5 Things We Learned This Week - 1/25/2025

Submitted by Silverlight Asset Management, LLC on January 25th, 2025

January 25, 2025

The S&P 500 gained 1.8% this week. The Bloomberg Aggregate Bond Index gained 0.09%. Gold jumped 2.6% and Bitcoin rose 0.13%.

The housing market experienced a challenging year in 2024, with existing home sales hitting a multi-decade low. According to the National Association of Realtors, sales totaled just 4.06 million, the lowest since 1995. There was a slight uptick in December with sales rising 2.2%. The University of Michigan's Consumer Confidence index fell to 71.1, a three-month low.

President Trump Announces $500 Billion AI Investment Deal

President Trump announced the Stargate Initiative this week, a $500 billion private sector deal to expand U.S. artificial intelligence infrastructure. Spearheaded by tech giants OpenAI, SoftBank, and Oracle, Stargate represents the largest AI infrastructure project in history.

AI infrastructure investment is set to benefit several key players in the energy, industrial, and utility sectors. Hubbell (HUBB), a leader in electrical and electronic products, stands to gain from increased demand for its power and utility solutions. Emcor (EME), a Fortune 500 company specializing in mechanical and electrical construction, as well as energy infrastructure, will likely see a surge in projects related to AI data centers and energy systems. Constellation Energy (CEG), the nation's largest producer of carbon-free energy, is poised to benefit from the heightened need for reliable and sustainable power sources to support AI operations. Silverlight owns HUBB, EME, and CEG in managed portfolios.

Is China's AI a Legit Threat to Silicon Valley?

The AI winners of today may not be the AI winners of tomorrow.

DeepSeek's recent rise has caught many in Silicon Valley off guard. DeepSeek, a Chinese AI startup, recently introduced DeepSeek R1, a large language model that rivals OpenAI's ChatGPT o1 but at a fraction of the cost. This model was developed with significantly fewer resources and lower expenses, challenging the notion that huge investments are necessary for cutting-edge AI development. Critics argue that big tech's heavy spending on AI may not always translate to proportional advancements. Unlike OpenAI's o1, which is available only to paying subscribers, DeepSeek R1 is open source, making it accessible to a wider audience. This structure helped facilitate its rapid adoption. It's too early to say if DeepSeek is a legit threat to Silicon Valley's AI dominance, but it is a trend we will be monitoring closely going forward.

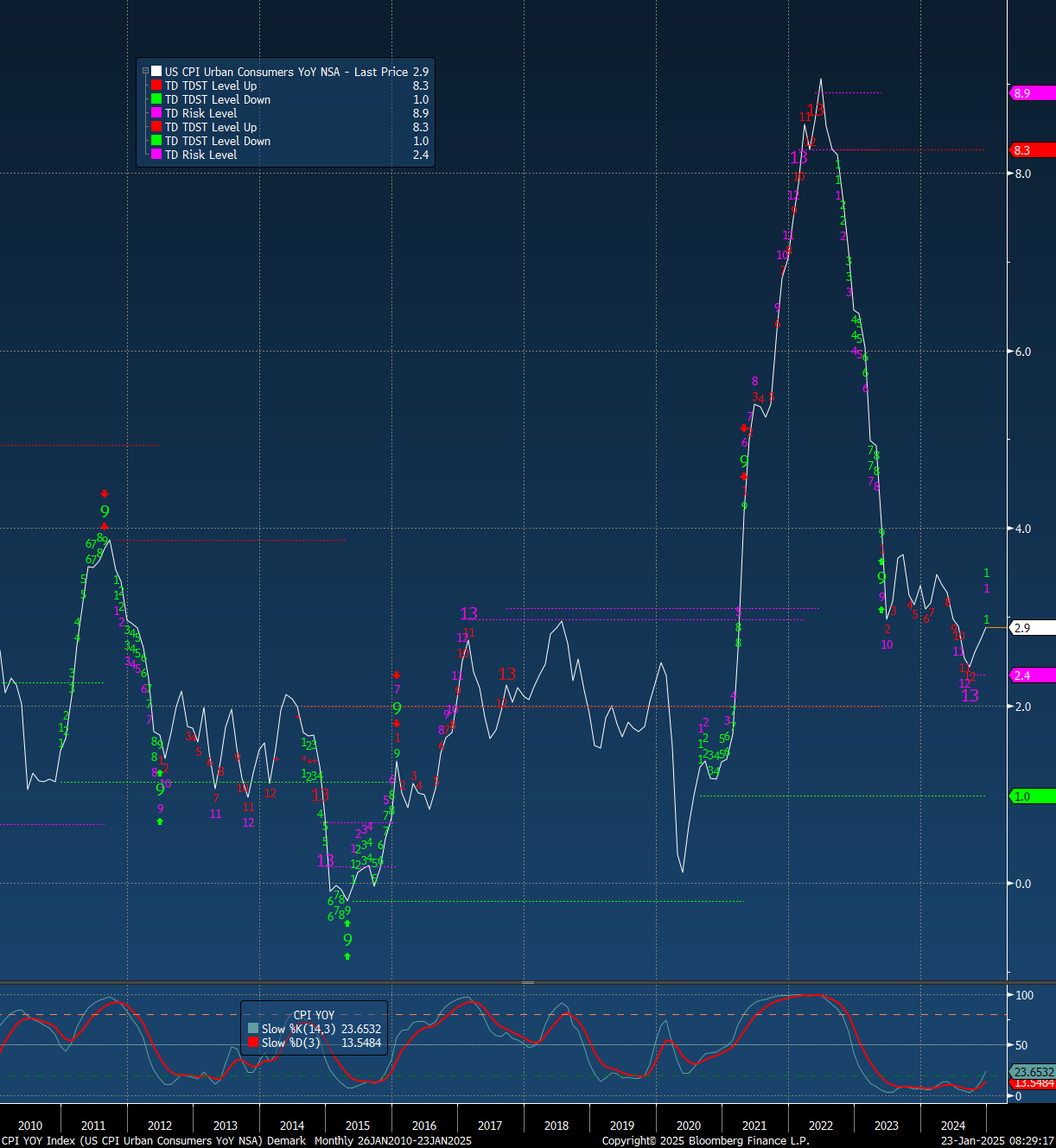

CPI Prints Demark 13 Buy Signal

A Demark TD Combo 13 buy signal is a technical indicator suggesting a potential reversal in market trends. When this signal appears, it indicates that the market may be poised for an upward movement. For the CPI index, which measures changes in the price level of a basket of consumer goods and services, this buy signal could imply an expectation of rising inflation rates.

The signal works by identifying trend exhaustion and predicting a shift in market momentum. If the CPI index follows this trend, it might suggest that inflationary pressures are building, potentially leading to higher consumer prices in the near future.

Note: Prior to the most recent 13 buy signal, there were 13 sell signals that nailed inflation's top in 2022.

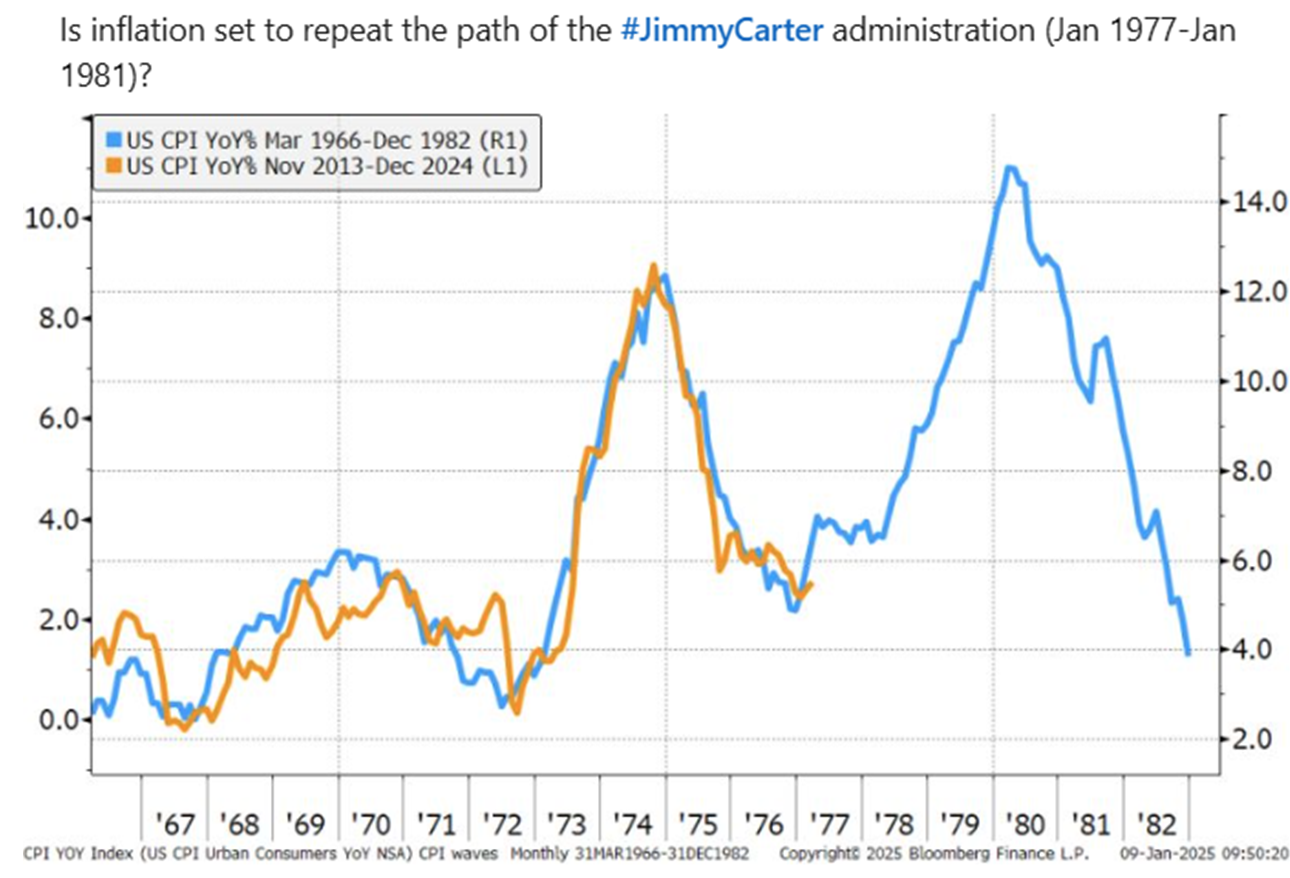

1970s Inflation Analog Suggests A Bottom

Inflation often comes in waves.

The current inflationary backdrop bears striking similarities to the 1970s. During the 1970s, America experienced rising prices due to a combination of loose monetary policy, oil price shocks, and supply chain disruptions. Many of those same factors apply today. There is also a risk that President Trump's policies to shrink the labor supply and increase tariffs will further stoke inflation pressure. Based on the 1970s analog and Demark chart, it looks like we could see an acceleration in inflation.

Unlikely Runner Completes 268 Mile Race

Mel Sykes, a 42-year-old podiatrist, was diagnosed with Chiari malformation in the summer of 2023 after experiencing balance issues and slurred speech. This rare brain condition forces the lower part of the brain into the spinal canal, causing symptoms like double vision and balance problems. Despite undergoing surgery with the risk of never running again, Mel remained determined to pursue her passion for long-distance running.

Eighteen months after her diagnosis, she defied the odds by completing the 268-mile Spine Race. She ran from Edale, Derbyshire to Kirk Yetholm, Scotland in 132 hours. To finish the race, she had to overcome deep snow drifts and harsh weather conditions. Mel’s recovery and achievement have been praised by her neurosurgeon, Dr. Ian Anderson, as a testament to her determination and the power of the human spirit

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX