5 Things We Learned This Week - 10/04/2025

Submitted by Silverlight Asset Management, LLC on October 4th, 2025

October 4, 2025

The S&P 500 rallied 1.1% this week. The Bloomberg Aggregate Bond Index gained 0.4%, while Gold rose 3.1% and Bitcoin soared 12.7%.

The U.S. government began its first shutdown in nearly seven years on Wednesday after President Donald Trump and congressional Democrats failed to reach a spending deal. The CBO estimates that 750,000 federal employees are furloughed, costing $400 million per day in lost pay. Trump has also suggested he may use the shutdown to dismiss federal workers. Despite the turmoil, the S&P 500 hit a new weekly record high. The market knows the U.S. isn't a long-term credit risk because it can always print more money to pay its bills and liquidity conditions remain buoyant. Liquidity rules in 2025.

In economic news, the ISM Manufacturing report came in virtually unchanged from the prior month at 49.1. New orders fell versus the prior month, which may indicate further weakness ahead. The ISM Services report decelerated slightly to 50, but the prices paid component rose to 69.4, which is the highest since 2021. It's hard to believe the Fed is cutting rates while inflation is accelerating this much, but these are the days of our lives.

The Debasement Trade Is Catching Fire

It appears Wall Street is catching up to one of Silverlight's longstanding investment themes, with JPMorgan now calling it "the debasement trade" in a widely read report this week. JPMorgan defines it as a trade that "reflects a combination of factors, which in our client conversations range from elevated geopolitical and policy uncertainty, to uncertainty about the longer-term inflation backdrop, to concerns about 'debt debasement' due to persistently high government deficits across major economies, to concerns about Fed independence, to waning confidence in fiat currencies in certain emerging markets in particular, and to a broader diversification away from the US dollar."

The two centerpieces of the debasement trade are bitcoin and gold. Bitcoin is up 26% year to date, while gold is up 46%. Silverlight clients have benefitted. Bitcoin and gold have been Silverlight's two largest investments all year long, and we continue to have a positive view. Many investors are very long tech stocks and have minimal exposure to the debasement theme. If the debasement trade continues to outperform, a speculative fever could erupt, eventually sending gold and bitcoin to heights few could fathom.

Here's why: in nominal USD terms, everything looks like it's booming right now. Stocks and home prices are up a lot, for example. But if you convert things like the S&P 500 and housing into a different unit of account, the picture dramatically changes. "Real" wealth evaporates. For perspective, here's what the debasement trade has looked like since they printed way too much money during the pandemic.

In USD, the Nasdaq is up 165%, the S&P 500 is up 102%, and home prices are up 56%.

Compared to gold, the Nasdaq is up 7%, the S&P 500 is down 18%, and home prices are down 37%.

Compared to bitcoin, the Nasdaq is down 78%, the S&P 500 is down 84%, and home prices are down 87%.

As more people realize how much of their purchasing power is being destroyed by the illusions of fiat money, more capital will likely crowd into the debasement trade. Since the supply of gold and bitcoin is limited, this could lead to parabolic price action that shocks the world.

Chinese Monetary Stimulus Is Accelerating

China is opening the monetary floodgates. After years of restraint, the People’s Bank of China (PBoC) has launched a powerful wave of liquidity — roughly RMB 7–8 trillion (about $1 trillion) in the past year — to stabilize its debt-heavy economy and reignite growth. This “monetization” drive, echoing Japan’s playbook a decade ago, aims to ease pressure on banks, lift property markets, and roll over vast amounts of legacy debt without triggering defaults.

Why the shift? China’s financial system was nearing a crunch point. With property values sliding and global capital rivalries intensifying, Beijing chose to expand liquidity rather than risk a deflationary spiral. More money means smoother refinancing, stronger balance sheets, and a softer landing for debt-burdened sectors.

For investors, this move tilts the scales toward real assets. Monetary easing devalues paper claims and boosts tangible stores of value. Expect rising demand — and higher prices — for commodities, gold, and industrial metals as China’s liquidity wave spills across global markets.

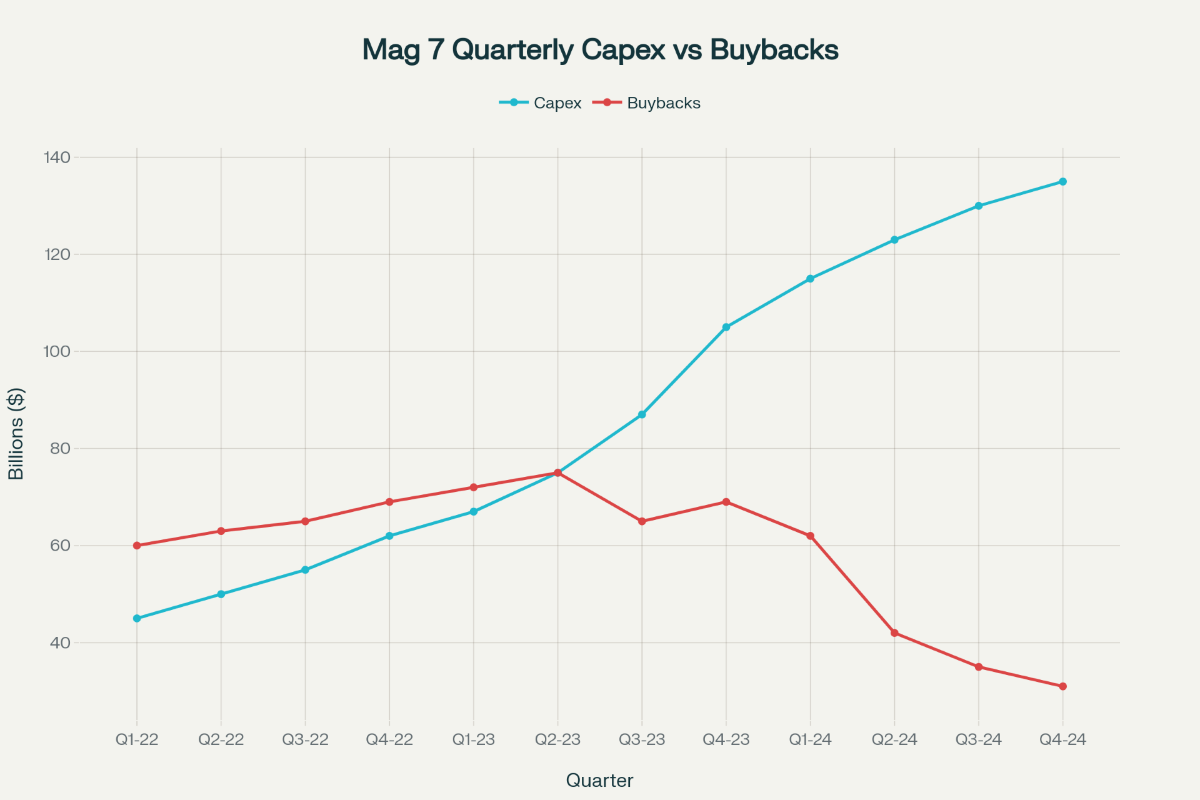

The Mag 7 Capex Splurge Will Dent Buybacks

The Magnificent 7—Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla—are fueling a capex boom, racing to dominate AI infrastructure and data centers. Over the past five years, their capex-to-sales ratios have surged, with companies like Meta projecting nearly $65 billion in capex for 2025 (about 30% of sales). Many are now allocating substantial sums to capital investments, driving a 24% year-over-year jump in S&P 500 capex—almost entirely propelled by these giants.

Nvidia's massive GPU capex splurge is squeezing the free cash flow and buyback capacity of its mega cap tech peers, especially those investing in AI data centers. As hyperscalers increase capex their free cash flow margins decline, which directly impairs their ability to pursue share buybacks and other shareholder-friendly capital returns.

Buybacks are already stalling. Goldman Sachs notes that surging AI capex spending is "preventing a major increase in the buyback payout ratio" for S&P 500 companies, as giants opt for capex over buybacks. For example, Microsoft and Alphabet have slowed the pace of buybacks even as their operating cash flow remains robust. The Mag 7 previously contributed about 30% of S&P 500 buybacks, but posted zero growth this quarter. Apple is the exception, with $83 billion in repurchases, while Amazon and Tesla have done none, redirecting all cash to expansion.

If these massive investments fail to deliver, shareholders face heightened risk—echoing past capex bubbles like the telecom bust, Japan’s real estate crash, and the oil supercycle. The high-stakes shift from buybacks to spending means more volatility and greater risk for investors going forward.

Silverlight portfolios are underweight the Mag 7, and we are overweight firms who produce things they are spending the most money on, including datacenters and the raw materials used to build AI infrastructure.

Franco Nevada (FNV) Investment Thesis

Franco-Nevada has built its reputation as the quiet powerhouse of the gold industry. Founded in 1983 by mining veterans Seymour Schulich and Pierre Lassonde, the company pioneered the royalty and streaming model — a structure that allows it to earn a share of revenue from mines without owning or operating them.

This asset-light approach makes Franco-Nevada less exposed to the operational risks and cost overruns that plague traditional miners. Its diversified portfolio spans more than 400 assets across gold, silver, oil, gas, and other resources. About 60% of revenue comes from gold, 10% from silver and other precious metals, and the balance from energy royalties—a mix that provides both resilience and upside. With gold and silver trading near multi-year highs, FNV’s unique business model translates that price momentum directly into expanding margins and accelerating cash flow.

Unlike miners that dig, blast, and borrow, Franco-Nevada simply collects. Its blend of scalability, diversification, and a pristine balance sheet make it the "gold standard" of gold investing. Silverlight clients are long FNV.

If you'd like to learn more about why FNV's royalty structure rocks, you can watch this interview with one of the company's founders.

How Your Mindset Can Slow Aging

At 92, Hiromu Inada can still blast down the Ironman finish chute, defying every age barrier with each stride. His secret weapon? Not advanced supplements or tech—just a mindset that rewrites what it means to grow older.

Groundbreaking science reveals that a positive attitude about aging can actually turn back your biological clock. Instead of dreading decline, people with optimistic beliefs about aging can gain up to 7.5 extra years of life—surpassing lifestyle tweaks like lowering cholesterol or blood pressure.

Pioneering researcher Dr. Becca Levy has shown that age optimists cut their risks for heart disease, dementia, and brain shrinkage. Their brains stay healthier, fending off amyloid plaques linked to Alzheimer’s and preserving critical memory regions like the hippocampus.

So how does it work? Through a process called “stereotype embodiment,” positive beliefs reshape your self-image, boost your motivation (hello, extra gym sessions!), and protect your body from stress-driven inflammation. Negative stereotypes, in contrast, crank up stress, quickening the pace of biological decline.

Programs like AgingPlus prove this transformation is possible, inspiring more exercise and self-empowerment. Want to start today? Seek out real-life heroes (like Ironman Inada), challenge ageist myths, and dismantle negative stereotypes wherever you spot them. The power to age like fine wine starts in your mind—and your next, brighter chapter can start right now.

This material is not intended to be relied upon as a forecast, research or investment advice. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by Silverlight Asset Management LLC to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Silverlight Asset Management LLC, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

Testimonials Content Block

More Than an Investment Manager—A Trusted Guide to Financial Growth

"I’ve had the great pleasure of having Michael as my investment manager for the past several years. In fact, he is way more than that. He is a trusted guide who coaches his clients to look first at life’s bigger picture and then align their financial decisions to support where they want to go. Michael and his firm take a unique and personal coaching approach that has really resonated for me and helped me to reflect upon my core values and aspirations throughout my investment journey.

Michael’s focus on guiding the "why" behind my financial decisions has been invaluable to me in helping to create a meaningful strategy that has supported both my short-term goals and my long-term dreams. He listens deeply, responds thoughtfully, and engages in a way that has made my investment decisions intentional and personally empowering. With Michael, it’s not just about numbers—it’s about crafting a story of financial growth that has truly supports the life I want to live."

-Karen W.

Beyond financial guidance!

"As a long-term client of Silverlight, I’ve experienced not only market-beating returns but also invaluable coaching and support. Their guidance goes beyond finances—helping me grow, make smarter decisions, and build a life I truly love. Silverlight isn’t just about wealth management; they’re invested in helping me secure my success & future legacy!"

-Chris B.

All You Need Know to Win

“You likely can’t run a four-minute mile but Michael’s new book parses all you need know to win the workaday retirement race. Readable, authoritative, and thorough, you’ll want to spend a lot more than four minutes with it.”

-Ken Fisher

Founder, Executive Chairman and Co-CIO, Fisher Investments

New York Times Bestselling Author and Global Columnist.

Packed with Investment Wisdom

“The sooner you embark on The Four-Minute Retirement Plan, the sooner you’ll start heading in the right direction. This fun, practical, and thoughtful book is packed with investment wisdom; investors of all ages should read it now.”

-Joel Greenblatt

Managing Principal, Gotham Asset Management;

New York Times bestselling author, The Little Book That Beats the Market

Great Full Cycle Investing

“In order to preserve and protect your pile of hard-earned capital, you need to be coached by pros like Michael. He has both the experience and performance in The Game to prove it. This is a great Full Cycle Investing #process book!”

-Keith McCullough

Chief Executive Officer, Hedgeye Risk Management

Author, Diary of a Hedge Fund Manager

Clear Guidance...Essential Reading

“The Four-Minute Retirement Plan masterfully distills the wisdom and experience Michael acquired through years of highly successful wealth management into a concise and actionable plan that can be implemented by everyone. With its clear guidance, hands-on approach, and empowering message, this book is essential reading for anyone who wants to take control of their finances and secure a prosperous future.”

-Vincent Deluard

Director of Global Macro Strategy, StoneX