5 Things We Learned This Week - 1/4/2025

Submitted by Silverlight Asset Management, LLC on January 4th, 2025

January 4, 2025

The S&P 500 closed down 0.5% in a holiday-shortened week. Meanwhile, the US Aggregate Bond Index rose 0.2%, gold rose 0.9%, and Bitcoin won the week rallying 4.3%.

The ISM Manufacturing survey came in at 49.3%, indicating a slight contraction. The Employment Index weakened while the Prices Paid Index rose, which may crimp future profit margins. Pending Home Sales increased 2.2%, suggesting at least some home buyers are willing and able to pay 7% for a 30-year fixed mortgage.

The Bulls Won In 2024

Source: https://awealthofcommonsense.com/2025/01/2024-it-was-another-good-year-in-the-stock-market/

In the words of Frank Sinatra, "It was a very good year." The US stock market soared in 2024, achieving back-to-back 20%+ annual gains for the first time in decades.

This stellar run was driven by robust corporate earnings growth. From 2020 to 2024, the market surged 99%, with earnings contributing 60% to this rise due to strong consumer spending and efficient cost management by companies.

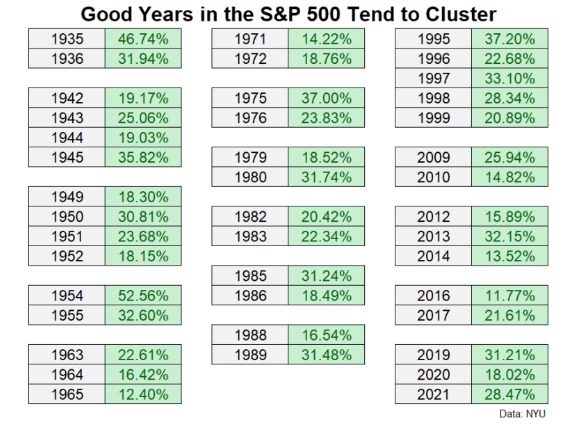

What comes next? Strong years in the stock market tend to cluster, so strong momentum can be a good thing. For example, the stock market looked very extended after a 33% jump in 1997, but that was followed by two more strong years with back-to-back gains over 20%.

Silverlight's Crystal Ball Forecast for 2025

Tis the season for crystal ball forecasts on Wall Street. We will spare you a precise prediction on where the S&P 500 goes in 2025, because the countless strategists making those calls now will just revise them later in the year. That said, the beginning of the year is as good a time as any to be actively thinking about macro risks and opportunities.

In our view, the fundamental outlook for risk assets remains positive, but less so compared to twelve months ago. Hedgeye Research's nowcast for the US economy projects a rate of change improvement in GDP for January. Since we trust their models, we don't think there is a recession right around the corner. That's important, because most serious bear markets coincide with recessions. However, investor sentiment and positioning is already quite bullish, which means less runway for bulls to keep pushing stocks dramatically higher before the next correction.

The three biggest risks we will be monitoring this year relate to trade policy, China, and liquidity conditions.

- Trade Policy. President Trump is unpredictable. His policies may be net bullish or bearish for the stock market this year. If trade protectionism goes into overdrive, that could dent investors' risk appetite.

- China. China's economy is already over-leveraged and wobbly. If Chinese exports are hurt a lot by trade protectionism, there's potential for social instability that could lead to geopolitical risk. Silverlight owns zero Chinese stocks and is underweight global firms with large exposure to China.

- Liquidity. The most important sign post for navigating recent years in the stock market has been liquidity. Liquidity spiked in 2020 and 2021, and so did stock prices. Liquidity receded in 2022, and so did stock prices. In 2023, liquidity started expanding when the Fed had to step in to arrest a brewing bank crisis, and that continued in 2024. This year, global liquidity is projected to rise 5% (source: CrossBorder Capital), which is probably sufficient for the market to head higher, but not as much as last year.

Silverlight's managed portfolios are currently positioned with a moderate level of risk. If we see a correction while the overall fundamental picture stays intact, we'll become more aggressive. If the liquidity outlook deteriorates further, we will pivot to a more defensive posture.

China Tells Economists To Be Positive, or Else

China's economy is facing significant challenges, with sectors like real estate and manufacturing struggling. Youth unemployment remains high, forcing many graduates to take jobs below their qualifications. In China, it's not uncommon to find a handyman with a master's in physics, a cleaner with a degree in environmental planning, a delivery driver who studied philosophy, and a PhD graduate applying for a job as a police officer.

In response, political officials are pressuring economists to publish only positive reports to maintain public confidence. This manipulation of economic data aims to project stability, but it risks undermining trust in official statistics. What's the point of someone going to school to study economics if they just end up being a propaganda puppet? The government's efforts to boost spending and stimulate growth have yet to yield the desired results, highlighting the complexity of the economic issues at hand. Given China's poor demographics, the economy needs to be extra productive to maintain a robust pace of growth. Forcing economists to lie to the broader population doesn't seem very productive.

The Dobermans of the Dow Crushed the Dogs of the Dow in 2024

Why own a normal dog when you can own a Doberman? From 2018 - 2024, I posed that question to Forbes readers every year around this time. 5 Things will provide annual updates on the Dobermans going forward.

The Dobermans of the Dow is a stock screen I invented as an alternative to the widely followed Dogs of the Dow strategy. Whereas the Dogs of the Dow ranks stocks only by dividend yield, the Dobermans is a two-factor screen that measures a company's Return on Equity and Free Cash Flow Yield.

Last year, the annual Dobermans screen rose 23.5%, beating the Dow Average return of 15.0%, as well as the Dogs of the Dow which returned a paltry 0.5%. American Express was a standout performer, rising over 60%. Please be advised these numbers relate to a stock screening method and not an actual portfolio strategy composite. In 2022, Silverlight started offering clients a separate account version of the Doberman strategy. That strategy composite outperformed for the third consecutive year in 2024. Final results will be tallied soon and are available upon request.

Tickers for the '25 Dobermans: NKE, IBM, AXP, JNJ, MRK, CAT, CSCO, AMGN, HD, PG.

Son Honors His Mother By Giving Away His Inheritance

Core values can be part of everyone's legacy.

David Clarke from Liverpool made a remarkable decision to donate his mother's $125,000 inheritance to his community. Clarke lost his mother in a cycling accident. “Her death was a devastating shock to me,” he says. “She had a huge social conscience and was interested in the world and how it worked – a lot of my moral framework comes from her. I don’t believe in holding on to inherited wealth, so I spent a long time thinking about what to do with the money.”

After thinking about it for ten years and consulting his neighbors, Clarke formed a committee that selected four local charities to receive equal shares of the money. The donations have had a profound impact, particularly on organizations like Team Oasis, which supports families and children with special needs. The generosity has provided opportunities for families to enjoy activities and experiences they otherwise couldn't afford, leaving an impact described as "out of this world." Does this story inspire you to think about how you might give back to your community in 2025?

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX