Canary in The Mall

Submitted by Silverlight Asset Management, LLC on March 24th, 2017

Early in 2017, the number of retail bankruptcies is spiking to record levels. It's a watershed moment. “What is happening right now is an absolute separation between winners and losers,” says consumer products expert, Steven Barr.

While the retailing rich get richer, beleaguered players are dropping like flies. If there were such thing as an ‘Economic Endangered Species List,’ many iconic retailers, struggling to stay afloat, would be on it.

- Macy’s plans to close 100 stores

- J.C. Penney said last month it would close 130 to 140 stores

- Sears plans to shut 108 Kmart stores, and 42 Sears stores

- Abercrombie & Fitch closed 54 stores last year, and will close 60 more this year

- Crocs announced March 1st it will close 160 stores by the end of 2018

- The Limited announced in January it will close all 250 stores

Among those recently filing for bankruptcy are: RadioShack, Sports Authority, and the women’s apparel chain BCBG.

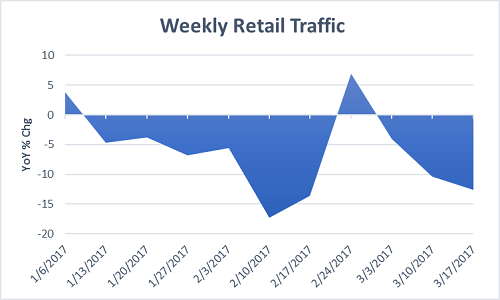

The main issue is that fewer people are physically shopping. In the week ending March 18, North American retail traffic fell 12.6%, consistent with the pattern most of the year.

Source: Bloomberg

Online shopping is responsible for less than 10% of overall U.S. retail sales, but the percentage is steadily rising. If retail emulates the path of the travel industry, expect digital sales to climb to 45% of the total. 15 years ago, the travel space looked more like retail does today. Then digital options like Priceline, Expedia and TripAdvisor emerged, offering superior price transparency and comparability. Conventional travel agents were largely replaced.

Source: Bloomberg

Since 2008, hardline retailers have invested more than $34 billion in tech and infrastructure to support digital commerce, logistics and ship-to/ship-from store capabilities. It’s necessary to stay competitive. Technology disruptions will only accelerate in the next five years, as artificial intelligence and virtual reality become integrated with mainstream shopping.

Some firms are successfully evolving to ‘omnichannel distribution,’ which balances instore and online channels. Like Wal-Mart, for instance. Instead of paying heftier dividends or buying back more stock in recent years, the retail giant has been investing in its long-term future. Last year it acquired shopping website Jet.com, making Wal-Mart the second-largest online retailer by traffic after Amazon.

However, elevated capital expenditure facing retailers is pressuring return on invested capital and free cash flow. Broadly, sales and margins have declined since the post-recession bounce. Retailers who are behind in the shift to digital now face a huge challenge to catch up. As their market values have fallen, many have been acquired by private equity firms, or merged with other retailers. A lot of those acquisitions were funded by debt.

Herein lies the reason bankruptcies are surging. Distressed retailers cannot generate enough cash flow to simultaneously pay down their debt and make necessary strategic investments in technology, distribution and in-store experience.

Per a recent report by Moody’s, the number of retailers with high credit risk or near default (Ca rating) has tripled over the last six years. Moody’s Vice President Charlie O’Shea said, “Today, 13.5 percent of our portfolio is comprised of distressed names—the largest showing since the Great Recession.”

Retailers listed in the report include Sears, Nine West, Claire’s Stores, and Payless—which just this week announced an intention to file Chapter 11.

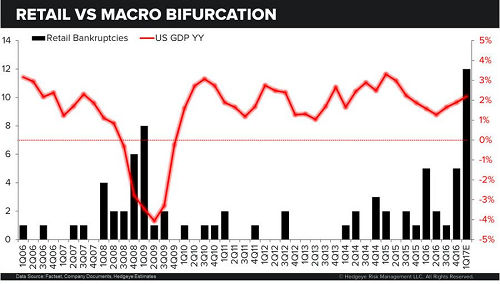

We are accustomed to seeing retailers go belly up when economic conditions are poor. Right now, U.S. GDP growth is positive, and accelerating. We are not in a recession. Yet there is serious carnage in the retail space. The magnitude of bankruptcies reported this quarter eclipses even the Great Recession.

Source: Hedgeye Research

All these dying stores mean another thing: dying shopping malls. Shopping malls are going dark across the United States.

Filmmaker Dan Bell has been documenting the trend. His ‘Dead Mall Series’ on YouTube boasts 231,000 subscribers. In the films, he strolls abandoned malls, mixing commentary with eclectic music.

My guess is the films strike a chord, because they illustrate how times they are a changin’. Society is changing. Investors should take notice.

***

A “canary in a coal mine” is an advanced warning of impending danger. The metaphor originates from when miners used to carry caged canaries while at work; if there was any methane or carbon monoxide in the mine, the canary would die before the levels of the gas reached levels hazardous to humans.

Every investment cycle has its own “canary in the coal mine,” or early warning indicator of an ensuing bear market. Ten years ago, it was turbulence in the real estate and finance sectors. The cycle before that, it was a disruption in the technology sector. Dislocations start small, and eventually spread.

This time around?

I am watching two spots very carefully: the fracking basins (energy sector) and the malls of America (retail sector). Both are likely candidates to be this cycle’s ‘canaries.’ If I had to pick one, I’d say retail is more consequential in its potential ripple effects.

Credit is the primary engine of economic and investment cycles. Recently, incomes have been on an upswing, and debt service ratios are manageable. That probably changes if interest rates keep levitating, and retail layoffs accelerate.

Two important indicators to watch are initial jobless claims and credit spreads. For now, the jobs data looks ok. However, subprime consumer loans are showing early cracks, and Total Consumer Credit growth slowed to +2.8% month-over-month in January—the slowest pace since 2011.

The proverbial canary is still breathing, but looking woozy.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX