The Amazon of Asset Management

Submitted by Silverlight Asset Management, LLC on July 11th, 2017

The most successful businesses do what others find impossible. They produce something special which can’t be copied or sell at price points no one else can match.

For years, Amazon has steadily gained market share by doing the latter. How? Sacrificing margin.

The firm has been able to operate like a non-profit entity because of a unique investor base willing to overlook current earnings and value the company on sales growth. In the last twenty years, the stock has delivered a compounded annual return exceeding 30% with an income statement that looks like this:

"Your margin is my opportunity." - Jeff Bezos

This defies how it’s supposed to go. Investors usually myopically focus on short-term results. If other retail heavyweights failed to produce profit growth, investors would vote their stock down, and management out.

But not Amazon. Not Bezos. Like Willy Wonka, he’s managed to build an empire operating on a completely different plane.

As you’re probably already aware, Amazon has hit a tipping point that is making life very difficult for retail competitors. Amazon Prime is up to 80 million subscribers, and Amazon’s North America division generated almost $80 billion in revenue last year.

That’s serious scale. But the unit’s operating margins remain surprisingly thin at just 3.0%. Rival retailer Target has a 7.2% operating margin followed by Wal-Mart and Best Buy at 4.7%.

Could Amazon raise prices and bump their margin? Sure.

However, Bezos would rather bump more competitors out of business first.

***

In the world of asset management, there is an emerging giant undercutting everyone on price and winning. Their name is Vanguard.

Last year, Vanguard set a record with $305 billion of inflows. The pace is even stronger this year—$206 billion through June. The firm’s asset-weighted fee average is a mere 0.12%.

When the firm started in 1974, it had similar fees to other mutual funds. But over the years, they have continually cut fees, earning a reputation as the low-cost provider. Their almost free investing model has sapped billions of dollars of revenue from financial industry competitors. They are the Amazon of asset management.

Unlike Amazon, though, Vanguard’s cost advantage does not emanate from a unique relationship with Wall Street. It’s not a public company.

What Vanguard’s founder, Jack Bogle, and company do have going for them is a unique ownership structure. Fund investors double as the shareholders. This allows Vanguard to essentially operate at cost, spending incremental profit on lower fees.

Low-cost providers are nearly impossible to beat in industries with sparse product differentiation. When products are fungible, scale wins. Period.

Amazon distributes similar goods as other retailers. They just do it cheaper and more conveniently, so they win.

However, investment management is not a fungible commodity. There are many different strategies and products, built to appeal to an array of variant objectives. Differentiation counts, because managers perform differently.

Vanguard has benefitted from a killer combination in recent years—low cost and quality performance. This is because although the firm distributes ETFs and actively managed funds, they specialize in passive, index-based investing—a style which has surged in popularity amid widespread underperformance across the active manager community.

Consider these sobering statistics: according to SPIVA, during the five-year period ending Dec. 31, 2016, 88% of large-cap managers, 90% of midcap managers, and 97% of small-cap managers underperformed their respective benchmarks.

Investing is a game of probability. Why would anyone want to pay 6x more for a product with a 90% likelihood of being inferior? The average actively managed mutual fund fee is 0.72%—6x higher than Vanguard’s 0.12% annual fee. And roughly 90% of those funds are underperforming Vanguard’s ultra-cheap option.

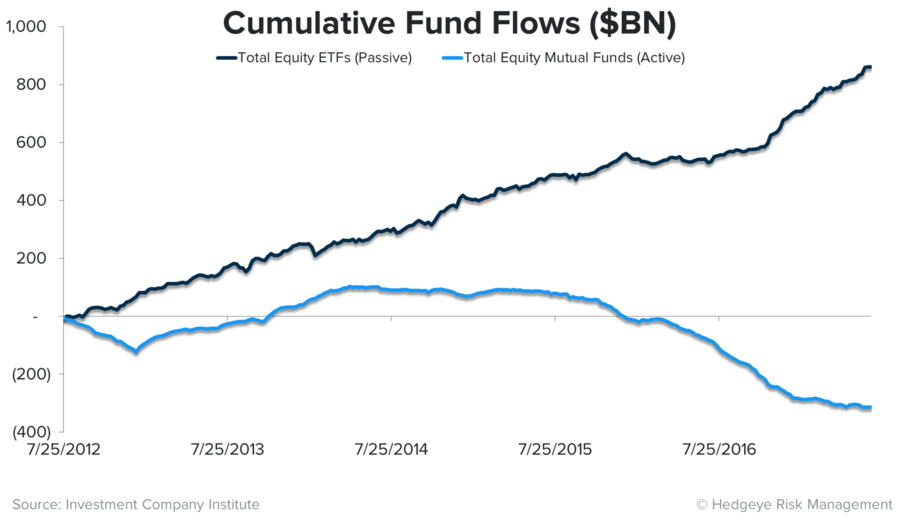

Unsurprisingly, many investors are flocking toward passive. Flows out of active mutual funds and into passive funds likely approached $500 billion in 1H, almost double any other start to a year. Active funds lost an estimated $72 billion. As shown in the chart below, this is a multi-year trend.

Which leads to this question: Why shouldn’t everyone join the stampede and hire Vanguard?

For starters, I do not believe we’re ever going to live in a world with just one retailer or asset manager.

Businesses are collections of people trying to solve each other’s problems. No single organization can possibly scratch every customer itch. People are complex, the world is complex, and that makes business too complex for any one individual or organization to figure everything out.

Moreover, conditions are always changing. That creates constant opportunity to better appeal to people’s evolving preferences and needs.

With investing, cycle dynamics play a key role in what people want. Keeping that in mind, consider the environment under which Vanguard has recently ascended to the top of the asset management food chain. Here is a look at how this cycle compares to previous ones from a return and volatility perspective.

| Years | Returns | Volatility |

|---|---|---|

| 1930 - 1945 | 3.4% | 28.9% |

| 1946 - 1968 | 12.9% | 16.9% |

| 1969 - 1977 | 2.6% | 20.3% |

| 1978 - 1999 | 17.2% | 12.5% |

| 2000 - 2008 | -3.6% | 20.1% |

| 2009 - 2016 | 14.3% | 10.6% |

When somebody buys an index, they are guaranteed:

- 100% of the index’s upside, and

- 100% of its downside

Passive investing has existed for a long time but really caught on in recent years. Conditions were ripe. 100/100 is a dandy ratio in an environment with lots of upside and little downside.

Here’s the rub, though: Investment cycles mean revert.

Just look at the table…

1969-1977: low returns, high volatility

1978-1999: high returns, low volatility

2000-2008: low returns, high volatility

2009-2016: high returns, low volatility

Notice a pattern?

What would you guess probably comes next?

That’s right, eventually we’re going to see a flip back to low returns and high volatility.

Will passive’s 100/100 ratio still feel like the right strategy then?

It is well-documented that investors suffer from a behavioral bias called loss aversion. We abhor losses about 2x as much as we enjoy gains. What that means is our experience of riding a passive investment will not always feel like 100 by 100. We’ll feel the losses more. Our perception will be more akin to a 100/200 ratio.

We are presently enjoying the lowest volatility era since 1930. So, loss aversion doesn’t influence our behavior a whole lot. It’s easy to be passive and stay invested. But what about when volatility spikes? Passive is a fine strategy for many investors, but only if they have the discipline to stick with it.

Even though Vanguard has been selling at price points others cannot match, it operates in an environment with abundant product differentiation. Will a 0.12% fee seem like a bargain when the S&P 500 declines more than 20%?

You get what you pay for in this world. Cheap is good, but not always best.

Sources: Bloomberg, Hedgeye Research, HiddenLevers

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX