5 Things We Learned This Week - 12/21/2024

Submitted by Silverlight Asset Management, LLC on December 21st, 2024

December 21, 2024

The S&P 500 fell 2.0% this week. Traders unwound positions quickly on Wednesday after the Fed made a hawkish pivot in tone. Another thing that weighed on investor sentiment was the latest standoff in Washington over a potential government shutdown. Congress played yet another game of chicken on the debt ceiling. But guess what? They passed a last minute bill. Like they always do. In other news, the Bloomberg Aggregate Bond Index fell 0.7% this week. Gold also dropped -0.9%, and Bitcoin declined -5.4%.

Consumer Sentiment for the month of December climbed to its highest level since April, reflecting continued post-election optimism. The Personal Consumption Expenditures Price (PCE) Index decelerated last month, but the core PCE (Fed's favorite inflation measure) was unchanged at 2.8%.

Fed Triggers Fear On Wall Street

The S&P 500 fell about 3% on Wednesday after Fed chair Jerome Powell spooked the market during his post-FOMC press conference. Here's an example of the Fed chair failing to inspire confidence. Powell: “You had two months of higher inflation, September and October. As I mentioned, November is back on track. But, you know, once again we’ve, you know, we’ve had a year-end projection for inflation. And it’s kind of fallen apart as we’ve approached the end of the year.”

The Fed cut rates by 25 basis points. However, it was considered a 'hawkish cut' based on the Fed's forward guidance. The Fed raised its 2025 and 2026 inflation forecasts and does not see inflation reaching the 2% target until 2027 (six years after Powell called elevated inflation “transitory”). 5 Things has consistently written about why inflation will stay elevated. We expect inflation to maintain an upward bias in the first half of 2025.

The Stock Market's Breadth Is Nasty

The stock market needs a hefty dose of Listerine, because it has bad breadth.

Bad breadth is when a small number of stocks are driving overall market gains while the majority are either stagnant or declining. This condition is usually considered a bearish omen. Prior to Wednesday's selloff, there were nine straight days in which more stocks in the S&P 500 finished lower than higher. That's the longest streak in 26 years, according to Global Markets Investor. The S&P 500 Value Index SPYV also fell for nine straight days—its longest losing streak on record, according to Dow Jones Market Data. The recent deterioration in breadth coincides with a notable spike in insider selling by corporate executives. These are yellow light signals for bulls to consider over the intermediate-term. In the short term, however, the market appears oversold and ripe for a bounce. The CNN Fear Greed Index registered Extreme Fear on Thursday, and that's usually a reliable contrarian signal.

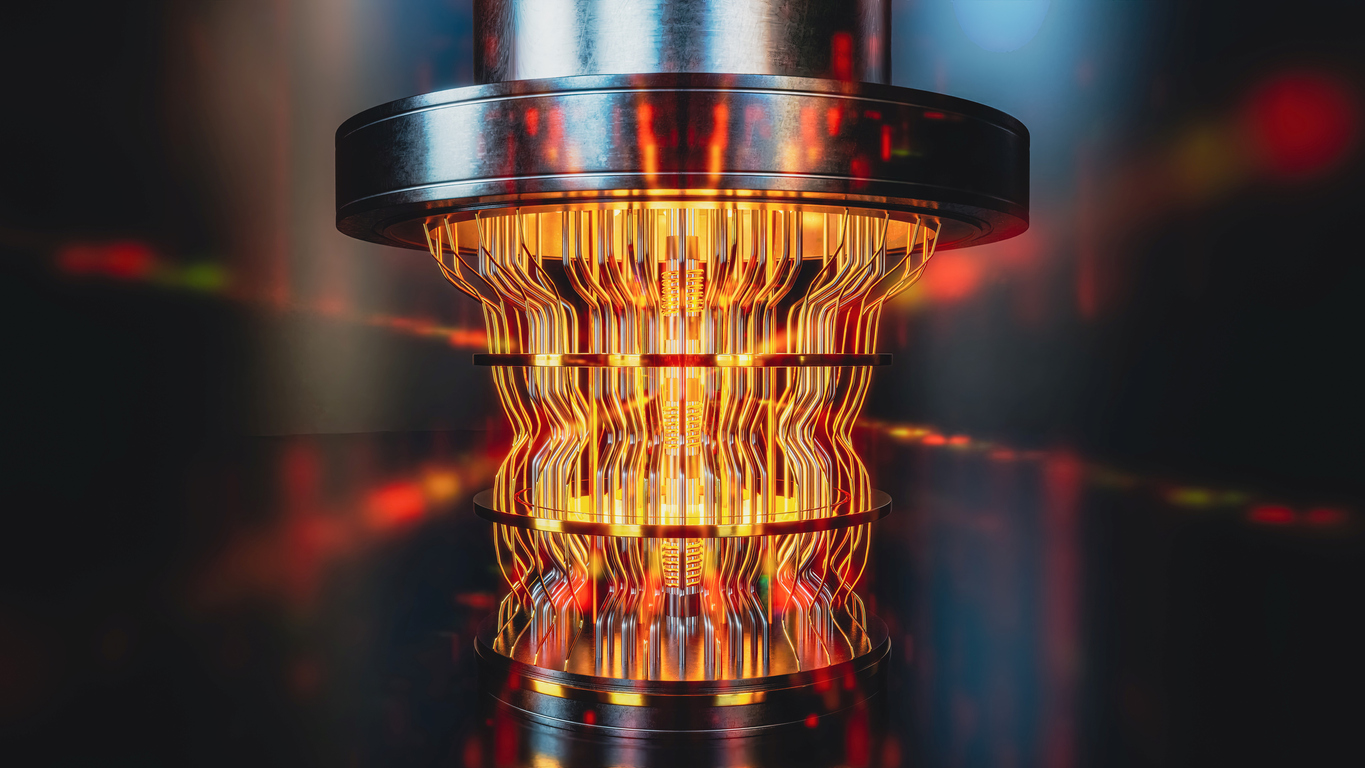

Quantum Computing Is Coming

Google's recent advancements in quantum computing with their quantum chip "Willow" show the immense potential of the technology. It performs calculations in minutes that would take classical computers septillions of years. This progress underscores the importance of quantum computing, which uses qubits to exploit subatomic phenomena for powerful computations. Achievements in the field suggest a functional quantum computer could be realized within a decade, promising significant societal benefits such as accelerated drug discovery, improved logistics, better climate modeling, and enhanced cybersecurity. Silverlight's new Managing Director, Matt Barkley, will lead research coverage of this exciting theme. We plan to profile individual quantum computing stock ideas in future 5 Things.

Tesla Is Up 73% Since Election Day

In today's stock market, the companies with the best stories win. Nowhere is that more evident than in how Tesla shares have performed post-election. Elon Musk reportedly spent $277 million to support President Trump and other Republican candidates. Since Election Day, Tesla has soared 73%, adding a staggering $572 billion to its market capitalization. The bull thesis is Musk's cozy relationship with Trump will manifest into very good things for Tesla. Whatever spin we attach to the story, the bottom-line takeaway is clear: spending $277 million to make $572 billion is one heck of a trade!

Here's an excerpt from a Bloomberg story summarizing Musk's extraordinary Trump trade: What happened to trigger the turnaround? Nothing at the company, where demand for its cars is still wobbly and the future looks increasingly uncertain. Rather it was what investors regard as a political masterstroke by Tesla’s leader Elon Musk, aggressively supporting President-elect Donald Trump on the campaign trail and taking an unofficial role in his administration. “How do you put a value on the fact that Musk has deep access with the incoming administration?” said Steve Sosnick, chief strategist at Interactive Brokers. “You can assign almost any number to it.”

AI Produced The Latest Beatles Song

AI is going to change the human experience in profound ways.

One example is a Beatles song that uses AI to mimic John Lennon’s vocals. The song "Now and Then" took over fifty years to complete. Paul, George, and Ringo worked on it in 1995 for the Beatles Anthology project. It was unfinished due to technical difficulties with John Lennon's 1970s tape-recorded vocals. However, in 2022, thanks to software developed by Peter Jackson's team during the "Get Back" documentary series, Lennon's vocal could finally be separated from his piano part. This allowed the original recording to be revived and completed with contributions from all four Beatles.

If you watch this video, you’ll also see AI video insertions of the Beatles at different ages. AI will be able to make the story of our life timeless. We can go backwards, forward, and push pause. We can be forever young. And we can stay vividly connected to the departed.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX