5 Things We Learned This Week - 9/14/2024

Submitted by Silverlight Asset Management, LLC on September 14th, 2024

September 14, 2024

The S&P 500 rose 4.1% this week, which was the best showing since last November. US stocks reside near their year-to-date high reached in July. Gold prices also rose sharply this week, finishing at an all-time high. 10-year treasury yields fell to a 15-month low.

The main economic news this week concerned inflation. The Consumer Price Index (CPI) for August met expectations, falling to 2.5% from 2.9%. Core CPI, which includes food and housing, stayed at 3.2%. Meanwhile, the Producer Price Index (PPI) also decreased slightly. Falling inflation helped nudge The University of Michigan's Consumer Sentiment reading to its highest level since May.

With inflation pressure receding, the worst kept secret on Wall Street is that the Federal Reserve is going to cut interest rates next week. The only question is whether they will cut by 25 or 50 basis points. We don't perceive the level of interest rate cuts as meaningful, but the direction of rates is now clearly turning south.

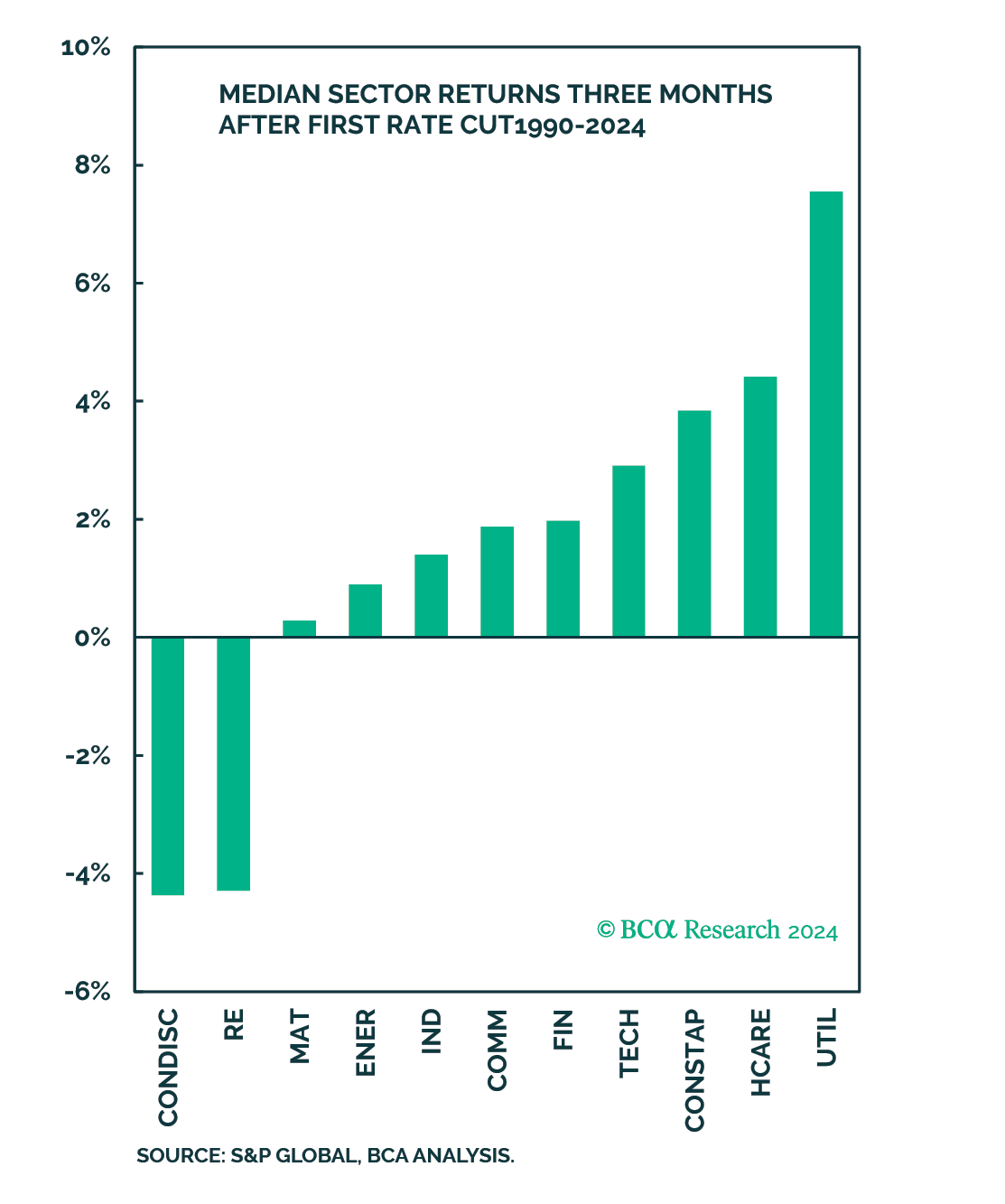

Sectors That Outperform When The Fed Cuts Rates

Most people perceive Fed rate cuts as bullish, but that's not always the case. Historically, US equities have pulled back after the first rate cut.

If borrowing costs are poised to go down, why wouldn't risk assets automatically go up? The reason is because the Fed is usually behind the curve by the time it starts cutting rates amid an economic slowdown. They usually have to cut deeper and for longer than most people expect at the front-end of their policy pivot.

According to BCA Research, the best performing sectors after the Fed has previously cut rates have been defensive sectors such as Utilities, Health Care, and Consumer Staples. Silverlight managed portfolios are currently overweight all three of these defensive sectors. Conversely, sectors that historically lag the market after monetary policy shifts to an easing bias include Consumer Discretionary, Real Estate, and Materials.

Parsing the Presidential Debate

The second Presidential Debate took place this week, marking the first match-up between Vice President Kamala Harris and former President Donald Trump. 67 million television viewers tuned in, according to Nielsen data, topping the roughly 51 million people who watched Trump debate then-candidate President Joe Biden in June.

Most observers thought Harris outperformed Trump in the debate, and a post-debate Reuters poll gives her a 47 to 42 percent edge in the general election. While the momentum has swung in Harris' direction, the overall race is still too close to call in our view. Harris has to win the popular vote by at least 3 or 4 percent to have a realistic shot at winning the Electoral College. Some prominent forecasters, including Nate Silver, think that's a long shot and forecast Trump to win.

Ultimately, we think investors should mostly tune out political noise between now and November. The candidates actually have mostly similar economic policies. Neither candidate spent any time at the debate talking about deficit reduction, even though a Peterson Foundation Survey found 61 percent of Americans think deficit reduction is "very important." For now, both parties seem content to provide short-term economic handouts and put the long-term bill on the nation's credit card.

Younger Generations Are Serious About Work-Life Boundaries

Per an article by The Financial Times, junior investment bankers and corporate lawyers are tired of burning the midnight oil. "Investment banking is at a crossroads, facing pressure from employees, regulators, and the media to address its workaholic culture. Banks have tried various fixes — protected weekends, wellness programs, hiring sprees, offshore teams, prohibitions on changing pitch books 12 hours before the deadline — but these feel like Band-Aids on a gushing wound. They don’t address the fundamental misalignment between the demands of the job and the expectations of a new generation of workers."

A Fast Company article shares that part of the problem is that Gen Z entered the workforce during the pandemic and so have little experience with how a pre-pandemic workplace functioned. The pandemic made younger workers more aware of their mental health and now they want clear and actionable boundaries around the personal life and needs. Some boundaries are non-negotiable such as picking up kids from school; others are softer boundaries such as taking stretch breaks every half hour at a desk job.

At the end of the day, it’s about healthy respect on all sides of the workforce.

How Many People Will Eventually Take Drugs Like Ozempic?

A Gallup Poll from March estimated that 3 percent of American adults (about 8 million people) are currently taking GLP-1 weight loss medication. Sales are growing fast, because GLP-1 drugs like Ozempic aren't just effective at helping people lose weight. They also improve cardiovascular health and help protect kidneys. Someday, Ozempic might even help alcoholics achieve sobriety, and cigarette smokers kick their most unhealthy habit.

The most pressing issue right now with weight loss drugs is not enough supply. As leading companies like Novo Nordisk and Eli Lilly increase production capacity in the coming years, the market of GLP-1 users is projected to grow to approximately 23 million Americans by 2030. However, even this level of supply would only be enough to serve about 15 percent of the 147 million Americans who suffer from diabetes or obesity. The potential target market abroad is even wider. International roll outs are being delayed until domestic demand is better met.

Silverlight is long Novo Nordisk (NVO) and Eli Lilly (LLY), and we expect both companies to continue to thrive over the remainder of this decade.

Endangered Sea Turtles Now Inhabit Atlanta's Subway Cars

Decommissioned subway cars from Atlanta have been repurposed as artificial reefs off the coast of Georgia. These rail cars, placed 65 feet below the Atlantic Ocean, are now home to various marine life, including fish, sea turtles, and coral. The project, led by the Metropolitan Atlanta Rapid Transit Authority (MARTA) and the Georgia Department of Natural Resources, aims to create habitats for marine wildlife. Initial inspections have shown promising growth of soft coral and the presence of multiple fish species.

Subway cars aren't the only strange objects scuba divers can find in Artificial Reef L. There are also US army battle tanks, barges, and New York City subway cars. The reef was created in 1976 and is part of a network of 32 offshore reefs.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX