Amid Stock-Market Corrections, the Boring Becomes Beautiful

Submitted by Silverlight Asset Management, LLC on December 8th, 2018

The S&P 500 Index fell 3.2% on Tuesday, while shares of McCormick & Co. (MKC) rose slightly. Why did most stocks go down while this one went up? It’s called a rotation.

McCormick makes the red spice containers almost everyone has in their cabinet.

Suddenly, consumer staples, utilities, REITs and health care stocks are popular places to park money. A lot of names in these sectors reside near 52-week highs, while the broad market has sold off sharply.

Investors are rotating to names with high earnings certainty because the broader outlook for earnings is starting to look a lot more uncertain.

The Profit Cycle

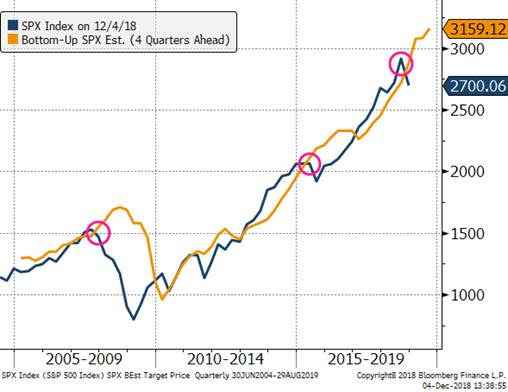

Below is a ten-year chart of the S&P 500 plotted alongside analysts’ bottom-up estimates for the next four quarters. Analysts see earnings climbing 12% in 2019. Consensus price targets imply the S&P 500’s price-to-earnings (P/E) multiple will nudge higher to 18.2x. As a result, the benchmark is projected to climb to 3,159 in the next 12 months, gaining about 17%.

Bloomberg Intelligence Strategist, Gina Martin Adams, recently wrote:

“S&P 500 companies' 3Q results have been extraordinary, with the index tracking more than 27% year-over-year growth, but nonetheless... below-expected revenue growth and downward estimate revisions have thrown cold water on results that have far surpassed expectations. Company guidance also remains more negative than in prior quarters, as earnings forecasts are weak and sales expectations decline.”

In other words, growth has been great, but momentum is waning.

In the above chart, I highlight several divergences (magenta circles). Specifically, in 2007/2008 and 2014/2015, analyst estimates kept rising while the market made a U-turn the opposite direction. The former was a severe bear market, while the latter became a market correction.

Currently, another divergence is taking shape. What is the market seeing in 2019 that analysts aren’t?

1. The economy may slow more than people expect. Growth accelerated for a record nine consecutive quarters in the U.S. Consensus expects GDP growth to moderate to 2.6% this quarter. The best macro firm I follow sees growth decelerating more dramatically to 1.2%. That wouldn’t be a recession. But if they’re right—as they often are, it’s a game-changer for portfolio managers.

2. Earnings estimates may be overly rosy. The S&P 500’s trailing net profit margin climbed to a record 10.1% in Q3 2018 (source: Bloomberg). Analysts expect the good times to continue, with net margins rising to nearly 12 percent in 2020. That may be a reach. Profit margins tend to mean revert. Another element to consider: Goldman Sachs recently highlighted that just 10 stocks are responsible for half of the margin expansion in the S&P 500 since 2009. If a few mega-cap techs were to stumble (i.e. Apple, Google, Facebook), the new profit paradigm could stall.

3. The cycle peak may be closer than many realize. David Rosenberg of Gluskin Sheff monitors 15 variables that have historically correlated well to business cycles. Currently, 14 of the 15 are flashing red. We’re definitely late-cycle. Thing about that is: no one rings a bell at a market top. It may occur next year, in 2020, or it may have already happened earlier this year. Some classic signs were there—i.e. bitcoin’s dramatic blow-off top, Amazon and Apple eclipsing a trillion dollars in market cap, retail investors piling in, and important technical indicators flashing long-term trend exhaustion. Also, key leadership has fallen on hard times (i.e. FAANGs). As in war, “market generals” are typically the last to fall.

Adding all this up, it appears the main risk the market is grappling with is the earnings outlook.

A lot of firms face margin pressures heading into next year. Wage inflation, stingier credit markets, and tariffs will all weigh on firms to varying degrees.

Will topline sales be strong enough to overcome such pressures? Only time will tell. Meanwhile, this uncertainty is likely what the market is digesting lately. That explains the defensive rotation, and why “Buying the dip” isn’t being rewarded like it normally has in recent years.

Growth expectations are always a critical ingredient for assigning “fair value” to a market. Bulls can argue the S&P 500 is a bargain trading at 15.5x next year’s earnings. That seems reasonable based on interest rates, and it’s near the valuation stocks bottomed at in the 2015 correction.

Yet for any P/E argument to hold, you first must believe the “E.” P/E multiples are worthless if the denominator is wrong.

***

MKC didn’t just start outperforming during that manic market slide on Tuesday. The stock is having a great year, up 51% including dividends. That beats Amazon and Netflix!

Unlike those two firms, McCormick is not an explosive growth company, transforming society with their innovations. They make spices.

There’s a time in every cycle where boring becomes beautiful. Usually, it’s when the earnings outlook becomes shaky.

Predictability trades at a premium when it is scarce in the surrounding environment. This explains why MKC’s forward P/E multiple has risen since the start of the year from 21x to 28x, while the S&P 500’s P/E shrunk from 20x to 15.5x.

To be clear, timing always matters. I wouldn’t necessarily recommend chasing MKC at its present level. It’s just a perfect case study for what the market is starting to reward—steady profitability.

Originally published by RealClearMarkets.com. Reprinted with permission.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX