5 Things We Learned This Week - 3/09/2025

Submitted by Silverlight Asset Management, LLC on March 9th, 2025

March 9, 2025

The S&P 500 experienced its worst weekly decline in six months, falling 3.1%. The Bloomberg Aggregate Bond Index fell 0.6%, while gold rose 1.9% and Bitcoin rallied 3.2%.

The ISM Manufacturing PMI report ticked down to 50 in February. The Prices Paid Index jumped sharply, indicating rising cost pressure in the supply chain. The ISM Services PMI increased slightly to 53. Similar to the manufacturing report, the prices paid index increased to 62. Meanwhile, the February jobs report came in below expectations. DOGE government layoffs haven't shown up in the data yet, so we expect to see further downward pressure in labor numbers over the coming months.

Market Technical Update

In recent weeks, 5 Things has profiled a growing list of bearish signals. The S&P 500 is currently down about 6% from its all-time high on February 19.

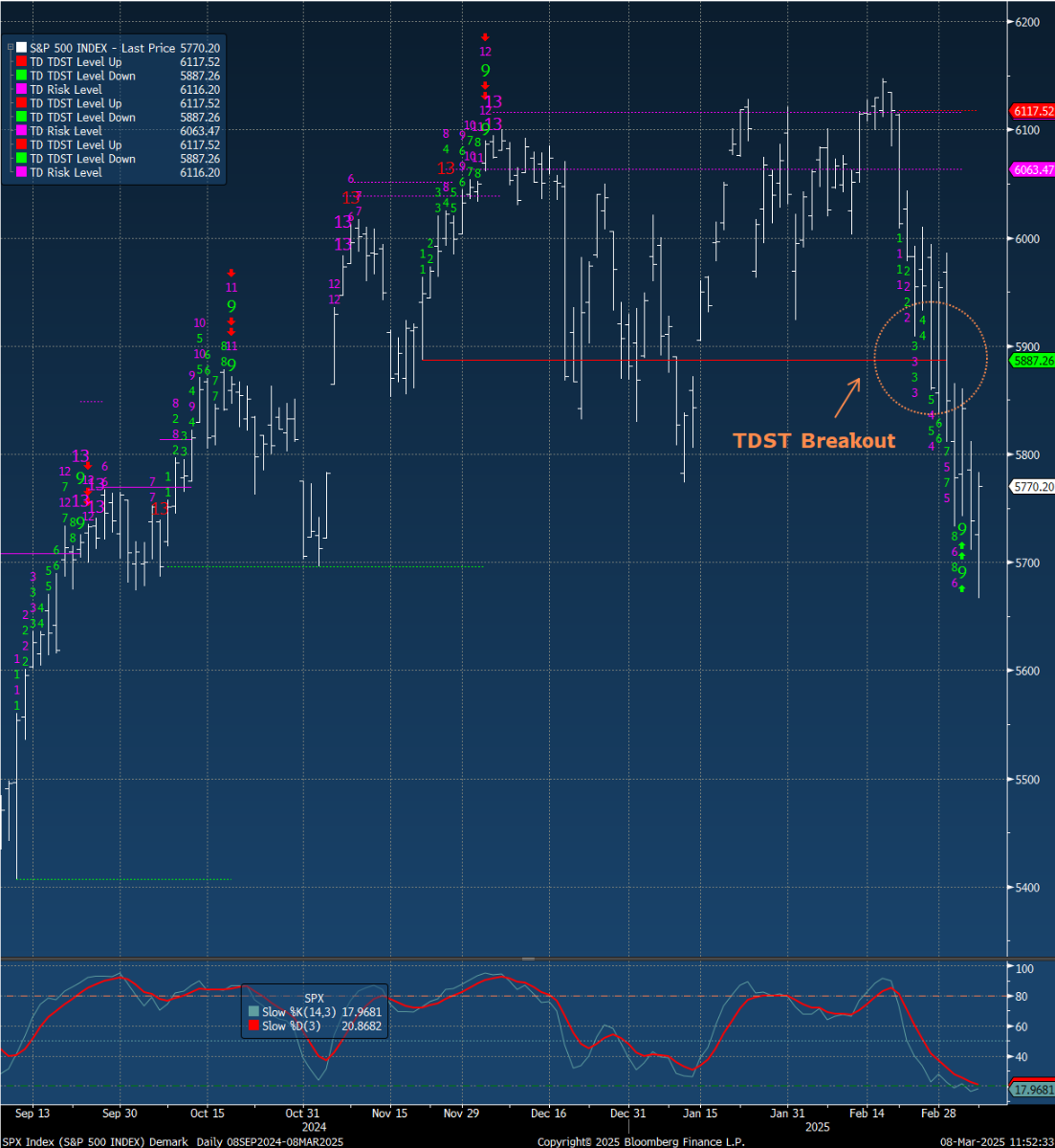

One of the reasons Silverlight recently pivoted defensive was because of a DeMark Monthly 13 sell signal. Now the daily chart of the S&P 500, shown above, also has a bearish complexion. The S&P 500's rally stalled at a 6,116 DeMark resistance level on 2/21 (source: DeMark Analytics), and stocks have been tumbling lower ever since. After the selloff commenced, the most important risk line of support was 5,887 (TDST), which the bulls failed to hold last week. The S&P 500 recorded a perfected TD 9 buy setup this Wednesday, which indicates a strong probability of an oversold bounce by Tuesday. After that, however, the primary trend in the market will likely tilt bearish.

It's unclear if this will be a normal market correction of around 10%, or something more severe -- like a 20% drawdown. We covered our NVDA short this week, as well as our short of Cathie Wood's ARKK fund. We did so because investor sentiment is becoming very depressed, reaching levels normally associated with short-term market bottoms. For example, the CNN Fear Greed Index resides at 20 (Extreme Fear), and the AAII Bullish reading for this week was 19 -- near a 5-year low.

Tariffs Are Top of Mind on Wall Street

Trump's escalating tariff policy is likely to drive the S&P 500's P/E lower as markets price in greater uncertainty. History shows that policy uncertainty leads investors to demand higher risk premiums, compressing valuations and increasing market volatility.

The irony is that tariffs likely won't achieve their stated goal. As economist Tyler Cowen notes, "countries with higher tariffs actually have higher trade deficits," not lower ones. US exporters relying on foreign inputs face higher costs under tariffs, hurting their international competitiveness and potentially worsening the trade deficit.

Corporate earnings will also be pressured by the tariffs. Bill Dudley warns the 25% tariffs could increase consumer prices by an additional percentage point, squeezing margins or reducing sales volumes if passed to consumers. Supply chain disruptions across North America will further impair efficiency and profitability.

During the 2007-2009 financial crisis, policy uncertainty contributed to the S&P 500's P/E ratio contracting from 16 to 11 – a 31% decline. Today's elevated multiples make markets particularly vulnerable to such compression. Investors should prepare for continued volatility as markets adapt to this uncertain policy landscape.

Steak Dinners Are No Reason to Invest

Matt Levine's recent "Steak Dinners Sell ETFs" column exposes a concerning practice in financial services. First Trust, an ETF provider, wins a lot of business via lavish perks to financial advisers. Bloomberg's reporting reveals First Trust salespeople enticed advisers with resort stays, sports tickets, personal coaching, and even Hermès scarves, potentially compromising their fiduciary duty to clients.

As Levine explains, this illustrates the classic principal-agent problem in finance. Advisers making investment decisions for clients might be influenced by perks rather than selecting the most suitable products based on performance, fees, and client needs.

This frictional dynamic is why Silverlight is structured as a fiduciary firm. We don't engage in "pay-to-play" arrangements, and we have no incentive to favor any particular investment products. We believe the overall wealth management industry will eventually migrate toward this fiduciary model, because it's what's best for clients. In the long run, client-centric value propositions typically prevail in competitive markets.

Why Gold Is Outshining Bitcoin In 2025

Gold is flexing its muscles in 2025. The yellow metal has surged 11%, while Bitcoin is down 7%. Since they are both considered fiat money hedges, what’s driving the divergence?

Geopolitical uncertainty and sticky inflation are gold’s tailwinds. With trade tensions simmering under Trump’s second term and central banks hoarding bullion, gold’s safe-haven status is rock-solid. Bitcoin, meanwhile, is tethered to risk-on sentiment, correlating tightly with the S&P 500. When stocks wobble, so does crypto. Bitcoin's beta to the S&P 500 is 0.96, whereas gold's beta to the S&P 500 is only 0.41.

Bottom-line: In shaky stock markets, gold’s timeless allure trumps Bitcoin’s digital promise.

Whales Are Really Smart

In a captivating video, a beluga whale demonstrates extraordinary intelligence by playing fetch with a rugby ball in Norwegian waters. The whale tracks the ball's trajectory, retrieves it precisely, and deliberately returns it to humans, showcasing sophisticated cognitive processing.

Belugas possess remarkable brains that facilitate complex echolocation and communication. Known as "sea canaries" for their diverse vocalizations, they live in intricate social structures that require advanced coordination and emotional intelligence. What makes this interaction particularly noteworthy is the whale's willingness to engage cooperatively with humans. Many species possess intellectual capabilities that continually surprise and impress human observers.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX