5 Things We Learned This Week - 9/28/2025

Submitted by Silverlight Asset Management, LLC on September 28th, 2025

September 28, 2025

The S&P 500 fell 0.3% this week. The Bloomberg Aggregate Bond Index fell 0.2%, Gold rose 2.2% and Bitcoin declined 5.3%.

The economic data was mostly positive this week. GDP growth was revised up to a 3.8% annual rate, boosted by consumer spending and lower imports. Retail sales and personal income showed solid gains. Durable goods orders jumped 2.9% in August, beating expectations and breaking a two-month decline. Looking forward, the Atlanta Fed’s GDP tracker now points to annualized third-quarter growth of 3.9%, up from earlier projections.

Technical Market Update

The stock market has enjoyed five consecutive months of gains. That's rare but not unheard of. The proverbial question is: what's next?

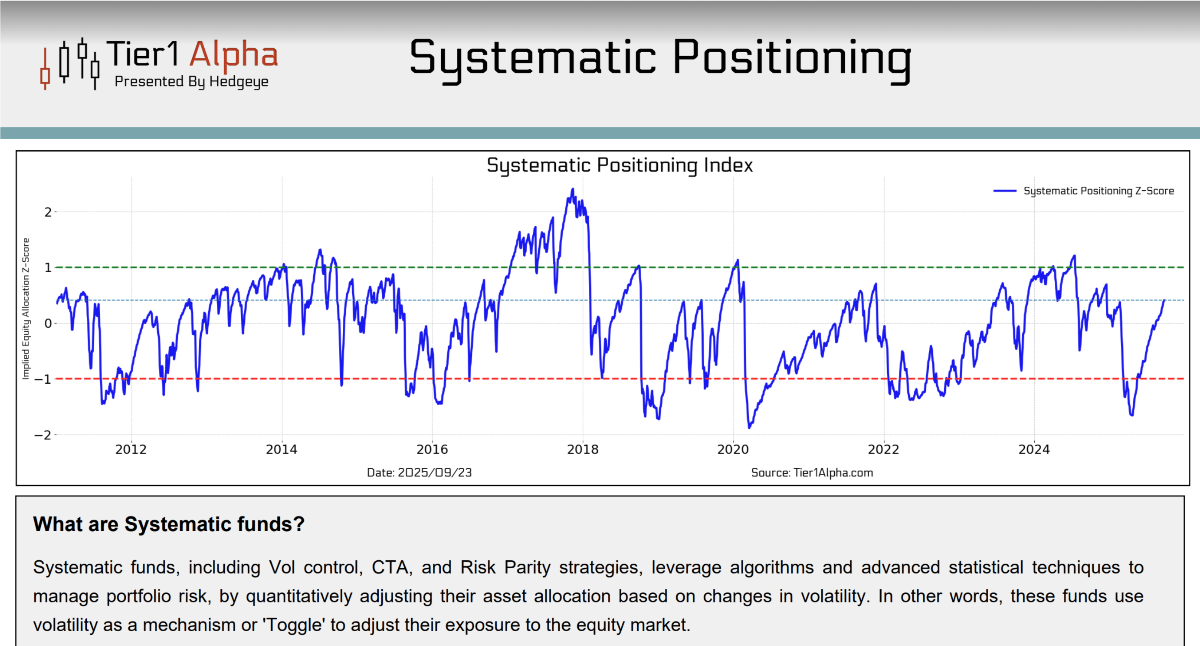

One important market timing signal is systematic positioning. This pertains to a group of investors who allocate funds mechanically in reaction to certain datapoints, such as volatility. Basically, when volatility goes up they sell, and when volatility goes down they buy. Hedgeye Research has an excellent service called Tier1Alpha that tracks this positioning daily. As shown in the chart above, systematic exposure was very low earlier this year. Any time systematics go under the red line, it's a recipe for a market bounce because they can't sell anymore. Markets tend to bottom when positioning gets low, like it was in April. Systematic positioning has since rebounded. We aren't in nosebleed territory yet, but we are getting in the zone where the future risk and reward calculus is less favorable.

Another technical development we are closely monitoring is early signs of sector rotation. The tech sector has led since the April bottom, but it is losing momentum in recent weeks while more defensive sectors like health care and energy have started flashing improvement.

Arguably the most bullish technical factor is liquidity. M2 money supply has shot higher over recent months. Central banks around the globe are cutting rates and the Fed appears to be following suit. When the Fed has cut rates near a market high historically, strong equity returns have followed.

Based on the overall technical setup, Silverlight portfolios have more of a defensive bias compared to a few months ago, but we remain close to fully invested.

Ukraine’s Energy Gambit Is Bullish For US Energy Producers

Ukraine is no longer just defending territory—it’s actively targeting Russia’s energy infrastructure. Ukrainian-made drones recently struck Russia’s Salavat petrochemical complex, sparking fires for the second time in a week. It’s part of Kyiv’s new strategy: precision strikes on refineries, export terminals, and pipelines designed to choke Moscow’s war chest.

President Zelensky has vowed to intensify these operations. The message is clear—Russia’s oil and gas exports are now in the crosshairs. For markets, that means turbulence and potential opportunity.

Every disrupted barrel tightens global supply, sending crude, diesel, and natural gas benchmarks higher. Moscow’s own export restrictions add fuel to the fire. This is a potential tailwind for North American energy producers. Shale producers are poised to gain pricing leverage, LNG exporters should enjoy strong demand from Europe, and refiners will likely see improved margins on constrained global flows.

President Trump declared at the UN that Russia’s war machine looks more like a “paper tiger.” Trump may have pivoted because he senses that Russia's oil-reliant economy is vulnerable to further drone attacks. This development translates into a bullish backdrop for U.S. energy firms.

Why Young Investors Are Gambling on Crypto and Stocks

As housing, tuition, and everyday costs sprint ahead of wages, many young adults are embracing “financial nihilism,” funneling savings into crypto, meme stocks, options, and even sports betting in search of a life-changing win. Why?

If the American Dream looks out of reach on a traditional glidepath, young people may be inclined to take extra risk to compress time. Speculative assets might feel like the only ladder left for them on a wall that keeps getting taller.

Easy-access platforms and finfluencers are pumping investing narratives 24/7. Platforms and people who have never experienced a serious bear market are encouraging a rampant retail appetite for options and leverage, even though drawdowns in such securities can erase years of progress overnight.

Today's young investors have certain advantages. They can tap information and trade quicker than previous generations. But they've also grown up investing in one of the easiest money eras ever. That can't last forever, and when the liquidity tide eventually goes out, a huge swath of young people will start to view "speculation" as a dirty word.

Our advice for the YOLO crowd: Build an “anti-nihilism barbell”—automatic savings into a well-diversified core investment strategy, and create a capped, rules-based sandbox for speculation.

Cintas Investment Thesis

In a world where too many investors are transfixed by unproven companies with a slim chance to become the next growth unicorn, Cintas is a reliable growth story trading at a reasonable price.

Cintas (CTAS) provides uniforms, facility services, first aid, and fire protection to over one million businesses in North America. It is the dominant uniform rental provider with 40% market share. The company’s economic moat stems from its robust scale, unmatched route density, and successful cross-selling—serving core clients with bundled offerings that make switching costly and less attractive. This strategy has led to consistently strong results. Cintas has a 23% operating margin, which ranks best-in-class versus its industrial peers. The Cincinnati-based company uses its high profitability to reinvest in expanding its network and capabilities, while growth in business formation and employment fuels steady demand and recurring revenue.

How has the market rewarded Cintas' strategy? CTAS shares have appreciated 932% (~26% per annum) over the last ten years compared to 310% (~ 15% per annum) for the S&P 500. Who knew selling uniforms could be so lucrative?!

CTAS shares were recently added to Silverlight managed portfolios.

Measuring Miracles

The dictionary defines a miracle as "a surprising and welcome event that is not explicable by natural or scientific laws and is therefore considered to be the work of a divine agency."

A few weeks ago, one of the authors did something simple but intentional—I prayed for someone who I hadn’t seen in a long time.

Later that same day, guess who I ran into in a Target parking lot? Yep. The very person I prayed for. We randomly parked right next to each other. Under the radiant light of a full moon, we talked for over an hour, catching up in a way that felt anything but ordinary. As I drove home, I couldn’t help but wonder: was that just random chance?

Curious, I asked Grok to crunch the numbers. Turn out, the estimated odds of a chance encounter like that are about one in three million. One in three million! That miniscule probability made me sit up a little straighter.

Here’s where it gets even more interesting. Some physicists believe that our consciousness, mixed with the strange rules of quantum theory, may play an important role in shaping reality. If that’s true, prayer may be powerful for scientific reasons we don't yet understand. Where focus goes, energy flows.

So here’s a fun challenge: the next time something unusual happens, ask your favorite AI to calculate the odds. You might be astonished by how rare your “random” experience really was. And when you realize just how slim the chances are, certain moments may become more valuable to you. Miracles surround us every day. Sometimes we just need measuring sticks to see them.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX