, Materials, and Industrials. These are all cyclical sectors that need reflation and a weaker dollar to prosper.

That environment may be coming later this year. But for now, it’s on hold, as we’re likely to navigate a few months of slushy data due to the Coronavirus.

The End Game

The S&P 500 is trading about 11% above the 200-day moving average, and there may be a correction soon. That said, a bear market still seems unlikely in 2020.

Bull markets don’t die of old age, or because of high valuations.

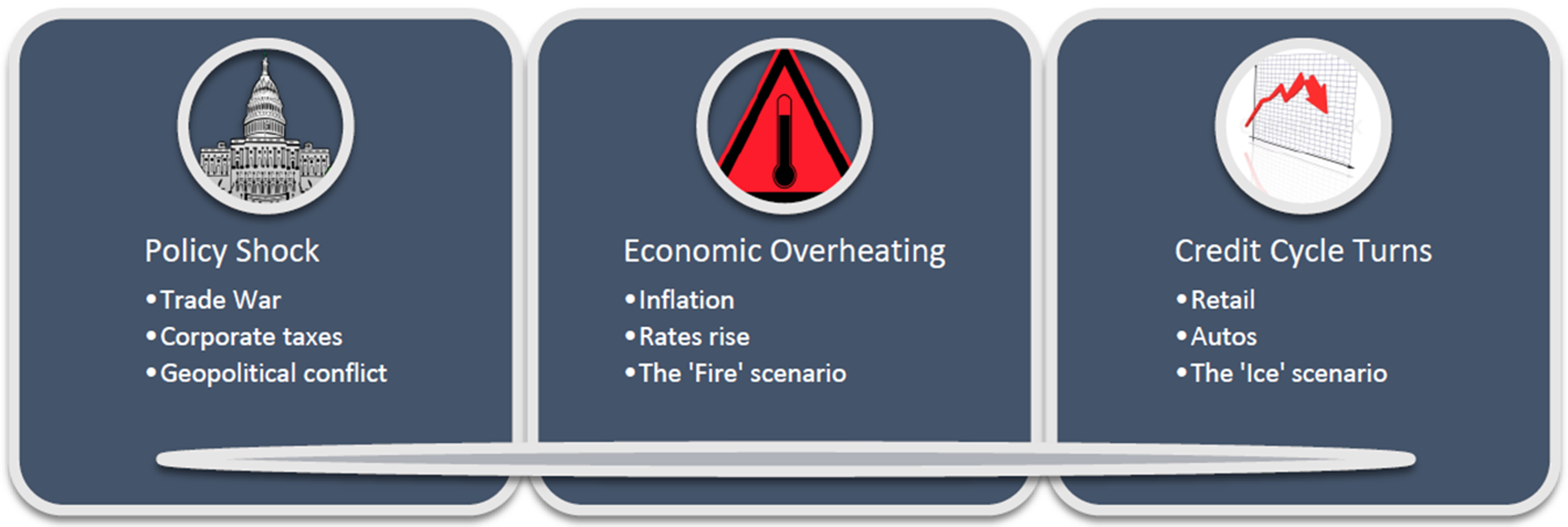

Rather, there are three catalysts that normally precede a bear market. Sometimes a big policy mistake tips over a cycle. Most cycles, though, end in either a fire or ice scenario. Meaning: inflation or deflation.

From a probability perspective, inflation still seems the most likely end game.

Policymakers came into 2020 firmly committed to letting inflation ‘run hot.’ And now, with the coronavirus adding more uncertainty, we can expect monetary policy to remain extra easy.

Furthermore, fiscal stimulus is probably coming in Europe and the U.S. after the election.

In the second half of the year, growth and inflation could both strongly rebound, stoking a reflationary rally into year-end.

Before we get there, though, there is going to be a lot of economic noise. Expect a whippy market and defensive assets to outperform over the next few months.

After the coronavirus is eventually contained, the setup could dramatically change. The gate for the market to stampede higher may open, with very different leadership than is presently the case.

Originally published by Forbes. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.